NETA Auto Thailand continues to expand its operations while its Chinese parent company, Hozon New Energy Automobile, faces potential bankruptcy proceedings. This contrast highlights the Thai subsidiary’s unique position as it pursues its “All in Thailand, All for Thailand” strategy despite the parent company’s financial turmoil.

NETA Auto Thailand Pushes Forward Despite Parent Company’s Financial Crisis

Thailand Operations: Growth Amid Uncertainty

Since launching in Thailand in August 2022 with the NETA V electric city car priced at 549,000 baht, NETA has delivered over 15,000 units to Thai customers. The company has captured approximately 17% market share, ranking as the second-largest player in Thailand’s EV market for two consecutive years.

In March 2024, NETA reached a significant milestone by beginning mass production at its Bangkok factory-the company’s first manufacturing facility outside China and the first EV factory within Bangkok’s industrial zone. This facility produces the NETA V-II model, which was launched at the 2024 Bangkok International Motor Show with prices between 549,000 and 569,000 baht.

NETA’s ambitious plans for Thailand include:

– Producing the NETA X model starting in July 2025

– Delivering over 30,000 EVs to Thai customers by the end of 2024

– Increasing annual production from 10,000 units in 2025 to 50,000 units by 2029

– Establishing Thailand as an export hub for ASEAN markets

– Launching at least one new model per year beginning in 2025

Chinese Parent Company: A Deepening Crisis

Meanwhile, Hozon Auto has accumulated losses of approximately 18.3 billion yuan (USD 2.5 billion) between 2021 and 2023. The situation has deteriorated significantly:

– Production at NETA’s three major factories in China has reportedly shut down

– Direct sales stores have closed in multiple Chinese cities

– Many employees are receiving reduced salaries

– The company’s headquarters in Shanghai appears nearly empty during working hours

– Suppliers have been visiting headquarters demanding payment for outstanding debts

On May 13, 2025, Shanghai Yuxing Advertising filed a bankruptcy review case against Hozon New Energy Automobile with the Intermediate People’s Court of Jiaxing City. While NETA has denied filing for bankruptcy internally, this legal action represents a formal procedure to assess whether the company is eligible for restructuring, liquidation, or acquisition.

Challenges in Thailand

Despite public confidence, NETA’s Thai operations face mounting challenges:

Parts Shortages and Customer Dissatisfaction

Thai customers have reported extended delays in spare parts delivery, with wait times exceeding 2-3 months for basic maintenance components. Service centers have cited supply chain disruptions from China.

To address these issues, NETA opened a 4,000-square-meter spare parts distribution center in May 2025, which is expected to store over 120,000 spare parts and improve logistics nationwide. However, parts shortages continue to be reported.

Financial and Regulatory Pressures

– Subsidy risks: NETA received up to 150,000 baht per vehicle in Thai EV subsidies, with potential repayment obligations if local production targets aren’t met

– Sales decline: Bookings at the 2025 Bangkok International Motor Show fell to 1,219 units from 1,618 units the previous year

– Workforce reductions: The Thai subsidiary reportedly cut 400 employees in late 2024 amid liquidity concerns

Survival Strategies

NETA Auto secured a 10 billion baht (USD 215 million) credit line in Thailand in March 2025, which appears to be one of the company’s financial lifelines. The company is pursuing various strategies to address its troubles:

– Attempting to secure a Series E funding round of 4-4.5 billion yuan

– Reaching debt-to-equity swap agreements with 134 core suppliers totaling over 2 billion yuan (USD 275 million)

– Organizational optimization and strategic cooperation with major customers

Sun Baolong, General Manager of NETA Auto Thailand, has repeatedly assured Thai customers that production and sales will continue uninterrupted. In March 2025, he announced that NETA Auto Thailand would start repaying its debts to dealers and suppliers in April and May before resuming full production in June.

