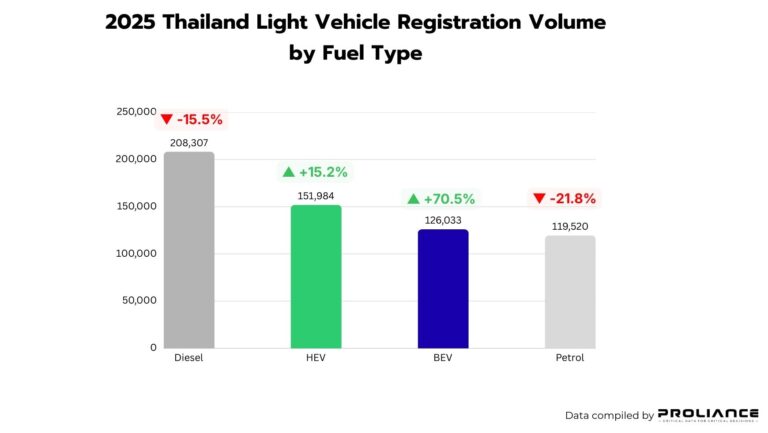

The era of hesitation is over. 2025 wasn’t just another year for the Thai automotive industry; it was the tipping point. While total market volume faced economic headwinds, the internal powertrain war delivered a clear verdict: The monopoly of the internal combustion engine (ICE) has officially collapsed.

Latest registration data from Proliance reveals a striking reality. While BEVs grabbed the headlines with explosive growth, Hybrid (HEV) technology silently cemented itself as the dominant alternative powertrain, capturing over a quarter of the passenger car market.

Executive Summary

- The Hybrid Stronghold: HEVs remain the volume leader in electrification, totaling 151,984 units.

- BEV Mainstream Adoption: Fully electric vehicles hit 126,033 registrations, fueled by aggressive price wars.

- Market Share Milestone: HEVs now command a massive 25.08% market share within the passenger car segment.

- Diesel’s Sharp Decline: Traditional diesel engines are losing ground rapidly, mirroring the slump in commercial pickup sales.

1. Market Trends Reality: Why Hybrids (HEV) Still Outsell EVs

While social media buzzed about electric vehicles, the actual sales data tells a different story. Hybrid Electric Vehicles (HEV) outperformed Battery Electric Vehicles (BEV) in total volume by nearly 26,000 units.

Why did Hybrids win 2025?

The Pragmatic Choice: With a 25.08% share of the passenger car market, Hybrids (led by Toyota and Honda) offered the perfect bridge for consumers. They provide fuel efficiency without the “range anxiety” that still plagues upcountry travel.

- Trust in After-Sales & Parts: Beyond the car itself, consumers prioritized long-term peace of mind. The established service networks of Japanese OEMs remained a decisive factor against newer EV brands. These networks guarantee parts availability and nationwide maintenance centers.

Resale Value Confidence: Unlike the volatile pricing of BEVs (due to heavy discounting), HEVs maintained more stable perceived asset value.

2. BEV Explosion: Driven by The Price War

The growth of BEVs in 2025 was nothing short of aggressive. Reaching 126,033 registered units, this segment is no longer a niche for early adopters.

The primary catalyst was not just environmental awareness, but economics. The brutal “Price War” initiated by Chinese OEMs dragged BEV prices down to match and often undercut B-segment combustion cars. For the first time, buying an EV became cheaper than buying a comparable petrol car, forcing a rapid conversion of first-time buyers.

3. The Diesel Downfall (With a Notable Exception)

The overall decline of Diesel (-15.5%) is the most significant casualty of 2025. However, a deeper dive into the data reveals a divided landscape.

The Commercial Collapse: The bulk of the drop is tied directly to the Pickup Truck segment, which faced a massive -20.11% contraction due to tighter financing criteria.

The PPV Stronghold: Interestingly, the SUV-PPV segment defied this trend. Diesel registrations here remained nearly flat compared to last year. Despite the arrival of Hybrid contenders, Thai families and adventure-seekers still heavily rely on the torque and durability of Diesel engines for this specific vehicle class.

Strategic Outlook: What to Watch in 2026

The data confirms Thailand has passed the “Point of No Return.”

The New Rivalry: The battle is no longer “ICE vs. EV.” It is now “BEV vs. Hybrid.”

Japanese Counterattack: Expect Japanese OEMs to aggressively defend their 25% Hybrid share with newer, more affordable HEV models to counter Chinese BEVs.

Get the Complete Picture: Thailand Automotive Market Report 2025

Don’t lose track of the key numbers. Download this consolidated executive report to keep all critical charts and insights handy for your strategic planning.

📊 Market Overview: H1 vs H2 Performance Analysis.

⚡ Powertrain War: The final verdict on EV vs. Hybrid volumes.

📍 Regional Hotspots: Exclusive data on provincial adoption beyond Bangkok.