By Proliance Automotive Insights Team

Once seen as a promising force in Thailand’s electric vehicle (EV) revolution, NETA Thailand is now in turmoil. The brand’s recent fire sale of the NETA V-II at just 299,000 baht has sent shockwaves through the market, highlighting deep-rooted financial and operational challenges. This dramatic price drop, widely promoted by dealers and accompanied by the removal of warranties, has raised serious questions about the company’s future and its commitment to Thai consumers.

Registration Data: The Hard Numbers

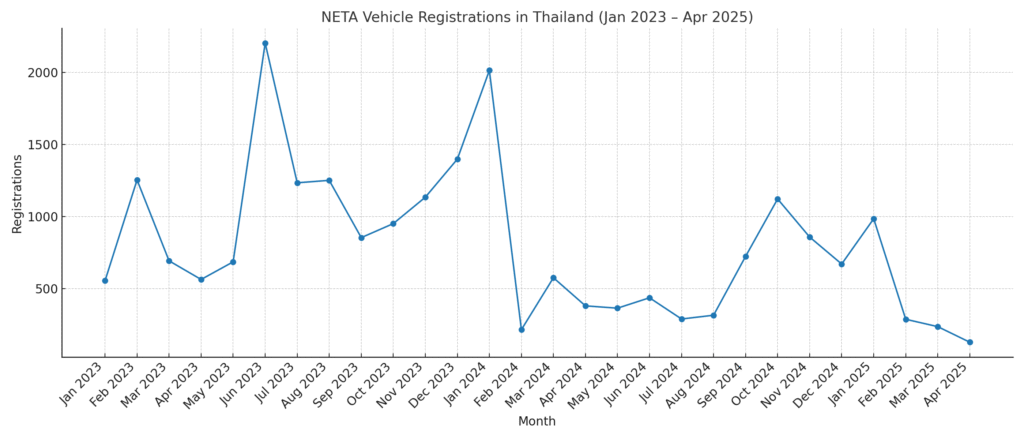

A close look at official registration figures compiled by Proliance reveals a stark reality behind NETA’s sales claims. According to the latest data, the cumulative registrations for all NETA models in Thailand from January 2023 to May 2025 are as follows:

| Model | Total Registrations (Jan 2023–May 2025) |

|---|---|

| NETA V | 13,996 |

| NETA V-II | 1,439 |

| NETA X | 16 |

This brings the total to just over 15,400 registered NETA vehicles—significantly lower than the often-cited sales figure of 25,000 units on Thai roads. The discrepancy underscores a growing gap between sales and actual vehicles legally registered for use.

Sharp Decline in Registrations and Sales

The momentum that once propelled NETA has now stalled. NETA V registrations peaked at over 2,200 units in June 2023 but have since dropped off significantly. The NETA V-II, introduced in late 2023, experienced a brief surge with 865 registrations in January 2024, yet this number dwindled to only 129 by May 2025. The NETA X has barely registered in the market, with just 16 units to date.

In the first five months of 2025, NETA managed only 1,439 new registrations—a dramatic decline from previous years and a clear indicator of the brand’s deepening crisis.

Analysis: NETA Vehicle Registrations in Thailand

Key Observations

-

Early Growth and Peaks:

The chart shows a significant rise in registrations during mid-2023, with a major peak in June 2023 (over 2,200 units). This reflects the initial surge in demand following NETA’s market entry and early promotional efforts. -

Second Surge:

Another pronounced peak appears in January 2024, indicating a short-lived resurgence, possibly linked to new model launches or aggressive marketing campaigns. -

Sustained Decline:

After the January 2024 high, the trend line shows a steady and marked decline. Monthly registrations drop sharply, with figures falling below 500 units by April 2025. This downward trend highlights the brand’s ongoing challenges, including financial instability, dealer exits, and eroding consumer confidence. -

Market Volatility:

The chart’s fluctuations underscore the volatility in NETA’s market performance, with periods of rapid growth followed by equally rapid declines.

Implications for the Market

-

The initial peaks demonstrate NETA’s ability to capture market attention and generate strong early sales.

-

The subsequent decline aligns with recent reports of operational and financial difficulties, shrinking dealer networks, and customer service issues.

The chart visually confirms that NETA’s registration momentum has not been sustained, raising concerns about the brand’s long-term prospects in Thailand.

Why the Data Matters

At Proliance, we believe that registration data is the leading indicator of brand health in the automotive space. In NETA’s case, the trend couldn’t be clearer: from 2,200 units/month at their peak to under 130 in April 2025.

This is not just a dip — it’s a structural collapse that may reshape the brand’s future in Thailand.

At Proliance, we’ll continue providing unbiased, data-driven insights so stakeholders can stay ahead of the curve — not get caught beneath it.

For more data-driven insights and analysis on the Thai automotive market, visit Proliance’s Automotive Insights section.