Market Contrasts

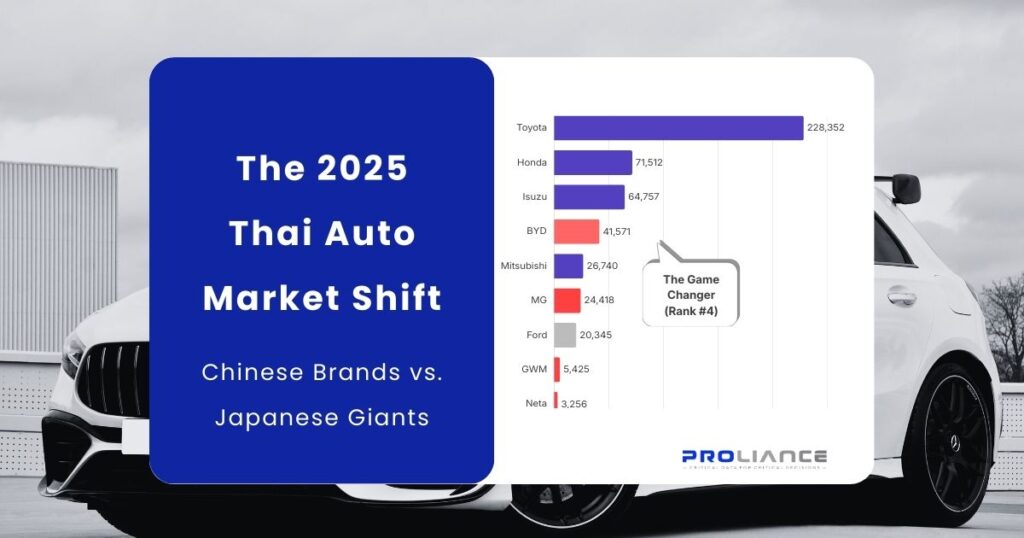

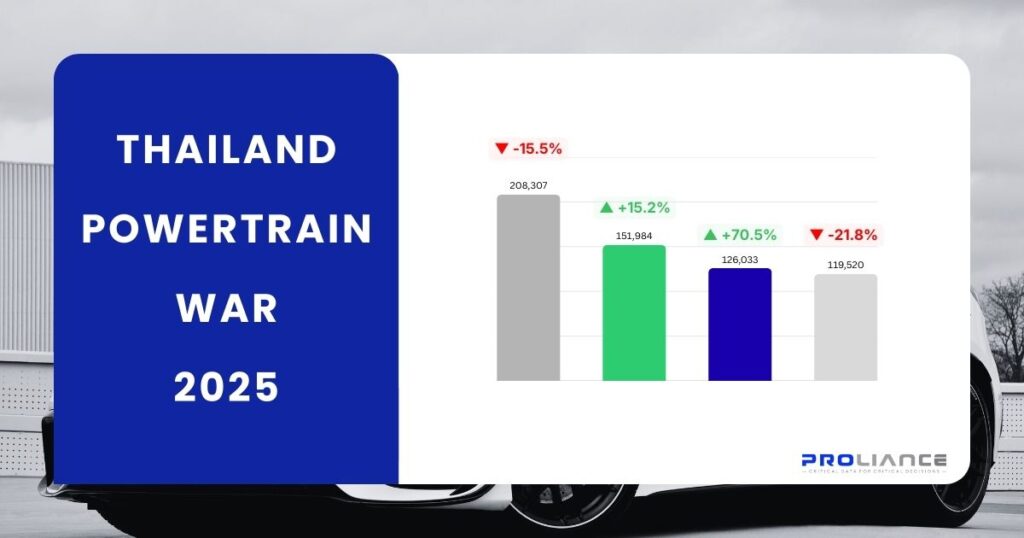

The divergent paths reflect different market conditions. In China, NETA faces intense competition in an increasingly saturated market, with sales dropping 16% in 2023.

In Thailand, however, NETA has established itself as a significant player in the developing EV ecosystem, benefiting from supportive government policies and incentives that have attracted numerous Chinese EV makers.

Uncertain Future

The future of NETA Auto remains uncertain. While the Thai subsidiary continues to project confidence and pursue expansion plans, the financial troubles of its parent company cast a significant shadow. For Thai customers, NETA emphasizes its commitment to its 25,000 car owners in the country by improving spare parts supply and enhancing repair response times.

As NETA navigates these challenges, its Thai operations may prove to be not just a bright spot but potentially a lifeline for the troubled EV maker’s global ambitions.