Thailand’s National EV Policy Committee has taken decisive action to recalibrate its electric vehicle (EV) strategy, shifting gears from aggressive import-led incentives to policies aimed at fostering long-term domestic production. The recently announced EV 3.5 policy marks a critical evolution in Thailand’s electrification journey, balancing the need to sustain momentum in EV adoption with urgent concerns about a market glut and the need for greater industrial self-reliance.

EV 3.0: A Success—But with Consequences

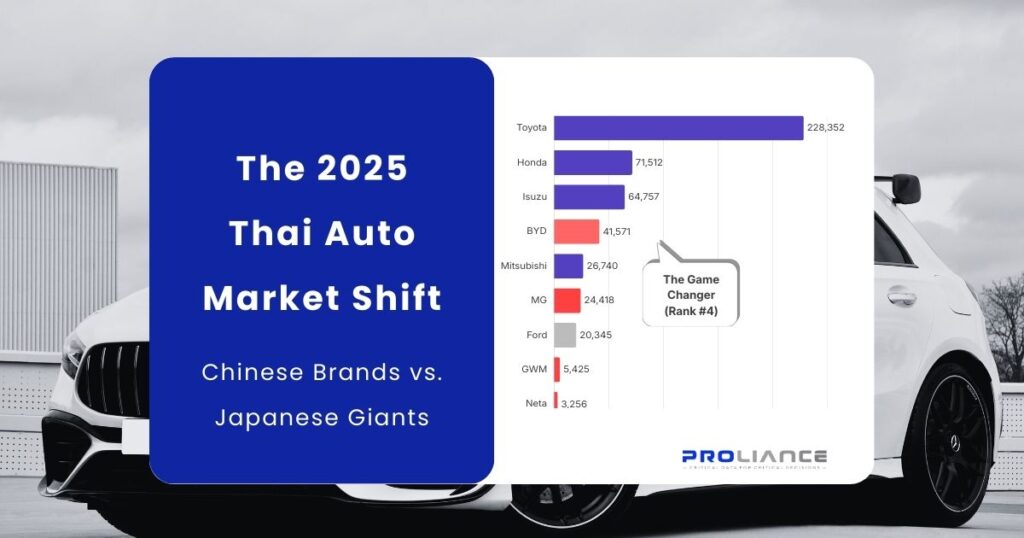

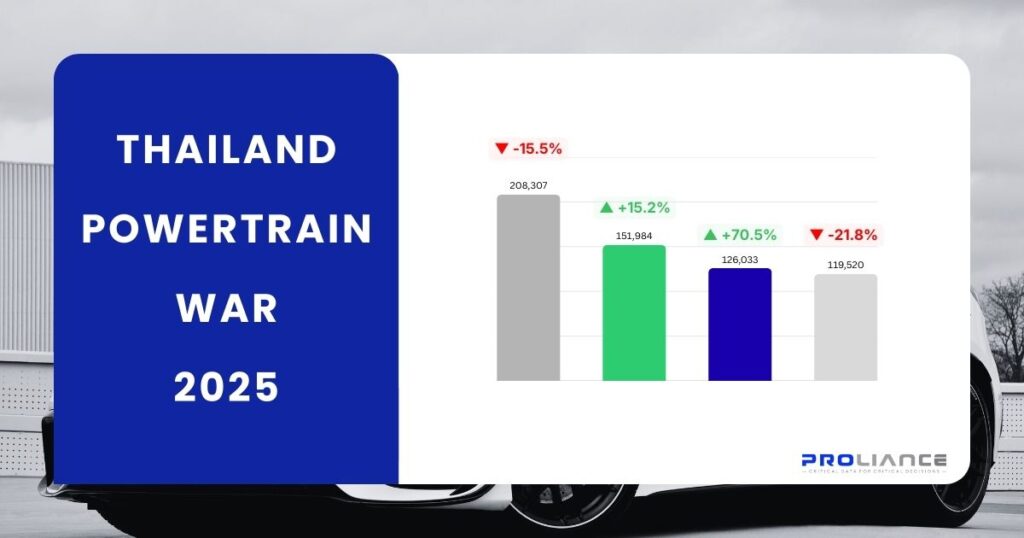

Thailand’s earlier incentive schemes—particularly EV 3.0—were successful in driving rapid growth in electric vehicle sales. Generous subsidies, excise tax breaks, and import duty reductions attracted major foreign players and lowered price barriers for consumers. Sales of battery electric vehicles (BEVs) surged from just 9,000 units in 2022 to over 80,000 in 2024, with Chinese brands such as BYD, MG, and Neta leading the charge.

