REEV Technology: Long-Range Electric Solutions for the Thai Market

Range-Extended Electric Vehicles (REEVs) are emerging as a compelling alternative in Thailand’s evolving automotive landscape, blending the benefits of electric propulsion with the practicality of internal combustion engines. As global automakers, particularly Chinese brands, prepare to introduce REEV models to Thailand in 2025, this technology is poised to address key challenges in the country’s transition to electrification.

How REEV Technology Works

REEVs operate on an “always-electric” principle, where wheels are driven exclusively by electric motors. A small combustion engine acts solely as a generator, activating only when the battery charge drops below 20%. Unlike Plug-in Hybrids (PHEVs), REEVs lack a mechanical connection between the engine and wheels, ensuring a seamless EV driving experience.

The system relies on a battery pack (25–35 kWh) capable of 150–200 km of pure electric range. When combined with the generator, total range extends to 1,000–1,400 km. Innovations like Changan’s Super Range 2.0 enhance efficiency through high-pressure fuel injection and adaptive thermal management, optimizing energy conversion during power generation.

Comparative Analysis with Competing Technologies

REEV vs. PHEV

While both technologies support external charging, REEVs outperform PHEVs in driving refinement and efficiency. PHEVs use a parallel hybrid system, intermittently engaging the combustion engine, which can cause drivetrain vibrations. REEVs maintain consistent electric propulsion, achieving 30% greater fuel efficiency in urban conditions due to the generator operating at optimal RPM.

REEV vs. e-POWER

Nissan’s e-POWER shares the series-hybrid concept but differs critically:

-

External Charging: REEVs support fast charging, while e-POWER relies entirely on onboard fuel-based generation.

-

Battery Capacity: REEV batteries (25+ kWh) are 16x larger than e-POWER’s 1.5 kWh pack, reducing generator runtime.

-

Range: REEVs prioritize long-distance capability, with models like the Deepal S05 achieving 1,200 km-double typical e-POWER ranges.

