The Definitive Source for Global Automotive Registration Data

From granular postal codes in ASEAN to state-level trends in India and cross-border insights in the GCC. Access uncompromised, verified intelligence across emerging markets.

Sales Data Is Failing Your Business

And you might not know it yet

Wholesale vs. Retail Gap

Factory "push" tactics inflate numbers. Wholesale reports hide the real gap between dealer inventory and actual customer delivery.

Inventory Manipulation

Self-reported data is prone to gaming. Unlike dealer spreadsheets, government registrations are timestamped, verified, and impossible to fake.

Geographic Blind Spots

Sales reports miss the "where." Without city-level precision, finding local hotspots or planning dealer territories is just guesswork.

Reporting Fragmentation

Disparate sources create lag. Official registrations provide a single, continuous stream of truth, eliminating conflicting timelines.

Lifecycle Blindness

Sales figures stop at the dealer. Registration data continues through ownership.

Traditional reporting is collapsing across emerging markets. In Thailand, official sales reports have ceased. In other regions, new EV players are excluded from industry associations. The old way of tracking market share is broken.

When sales data stops… what do you use?

Why Leading OEMs & Consultancies Choose Us

Authoritative Data Integrity

We aggregate data strictly from validated, high-credibility streams. Every dataset undergoes multi-stage verification to ensure it meets global strategic standards.

"Ghost Booking" Filtration

Proprietary algorithms strip out duplicate bookings, financing rejections, and commercial noise to reveal true on-road volume.

Unified Global Taxonomy

We standardize fragmented data from ASEAN, India, and GCC into one consistent format, ready for immediate cross-regional analysis.

Hyper-Localized Precision

Stop planning at the national level. Drill down to granular administrative layers—Postal Codes, Cities, or Wilayats—to target demand exactly where it is.

Data Privacy & Compliance

Fully compliant with PDPA and international data privacy standards, ensuring your strategic usage remains confidential and secure.

Analyst-to-Analyst Support

Speak directly with automotive data experts, not chatbots. Our team helps you interpret complex trends and locate niche datasets.

The Foundation of Your Strategy: Vehicle Registration Data

Bypass estimates. Access the raw, verified registration figures that drive the industry’s most critical decisions.

Total Market Volume (TIV)

- Complete TIV tracking by month/quarter/year

- Real-time Growth Analysis (YoY, MoM, YTD)

- Seasonal trend identification

Powertrain & EV Shift

- Granular ICE (Petrol/Diesel) segmentation

- xEV Tracking (HEV, PHEV, BEV)

- Fuel migration trends & adoption rates

Competitive Benchmarking

- Head-to-head Make & Model comparison

- Sub-segment market share battles

- Leaderboard tracking by body style

Historical Trend Analysis

- Long-term cyclical pattern analysis

- Pre- vs Post-crisis recovery tracking

- Forecasting baseline data

Specialized Intelligence Modules

Hyper-Local Geolocation Intelligence

Don't settle for regional averages. Optimize your dealer network and identify white-space opportunities with precision data down to the Postal Code and Micro-District level.

Key Features (What’s Included):

- State, City, & Postal Code granular breakdown

- Territory gap analysis & White-space mapping

- Competitor density tracking

xEV & Powertrain Dynamics

The industry's most detailed electrification tracker. Monitor the rapid shift from ICE to HEV, PHEV, and BEV to align product roadmaps with actual adoption rates.

Key Features (What’s Included):

- Pure EV (BEV), PHEV, and Hybrid (HEV) split

- Fuel-type migration analysis

- Charging infrastructure planning data

Global Reach, Local Precision

Standardized automotive intelligence across high-growth markets.

Thailand

Updated Monthly

Coverage:

- All 77 Provinces covered

- Postal Code level precision

Key Intelligence:

- EV Technical Specs (Battery kWh, Motor)

- Granular Sub-district Segmentation

Philippines

Updated Quarterly

Coverage:

- All Provinces

- City/Municipality breakdown

Key Intelligence:

- Grey Market & Import Tracking

- 140+ Cities Visibility

India

Updated Monthly

Coverage:

- All Major States & Union Territories

- Comprehensive State-level breakdown

Key Intelligence:

- State-wise Market Share

- High-Growth State Identification

GCC Region

Updated Quarterly

Coverage:

- 6 Gulf Nations (Saudi, UAE, etc.)

- Cross-border aggregation

Key Intelligence:

- Unified Taxonomy (Standardized Format)

- Luxury & Import Segment Focus

Expanding Coverage: Vietnam • Indonesia • Malaysia. Available upon request. Check Availability →

Who Uses Our Data

Real Applications Across the Automotive Industry

How They Use Our Data

Supporting market entry studies, due diligence, and policy advisory with uncompromised, granular data.

Primary Use Case: Market Entry & Feasibility Studies

Consultants rely on our micro-market data (Postal Code/District) to validate business models and forecast 5-year growth trends for their global clients.

Key Benefits:

- Validate TAM (Total Addressable Market) sizing

- Granular segmentation for precise forecasting

- Reliable historical baseline for trend analysis

How They Use Our Data

Monitoring real-time registration figures against production targets to align supply chain and dealer inventory with actual market demand.

Primary Use Case: Supply Chain & Dealer Network Optimization

OEMs utilize our granular data to identify underperforming territories, adjust production schedules, and optimize vehicle distribution to match regional preferences.

