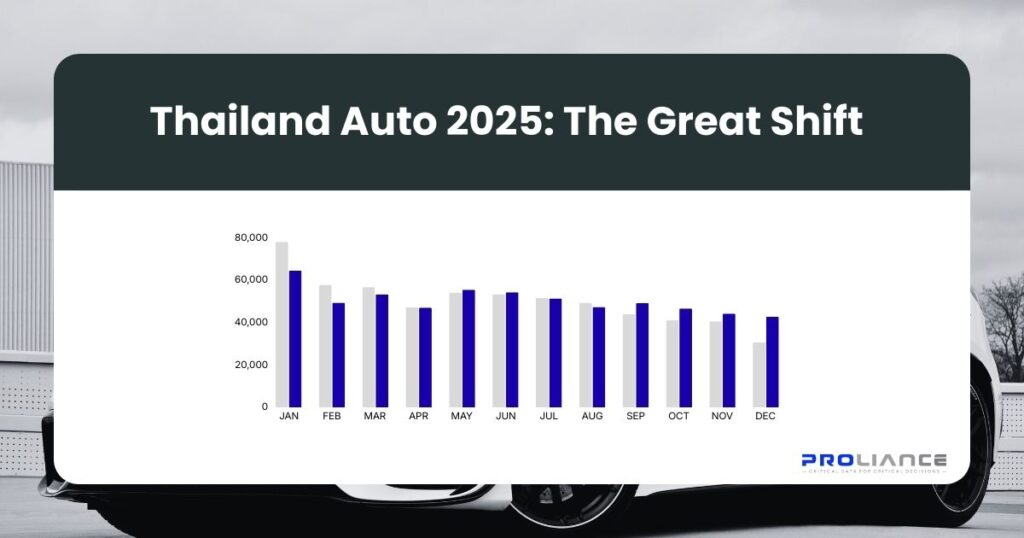

Thailand’s automotive market underwent a significant transformation in Q1 2025. While total light vehicle registrations declined 13.23%, electrified vehicles captured 40% market share, representing one of the highest EV adoption rates in Southeast Asia. Our analysis of official Department of Land Transport registration data reveals key trends and market shifts in Thailand’s evolving automotive landscape.

Q1 2025 Thailand Registration Highlights

Market Overview:

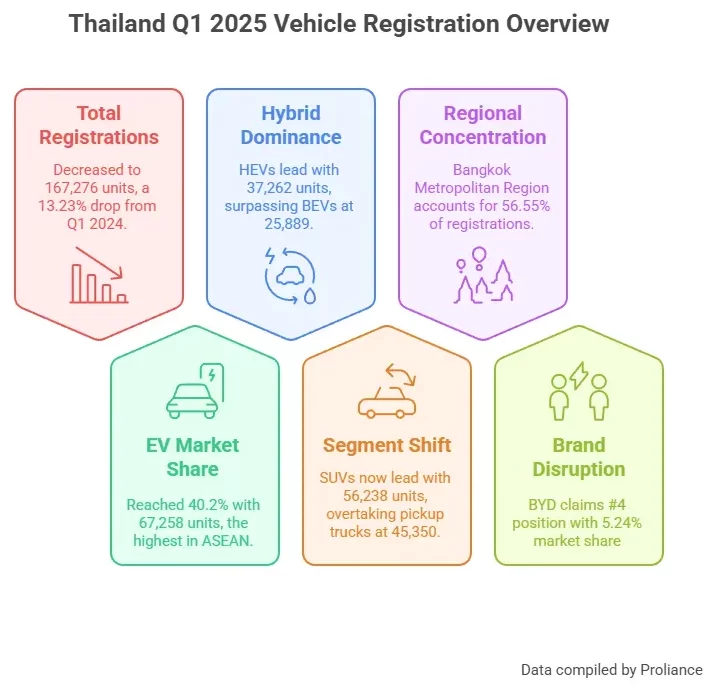

- Total registrations: 167,276 units (-13.23% vs Q1 2024’s 192,789)

- EV market share: 40.2% (67,258 units) – highest in ASEAN

- Hybrid dominance: HEV leads with 37,262 units vs BEV’s 25,889

- Body style shift: SUVs (56,238) now lead pickup trucks (45,350)

- Regional concentration: Bangkok Metropolitan Region captures 56.55% of registrations

- Brand disruption: BYD claims #4 position with 5.24% market share

Market Overview: Transformation in Progress

Thailand’s Q1 2025 light vehicle registration data tells a story of market evolution rather than simple growth. With 167,276 total registrations compared to 192,789 in Q1 2024, the 13.23% decline masks a fundamental shift toward electrification and premiumization.