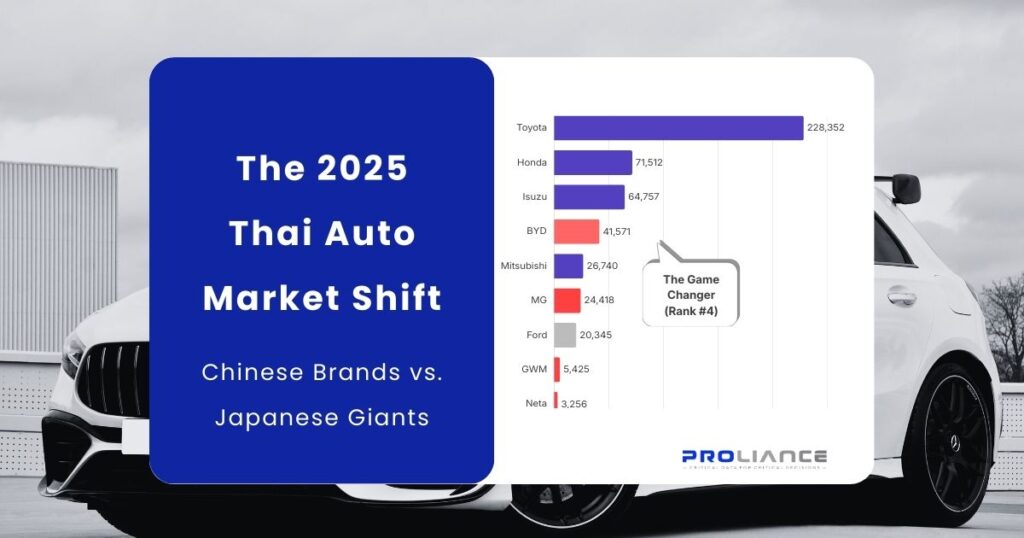

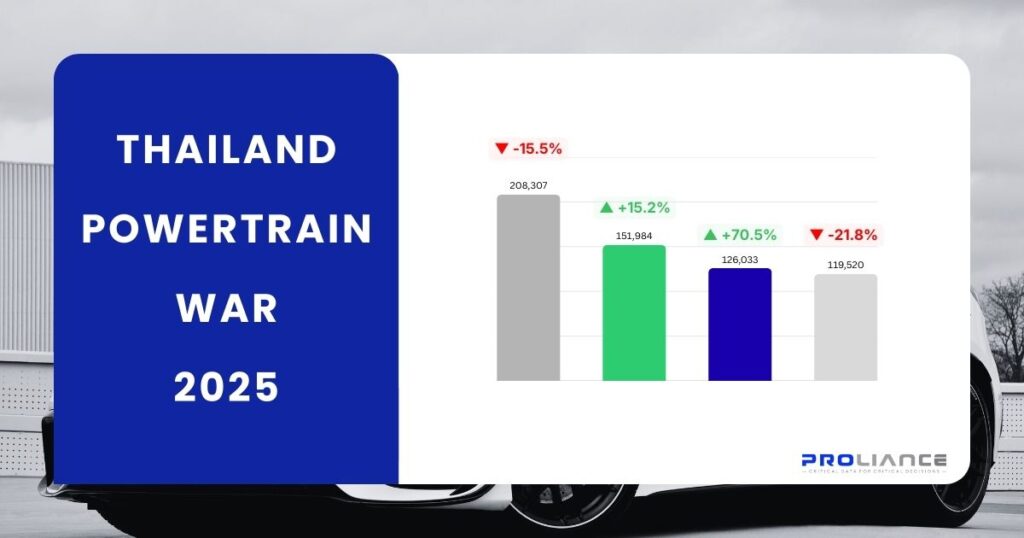

Market Dynamics in Thailand

Thailand’s EV market is witnessing renewed interest in REEVs following the 2025 Motor Expo debut of Changan’s Deepal S05. Priced competitively at ฿790,000–฿990,000, this model combines a 27 kWh battery and a 1.5L generator, positioning it as a viable alternative to mid-tier PHEVs. However, regulatory ambiguity persists. Unlike Battery EVs (BEVs) and PHEVs, which receive tax incentives, REEVs are classified as internal combustion vehicles, subjecting them to a 30% excise tax-a significant barrier to adoption.

Challenges and Opportunities

Policy Uncertainty

Thailand’s Ministry of Transport has yet to clarify REEV categorization, creating uncertainty for manufacturers and consumers. Resolving this could unlock subsidies similar to those for BEVs, which currently reduce import duties by up to 40%.

Infrastructure Adaptation

REEVs mitigate “range anxiety” in Thailand’s uneven charging network. Rural areas, where 65% of public charging stations are concentrated in Bangkok, stand to benefit most from REEVs’ fuel flexibility.

Future Outlook

Industry analysts project REEVs to capture 15–20% of Thailand’s EV market by 2027, driven by:

-

Local Production: BYD and Great Wall Motor plan localized REEV assembly to bypass import tariffs.

-

Fuel Compatibility: Next-gen REEVs compatible with E20 ethanol blends align with Thailand’s biofuel initiatives.

-

Feature Expansion: Camping modes and vehicle-to-load (V2L) capabilities cater to Thai consumers’ outdoor lifestyles.

McKinsey’s 2024 Southeast Asia EV Report notes REEV sales in China surged 150% year-on-year, contrasting with BEV growth plateauing at 22%. This trend suggests Thailand could follow suit, particularly if policies stabilize.

Conclusion

REEV technology bridges the gap between conventional hybrids and pure EVs, offering Thais a pragmatic transition path. Its success hinges on regulatory support and consumer education campaigns highlighting total cost of ownership advantages. For Thailand’s automotive sector-where pickup trucks dominate-REEVs present a strategic opportunity to diversify