Key Benefits:

- True Market Share tracking (vs. Wholesale)

- Competitor model benchmarking at a city level

- Just-in-time inventory adjustments

How They Use Our Data

Tracking new vehicle registration volumes to benchmark lending penetration rates against the total market and identify emerging growth sectors.

Primary Use Case: Market Share Analysis & Sales Forecasting

Banks and leasing firms use our precise TIV (Total Industry Volume) data to validate their loan origination performance and set accurate regional targets for sales teams.

Key Benefits:

- Benchmark internal loan volume vs. Actual Registrations

- Identify high-growth regions for targeted lending

- Track the shift to EV financing with precision

How They Use Our Data

Mapping EV adoption density down to the postal code level to strategically plan charging station locations and grid capacity upgrades.

Primary Use Case: EV Infrastructure Planning (Site Selection)

CPOs and utilities use our "Heat Maps" to pinpoint high-growth EV areas, ensuring chargers are placed where demand is highest.

Key Benefits:

- High-precision demand forecasting

- Optimized ROI for new charging stations

- Data-driven grid load estimation

Ready to validate your next strategic move? Contact Us →

Market Pulse & Expert Analysis

Uncover the trends shaping the automotive landscape before they hit the mainstream.

Ford Signs Agreement to Acquire Suzuki Rayong Plant, Expands Thailand Footprint

Ford has signed an agreement to acquire Suzuki’s manufacturing facility in Rayong, marking a strategic...

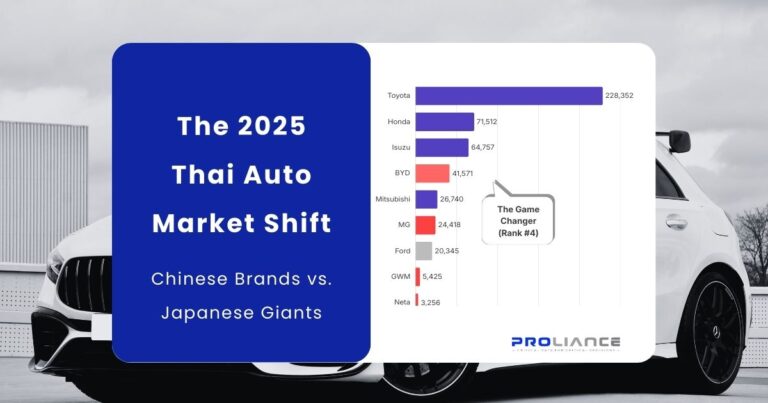

The Shift of Power: 2025 Thailand Automotive Market Share Analysis (China vs. Japan)

The Thai automotive landscape has historically been a fortress for Japanese manufacturers. However, the 2025...

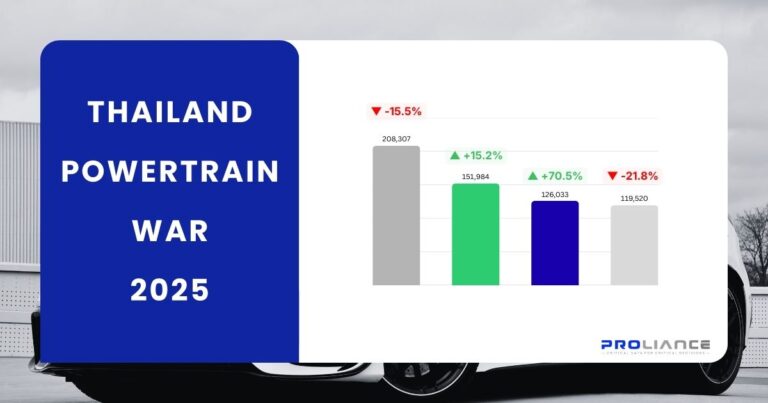

BEV vs. Hybrid vs. Diesel: The 2025 Powertrain War in Thailand [Data Analysis]

The era of hesitation is over. 2025 wasn’t just another year for the Thai automotive...

Frequently Asked Questions

While sales data often reflects wholesale figures (sell-in to dealers), Registration Data represents the true ‘sell-out’ to actual consumers. It captures real-time on-road units, eliminating distortions from dealer stock piling and providing accurate market share visibility.

Our data is comprehensive and all-inclusive. We aggregate independent imports (Grey Market) directly into the total registration figures. This ensures you see the true Total Industry Volume (TIV) on the road, capturing the complete market reality without missing the ‘hidden’ volumes often excluded from standard wholesale reports.

We provide data in flexible formats to suit your workflow, including raw Excel/CSV files for internal analysis and interactive Dashboard access for executive presentations.

Yes. We maintain a comprehensive historical database spanning over 10+ years across key markets. This allows you to perform deep cyclical analysis, pre- vs. post-crisis benchmarking, and accurate long-term forecasting.

Data update frequency varies by market regulation:

- Thailand & India: Updated Monthly (typically by the 20th-30th of the following month).

- Philippines & GCC: Updated Quarterly.

We always aim for the fastest release cycle in the industry to give you a competitive edge.

Still have questions? Contact Us

Stop Guessing with Sales Reports. Start Strategizing with On-Road Reality.

Join top OEMs and consultancies who leverage our granular, verified registration data for mission-critical decisions.