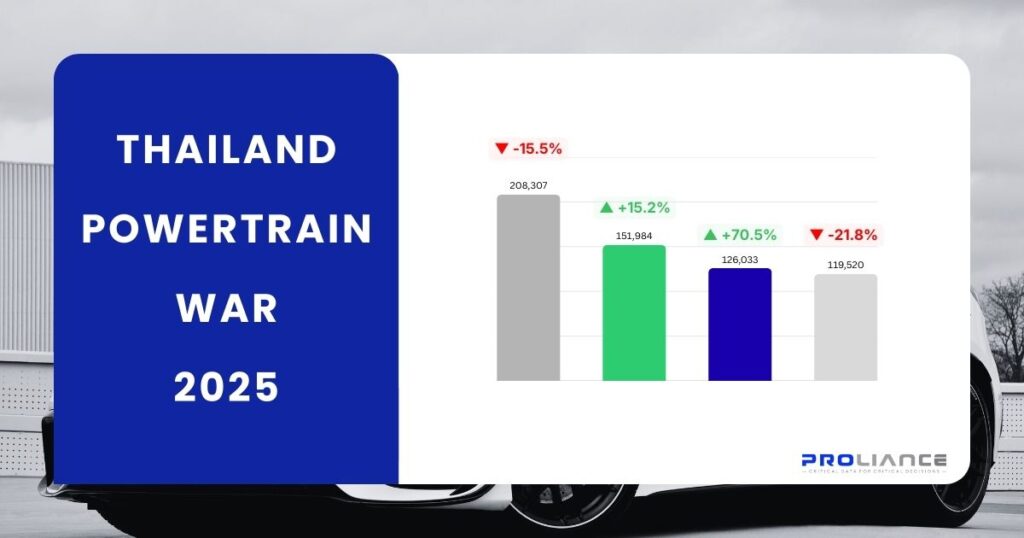

The Thai automotive landscape has historically been a fortress for Japanese manufacturers. However, the 2025 registration data reveals a seismic shift. While Japan remains the dominant force, Chinese automakers have officially captured nearly a quarter of the market, signaling that the Electric Vehicle (EV) era has permanently altered consumer behavior in Thailand.

Here is the breakdown of the battle for Thailand’s roads.

Executive Summary: The 2025 Market Shift

The 2025 Thai automotive registration data marks a historic turning point. While Japanese manufacturers (Toyota, Honda, Isuzu) defend their dominance with a 68.51% market share, the monopoly has officially fractured.

- The Chinese Surge: Chinese brands, led by BYD, have captured 22.58% of the market; a figure previously unimaginable.

- The New Challenger: BYD (41,571 units) has overtaken legacy players like Mitsubishi and Ford to secure the #4 spot overall.

- The Verdict: The market has evolved from a Japanese stronghold into a dual-pole competition based on "Reliability vs. Technology."

The Big Picture: Japan vs. China

The data clearly categorizes the market into two major superpowers.

The Japanese Stronghold (68.51%): With 415,257 units registered, Japanese brands continue to leverage their long-standing reputation for reliability, massive service networks, and dominance in the pickup truck segment.

The Chinese Surge (22.58%): Chinese brands have registered 136,871 units. This is no longer a niche segment. To put it in perspective, for every three Japanese cars sold, approximately one Chinese car is hitting the road.

Analyst Note: The 22% threshold is critical. It suggests that Chinese brands have moved past “early adopters” and are now entering the “early majority” phase of mass market acceptance.

