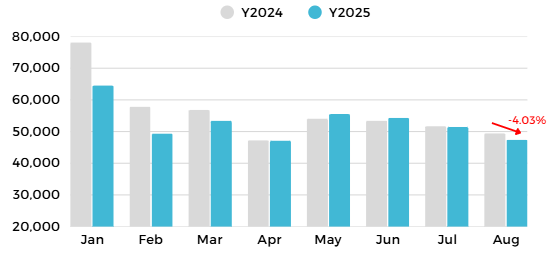

Thailand’s light-vehicle market remained subdued in August 2026, with registrations declining 4.6% year-on-year amid persistent caution in household spending and ongoing credit tightening.

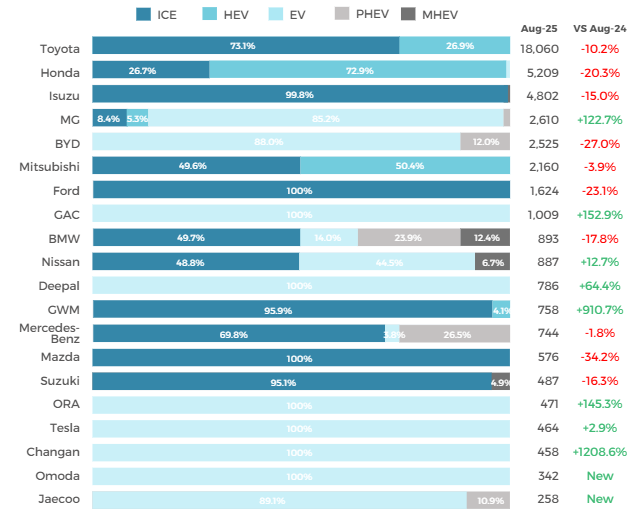

Toyota, Honda and Isuzu retained leadership positions, though emerging EV-focused brands are gradually reshaping Thailand’s automotive hierarchy.

Top 20 Most-Registered Brands – August 2025

Toyota remained the market leader with 18,060 units (-10.2% YoY), followed by Honda with 5,209 units (-20.3%) and Isuzu with 4,802 units (-15.0%). While these three Japanese brands continued to anchor Thailand’s market, their combined share slipped slightly as Chinese brands expanded aggressively through competitive pricing and product refreshes.

MG, in particular, recorded significant momentum — registering 2,610 units (+122.7% YoY), propelled by strong sales of its MG 4. GWM also maintained steady volume with 758 units, while Changan through its Deepal brand at 458 units (+1,208.6% YoY).

These developments highlight the ongoing rebalancing between traditional Japanese incumbents and emerging Chinese EV challengers.

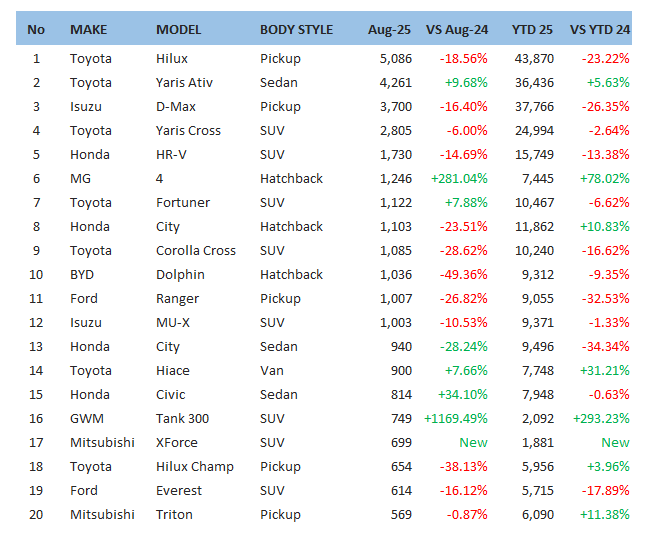

Top 20 Most-Registered Models – August 2025

Thailand’s model rankings in August 2025 reflected solid performance across core segments, with pickups and SUVs continuing to anchor the market.

The Toyota Hilux and Toyota Yaris Ativ remained the country’s two best-selling models, preserving the brand’s long-standing position despite softer demand from rural buyers and tighter lending criteria for commercial users. Popular SUVs and crossovers from Japanese brands maintained healthy volumes, reinforcing the ongoing shift away from traditional sedans.

Among electrified vehicles, top-selling BEV and HEV nameplates from Chinese and Japanese manufacturers posted strong showings within the top 20, supported by attractive pricing, tax incentives, and expanding dealer networks. These results indicate that EV adoption is no longer confined to niche early adopters but is increasingly evident in mainstream model rankings.

In short, August 2025 rankings confirm a two-speed market:

-

traditional pickups remain essential for work and regional mobility,

-

while urban buyers increasingly opt for SUVs, crossovers, and electrified models.

New Models Enter the Market

New model introductions broadened consumer choice, particularly in compact and urban-oriented EVs. These launches reflect Chinese OEMs’ continued push into lower-price bands, a strategy that pressures incumbents to localize more affordable electrified offerings.

Most of these new entrants feature moderate battery capacity paired with practical daily-use range, targeting first-time EV buyers seeking affordable ownership. However, as consumer awareness grows, after-sales service quality has become a key purchasing factor; recent social-media discussions about costly replacement parts have heightened buyer caution and expectations of stronger warranty support.

Insurance has also become a crucial consideration. Several insurers are increasingly hesitant to underwrite EVs, as even minor accidents often result in total-loss assessments due to high repair costs and limited repair expertise. With EV technology still relatively new to Thailand, technicians at many service centers lack the specialized skills required for complex repairs—leading to full component replacements instead of restorations, further inflating claim values and premiums.

At the same time, frequent and aggressive price reductions by Chinese OEMs have introduced another layer of concern. Early buyers of these models face significant depreciation, as newer units are often discounted well below their original purchase prices. This rapid loss of resale value has added to consumer caution, reinforcing perceptions that while EV ownership costs are falling, long-term value stability remains uncertain.

Outlook

The Thai automotive market continues to face multiple headwinds, with overall sales declining slightly and competitive pressure intensifying. Higher household debt, tighter loan approvals, and lingering macroeconomic uncertainty are expected to cap near-term upside for total registrations.

At the same time, the brand and model mix is shifting meaningfully:

-

Japanese brands still anchor the market but are being challenged at the edges by agile Chinese EV players.

-

Pickups remain vital, yet growth momentum is clearly stronger in SUVs, crossovers, and electrified segments.

-

New BEV launches are expanding choice, driving price competition, and gradually normalizing EVs in the eyes of Thai consumers.

For OEMs and suppliers, August 2025 serves as another reminder that product strategy and positioning now matter as much as absolute volume. Brands that adapt quickly to evolving consumer preferences — particularly in electrified and urban-oriented vehicle types — will be best placed to capture future growth as Thailand’s market transitions into its next cycle.

Learn more:

- Thailand Auto Market Contracts 4.6% in August 2025, EVs Continue to Gain Share

- Thailand EV Market August 2025: Sustains Momentum Amid Cooling Incentives

- Dataset: Full Thailand Light Vehicle Registration