However, this success came with unintended consequences. The overwhelming reliance on imported vehicles—mainly from China—raised concerns about a supply glut. EV inventories ballooned. Local assembly facilities lagged behind, and component manufacturing failed to keep pace. Many domestic stakeholders feared Thailand might become merely a dumping ground for foreign-made EVs rather than an integrated player in the global EV value chain.

Enter EV 3.5: A Strategic Reset

The new EV 3.5 scheme, effective from 2024 through 2027, reflects a strategic pivot. While retaining certain subsidies, it places much stronger emphasis on local production, component localization, and supply chain investment.

Key changes include:

-

Higher localization ratios: Automakers who wish to continue enjoying subsidies must now adhere to a stricter import-to-production ratio—1:2 in 2026, rising to 1:3 in 2027. This is a step up from the previous 1:1 ratio under EV 3.0.

-

Reduced subsidies over time:

-

For BEVs priced below ฿2 million:

-

฿50,000–100,000 subsidy in 2024–25

-

Reduced to ฿25,000–50,000 in 2026–27

-

-

For EV pick-ups and electric motorcycles, subsidies remain significant: ฿100,000 for pickups and ฿10,000 for motorcycles.

-

-

Tax breaks maintained, but more targeted: Import duties can still be reduced by up to 40%, and excise tax is slashed to 2% for eligible EVs. However, these benefits are now conditional on local commitments.

Localization: Not Just Assembly—But Components Too

In addition to final vehicle assembly, EV 3.5 places a heavy emphasis on domestic production of key components—specifically electric motors, inverters, and reducers. By 2026, manufacturers receiving incentives must be able to demonstrate local sourcing or production of these vital parts.

The goal here is twofold:

-

Create a resilient and vertically integrated EV supply chain within Thailand

-

Position the country as a strategic EV manufacturing hub for ASEAN and global markets

According to the Board of Investment (BoI), over ฿80 billion has already been committed by both local and foreign firms in support of EV-related manufacturing projects. New plants by BYD in Rayong and battery initiatives from Foxconn and PTT Group are clear signals of momentum.

Human Capital & Infrastructure: Parallel Priorities

Recognizing that factories alone aren’t enough, Thailand’s Ministry of Higher Education, Science, Research and Innovation (MHESI) has introduced a three-pronged strategy—EV-HRD, EV-Transformation, and EV-Innovation—aiming to train over 150,000 workers with EV-related skills over the next five years. Curriculum upgrades, university-industry linkages, and R&D incentives form the backbone of this effort.

Meanwhile, the charging infrastructure is also expanding. Time-of-use electricity rates for EV chargers have been approved, and the Energy Regulatory Commission (ERC) is streamlining licensing to accelerate charger installations nationwide.

Market Outlook: From Quantity to Quality

Thailand’s EV strategy is maturing—from chasing raw registration numbers to shaping a robust domestic industry. The pivot from import-heavy incentives toward production-linked support reflects lessons learned and mirrors policy trends seen in other major EV markets like India, the EU, and the US.

The country’s long-standing ambition of achieving 30% zero-emission vehicle production (30@30) by 2030 remains intact. However, EV 3.5 ensures that this target is achieved through Thai hands, Thai factories, and Thai-trained talent—not just imported solutions.

What This Means for Stakeholders

-

Automakers will need to localize faster than originally planned. Final assembly isn’t enough—local parts production is now mandatory.

-

Investors and suppliers should seize opportunities in battery packs, drivetrain components, and EV-related services such as software, telematics, and maintenance networks.

-

Consumers may see fewer ultra-low-priced EV imports in coming years, but gains in quality, servicing, and parts availability are expected as local capacity ramps up.

Final Thoughts

EV 3.5 is not a retreat—it’s a realignment. The Thai government has reaffirmed its commitment to a sustainable EV future, but with smarter tools. By shifting the incentives from sheer volume to value creation, Thailand is setting the stage for an EV industry that is not only greener, but economically resilient and globally competitive.

Proliance monitors EV and vehicle registration trends in Thailand, India, the Philippines and the GCC—offering data-driven insights to help businesses stay ahead.