Brand-by-Brand Performance

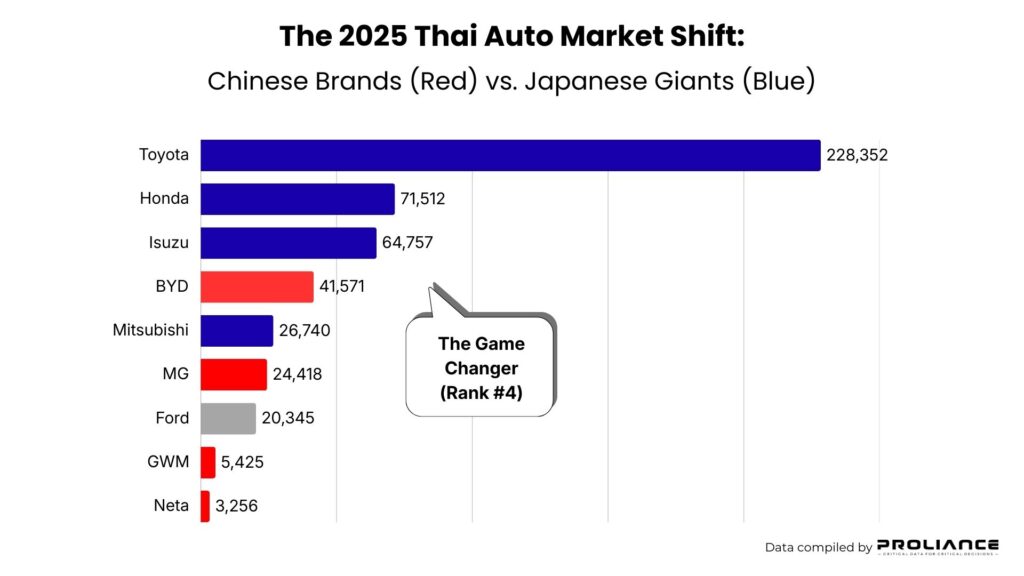

The individual brand rankings tell an even more compelling story about the changing hierarchy.

1. The Unshakable Leader: Toyota Toyota remains in a league of its own with 228,352 units and a massive 37.68% market share. Their strategy of offering a full lineup—from hybrid SUVs to commercial pickups—keeps them far ahead of the competition.

2. The New Top-Tier Contender: BYD The standout performer of 2025 is undoubtedly BYD.

Rank: #4 Overall

Units: 41,571

Market Share: 6.86% BYD has successfully positioned itself as a mainstream choice, surpassing legacy players like Mitsubishi (4.41%) and Ford (3.36%). This proves that Thai consumers are willing to switch loyalty for advanced EV technology at the right price point.

3. The Mid-Market Battleground While Toyota, Honda (11.80%), and Isuzu (10.68%) lock down the podium, the middle of the pack is fierce:

MG (China): Holds 4.03% (24,418 units), maintaining its role as a budget-friendly option.

Ford (USA): Stands at 3.36% (20,345 units), driven largely by the Next-Gen Ranger/Everest popularity.

GWM & Neta: The paths of these two brands have diverged drastically. While GWM (0.90%) continues to battle for niche segments, Neta has effectively exited the competitive equation. With its parent company, Hozon Motor, filing for bankruptcy in China and local inventory depleted, the brand now serves as a cautionary tale for the market.

Strategic Comparison: Japan Inc. vs. China EV

The 2025 registration data highlights a definitive split in consumer preference. It is no longer just about choosing a brand; it is a choice between two distinct ecosystems. On one side, Japan Inc. defends its territory with proven reliability and hybrid technology. On the other, China EV aggressively captures market share with pure electric performance and high-tech features.

Here is the head-to-head breakdown of the two dominant forces:

| 🇯🇵 JAPAN INC. | VS | 🇨🇳 CHINA EV |

|---|---|---|

|

68.51% (Dominant) |

MARKET SHARE |

22.58% (Rapid Growth) |

| **415,257** | TOTAL UNITS | 136,871 |

| Toyota, Honda, Isuzu | KEY PLAYERS | BYD, MG, GWM |

| Combustion (ICE) & Hybrid | CORE TECH | 100% Electric (BEV) |

| Reliability, Resale Value, Parts | WINNING FACTOR | Price, Features, Performance |

What This Means for Buyers in 2025

The “China vs. Japan” debate is the most common dilemma for car buyers today. The data suggests two distinct paths:

Choose Japan (Toyota/Honda/Isuzu) if: You prioritize long-term resale value, spare parts availability anywhere in the country, and proven durability over 10+ years.

Choose China (BYD/MG) if: You want cutting-edge technology, electric performance, and better options-per-dollar value. The 136,000+ units sold this year indicate that the “trust barrier” has been significantly lowered.

Final Verdict: The New Automotive Reality

2025 is the year of the “New Normal” in the Thai automotive industry. Japanese brands are down but definitely not out, while Chinese brands have secured a permanent foothold. As competition heats up, the real winner is the Thai consumer, who now has more choices than ever before.

Stop Viewing the Market in Fragments.

To dominate 2026, you need the master dataset—Brand, Model, Location, and Powertrain combined.

Get the single source of truth for Thailand’s automotive landscape.

➤ Access Full Thailand Light Vehicle Registration Data