If you are looking for a balanced distribution of automotive wealth in Thailand, you won’t find it in the 2025 registration data.

The latest figures from the Department of Land Transport reveal a polarized landscape. While the adoption of Electric Vehicles (EVs) is often touted as a nationwide phenomenon, the hard data tells a different story: Thailand’s EV market is overwhelmingly a “Bangkok Story.”

For investors, marketers, and policymakers, understanding this geographical skew is critical. You cannot apply a “one-size-fits-all” strategy to a country where one region holds nearly 70% of the purchasing power for new technology.

Executive Summary: The Great Divide

- Market Dominance: Bangkok Metropolitan Region (BMR) accounts for 58.20% of total vehicle registrations but commands a staggering 69.37% of the EV market.

- The "Infrastructure Gap": The +11% variance between general car ownership and EV ownership in Bangkok suggests that outside the capital, infrastructure anxiety is significantly stifling adoption.

- The Secondary Tier: Only Chiang Mai (3.87%) and Chonburi (3.07%) show meaningful traction, while major regional hubs like Korat and Khon Kaen lag behind their potential.

1. The Bangkok Metropolitan Monopolization

The most striking insight from the 2025 dataset is the sheer dominance of the capital region.

While the Bangkok area accounts for 58.20% of all vehicle registrations (ICE + EV + Hybrid), its grip tightens significantly when we isolate the EV segment, jumping to 69.37%.

This +11.17% variance indicates that EV adoption is not just correlated with population density, but heavily skewed by infrastructure readiness, urban commuting patterns, and higher disposable income found in the capital.

Important Editor’s Note: Throughout this report, references to “Bangkok” denote the Bangkok Metropolitan Region (BMR). This includes Bangkok proper and its five surrounding provinces: Nakhon Pathom, Nonthaburi, Pathum Thani, Samut Prakan, and Samut Sakhon.

2. Regional Analysis: The "Emerging" vs. The "Lagging"

Once we step outside the BMR, the market share fragments into single digits. However, the data reveals interesting behavioral nuances in key provinces.

The Chiang Mai Anomaly

Chiang Mai is the only major province in the top tier where the EV Market Share (3.87%) actually exceeds its Total Market Share (3.64%).

Insight: Chiang Mai’s adoption is driven by “Housing Infrastructure” rather than terrain. Unlike Bangkok’s condo-heavy market, Chiang Mai’s affluent demographics mostly reside in detached houses, making Home Charger installation effortless. Furthermore, due to the lack of mass transit, EVs serve as the ideal “Second Car” for the daily school-and-office loop and slash fuel costs in the city’s notorious congestion while ICE vehicles are reserved for long-distance trips.

The Chonburi Gap

Despite being an economic powerhouse and part of the EEC (Eastern Economic Corridor), Chonburi underperforms slightly in EV adoption relative to its total car market (3.07% EV vs 3.57% Total).

Insight: The infrastructure is there, but the market composition (likely heavier on industrial logistics and pickups) may be slowing down the shift to passenger EVs compared to the lifestyle-focused consumers in Bangkok and Chiang Mai.

3. Detailed Data Breakdown (2025)

For analysts requiring precise figures, the table below outlines the market share distribution across Thailand’s top provinces.

| Province (Changwat) | Share of All Fuel Types | Share of EV Market | Performance Gap |

|---|---|---|---|

| Bangkok (BMR) | 58.20% | 69.37% | +11.17% (Over-index) |

| Chiang Mai | 3.64% | 3.87% | +0.23% |

| Chonburi | 3.57% | 3.07% | -0.50% |

| Nakhon Ratchasima | 2.18% | 1.65% | -0.53% |

| Khon Kaen | 1.89% | 1.84% | -0.05% |

| Songkhla | 1.76% | 1.72% | -0.04% |

| Phuket | 1.66% | 1.65% | -0.01% |

| Rayong | 1.51% | 1.13% | -0.38% |

| Chiang Rai | 1.40% | 1.09% | -0.31% |

4. Strategic Takeaways for Business Leaders

What does this data mean for your 2025-2026 roadmap?

Stop treating “Thailand” as a single market. If you are launching an EV brand or a charging network, 70% of your initial ROI exists in the Bangkok Metropolitan Region. Marketing budgets should be allocated accordingly.

Infrastructure is the bottleneck in the Northeast. Provinces like Nakhon Ratchasima (Korat) and Khon Kaen show a drop in EV share compared to their total car ownership. This “gap” represents a lack of confidence in charging infrastructure. The first movers to build reliable fast-charging networks in Isan will capture this latent demand.

Stop selling “Green Lifestyle”. Sell “The Ultimate City Utility”. In provinces like Chiang Mai, the “Eco-Chic” marketing angle has reached saturation. The real opportunity lies in positioning EVs as the ideal “Second Car” for homeowners. Campaigns should shift focus from saving the planet to “Beating the Traffic Cost” by highlighting how EVs are the perfect tool for the daily school-and-office loop in congested cities, offering a lower cost per kilometer than the household’s primary SUV or pickup.

Strategic Outlook

The 2025 data paints a clear picture: Bangkok is the engine, but the provinces are the frontier. While the capital has reached a high level of EV saturation relative to the country, the next phase of growth will not come from selling more cars to Bangkokians but from unlocking the potential of Chonburi, Chiang Mai, and Korat.

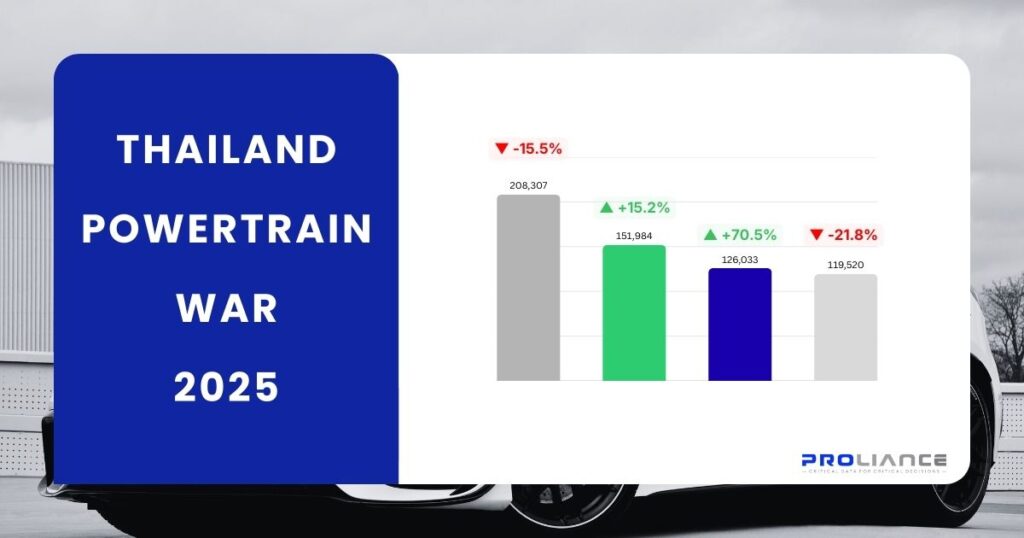

Go Beyond the Surface: Decode the EV vs. ICE Battle.

Top-level numbers hide the real story. Get granular with the definitive Thailand Light Vehicle Registration Data (Fuel Type Analysis) to see exactly which powertrains are winning market share.

➤ Access the Fuel Type Analysis Report