2025 reforms promise incentives for PHEVs, export-based compliance, and infrastructure scaling to drive long-term EV investment.

Thailand’s electric vehicle (EV) strategy is revving up—combining tradition with innovation to fuel an electrified future across the kingdom.

From Local Focus to Global Outlook: Policy Tweaks in 2025

Traditionally, Thailand required automakers to match each imported EV with locally produced units. Under the EV 3.0 and EV 3.5 schemes, this ratio rose from 1:1 in earlier years to as steep as 1:2—and eventually 1:3—by 2027. This ensured investment stayed local and the supply chain stayed Thai.

This year, however, policymakers have widened the lane: exported EVs now count toward production quotas. Automakers can claim 1.5 locally produced outbound EVs as offsets against imports. This shift is expected to boost EV exports to around 12,500 units in 2025, scaling to 52,000 by 2026.

Sales Surge—But Tensions Persist

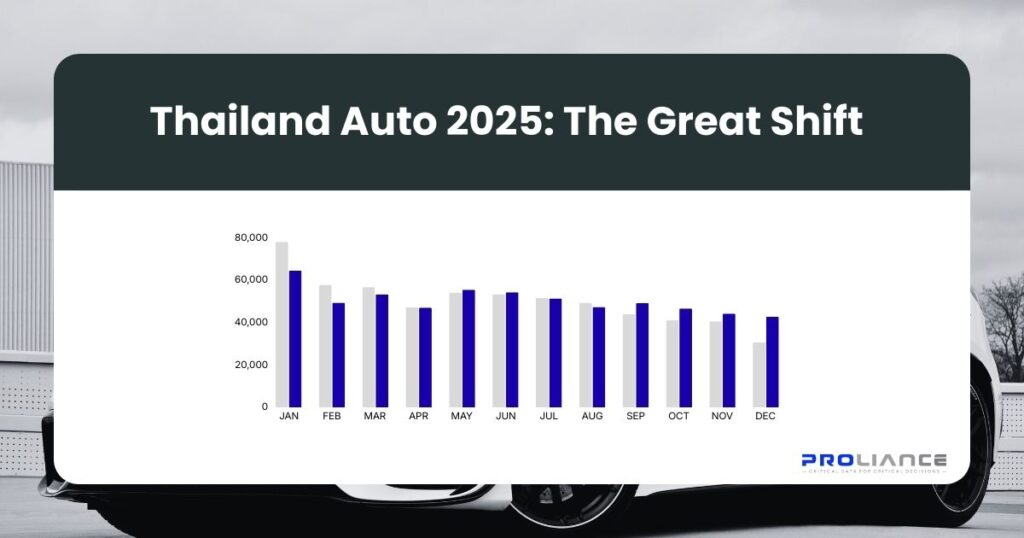

Registrations of battery-electric vehicles (BEVs) skyrocketed in the first half of 2025, with 57,289 new BEVs—a 52% jump year-on-year—now making up 15% of all new car sales, the highest proportion in Southeast Asia.

Yet the market isn’t without friction. A surge in production, especially from Chinese manufacturers, has prompted aggressive price cuts, sparking fears of prolonged price wars. Some companies have already returned subsidies or paid penalties for missing local-production targets.

Plug-In Hybrids: A Pragmatic Push into 2026

Looking past pure EVs, Thailand is embracing plug-in hybrids (PHEVs) as a bridge technology. Starting in 2026, excise taxes for PHEVs will be tied to their electric-only range—encouraging longer-range models with potentially hefty tax reductions.

Under the new PHEV incentive structure, manufacturers producing locally with high-density battery systems may benefit from a 50% lower excise tax while supporting the policy’s industrial aims—including a production target of at least 100,000 PHEVs and EVs domestically and aligning with the 30@30 goal of 30% electric vehicle production by 2030.

Scale and Support: Investment, Subsidies, and Infrastructure

Thailand’s EV supply chain is burgeoning—BOI‑approved investments have reached 137.7 billion baht (~USD 4.2 billion). Meanwhile, over 12 billion baht in subsidies have been awarded to 175,064 BEV cars and 34,559 electric motorcycles under the EV 3.0 and 3.5 programs.

Crucially, infrastructure is following pace: as of March 2025, 3,720 charging stations were operational nationwide, with 6,524 DC fast chargers already installed—surpassing earlier projections and setting the groundwork for 12,000 DC chargers by 2030.

A Forward-Thinking, Traditional Balance

Thailand’s EV policy strikes a fine chord—honoring proven industrial practices (like local‑production mandates) while adapting to economic realities. Export‑friendly adjustments and hybrid incentives show boots‑on‑the‑ground pragmatism mixed with a long view toward regional leadership.

Automakers and investors now see:

- Flexibility in leveraging exports to meet quotas,

- Rewarded environmental transition, via PHEV range-based excise benefits,

- Industrial momentum, through massive investments and infrastructure build-out.

Thailand is steering its EV journey down a well-worn path of manufacturing integrity, while accelerating toward the future with export flexibility and hybrid incentives. It’s a balancing act—grounded, strategic, and electrifying the road ahead.