The Thai automotive landscape didn’t just change in 2025; it decoupled. While the headline figure shows a stagnant market (+0.15% YoY), the underlying data from Proliance exposes a radical structural rotation. We observed a decisive capital flight from the traditional Pickup segment toward Passenger Cars, driven primarily by an aggressive 70.50% surge in EV adoption.

Here is the definitive breakdown of Thailand’s 2025 Light Vehicle registration data.

Executive Summary

- Total Market: Flat growth (+0.15%), closing at 606,104 units.

- Major Shift: Pickup trucks slumped -20%, while EVs surged +70%.

- New Reality: BYD enters Top 4; Toyota & Honda hold top spots due to diverse mix.

1. Market Overview: Stagnation Masks Volatility Total Registrations: 606,104 Units (+0.15% YoY)

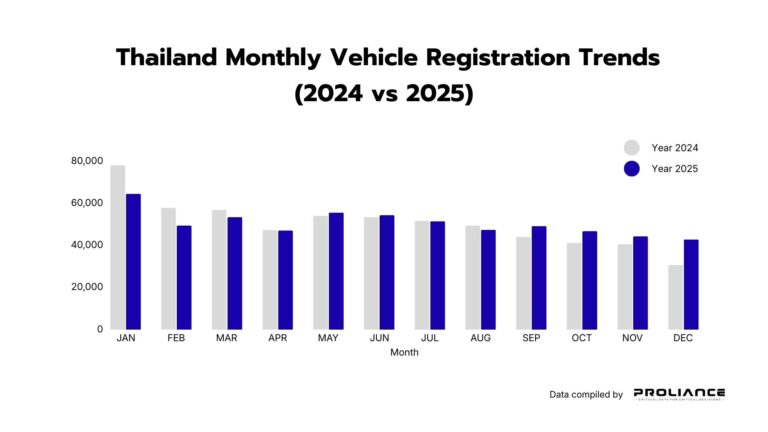

The full-year stability is misleading. A half-year analysis reveals a deteriorating trend in consumer purchasing power:

- H1 Resilience (324,276 units): Buoyed by backlog deliveries and aggressive Q1 campaigns.

H2 Contraction (281,828 units): The market cooled significantly in the second half. This sharp decline signals tightening credit approval rates and macroeconomic headwinds that will likely persist into Q1 2026.

2. The Competitive Landscape: The "EV Effect" on Rankings

2025 marked a changing of the guard. The correlation between EV product mix and market share growth is now undeniable.

| Rank | Brand | Units Registration (2025) | Market Status |

|---|---|---|---|

| #1 | Toyota | 228,352 | Remains the market anchor. Their strategy of diversifying across ICE, HEV, and Commercial segments provided a hedge against volatility. |

| #2 | Honda | 71,512 | Outperformed the market to secure the runner-up spot. Their focus on the Passenger Car (PC) segment and e:HEV technology shielded them from the commercial sector's downturn. |

| #3 | Isuzu | 64,757 | The biggest casualty of the year. Heavily exposed to the contracting pickup market and tighter commercial lending, Isuzu slid to third place. |

| #4 | BYD | 41,571 | The disruptor. Climbing to #4 isn't just a win for BYD; it validates that EVs have graduated from "early adopter" status to mass-market acceptance in Thailand. |

The Battle has shifted: It's no longer just Brand vs. Brand.

It’s ICE vs. HEV vs. BEV. While the macro numbers look flat, the powertrain mix is volatile.

Don’t fly blind. → Get the full Thailand Light Vehicle Registration Data (Fuel Type Analysis) to see the exact split between Diesel, Hybrid, and Electric registrations in 2025.

3. Segment Analysis: The Great Rotation

The data confirms a historic divergence between commercial and private mobility demand.

- The Pickup Slump (-20.11%): Don’t mistake this for a lack of demand. The appetite for commercial pickups remains strong, but the Credit Rejection Rate has skyrocketed. High household debt and strict lending criteria (NPL controls) have created an artificial contraction; buyers want the trucks, but financing won’t clear. This is a liquidity issue, not a product preference shift toward EVs.

The EV Explosion (+70.50%): This is where the liquidity went. The massive growth in Battery Electric Vehicles drove the broader Passenger Car segment to a +9.39% expansion, offsetting the losses in commercial vehicles.

4. 2026 Outlook: What the Data Predicts

The “Pickup Nation” narrative is eroding. For 2026, OEMs and stakeholders must pivot strategies to accommodate a diversified powertrain mix. We anticipate the slowdown to continue into at least H1 2026, making granular targeting essential for survival.

Get the Complete Picture: Thailand Automotive Market Report 2025

Don’t lose track of the key numbers. Download this consolidated executive report to keep all critical charts and insights handy for your strategic planning.

📊 Market Overview: H1 vs H2 Performance Analysis.

⚡ Powertrain War: The final verdict on EV vs. Hybrid volumes.

📍 Regional Hotspots: Exclusive data on provincial adoption beyond Bangkok.