This transformation reflects several factors: delayed purchases during economic uncertainty, consumer migration toward electrified vehicles, and a preference shift from traditional segments to SUVs and premium models.

The most striking revelation: Electrified vehicles (EVs, PHEVs, and HEVs) now represent 40.2% of all light vehicle registrations, positioning Thailand among Southeast Asia’s electrification leaders.

“Thailand’s 40.2% electrified vehicle market share represents one of the highest EV adoption rates in Southeast Asia, indicating a significant shift toward advanced automotive technologies in emerging markets.” – Proliance Automotive Insights Team

The Electrification Revolution: 40% Market Share Achievement

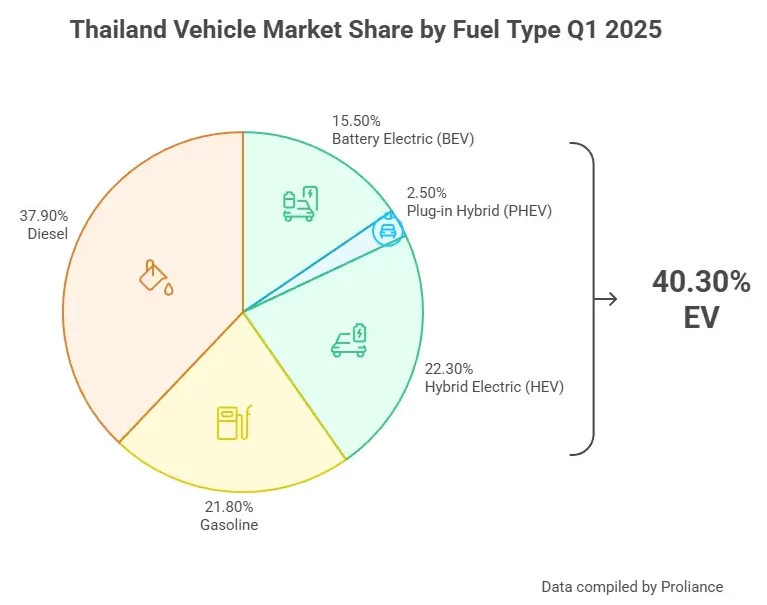

EV Segment Breakdown – Q1 2025

Thailand’s electrification journey reached a significant milestone with 67,258 electrified vehicle registrations across three categories:

Hybrid Electric Vehicles (HEV): 37,262 units (22.3% market share)

- Toyota’s hybrid portfolio dominates this segment

- Yaris Cross Hybrid and Corolla Cross Hybrid lead registrations

- Consumer preference for proven hybrid technology, coupled with strong confidence in the brand, is clearly evident

Battery Electric Vehicles (BEV): 25,889 units (15.5% market share)

- BYD dominates the market with the highest sales figures, led by the Dolphin (#1) and Sealion 7 (#2)

- MG4, operating under Chinese parent company SAIC, secures third position due to aggressive discounts of up to 140,000 baht

- Emerging Chinese brands like Deepal S07 and Denza D9 achieve success, ranking 4th and 5th respectively

Plug-in Hybrid Electric (PHEV): 4,107 units (2.5% market share)

- BYD Sealion 6 leads PHEV registrations, demonstrating Chinese brand expansion beyond pure electric vehicles into hybrid technology

- Premium European brands dominate luxury segment with BMW 3-Series (#2) and Mercedes-Benz E-Class (#3) maintaining strong market presence

- PHEV buyers favor luxury sedans, seeking electric capability combined with traditional powertrain backup for long-distance driving needs

What This Means for ASEAN

Thailand’s 40% electrified market share appears to significantly exceed regional averages, potentially positioning the kingdom as a regional EV adoption leader. This rapid adoption suggests that emerging markets can accelerate automotive electrification when supported by appropriate policy frameworks. With our capability to analyze EV markets across the ASEAN region, Proliance is well-equipped to provide specific comparisons and insights into how Thailand’s progress measures against other ASEAN markets.

Brand Performance: Winners and Surprises

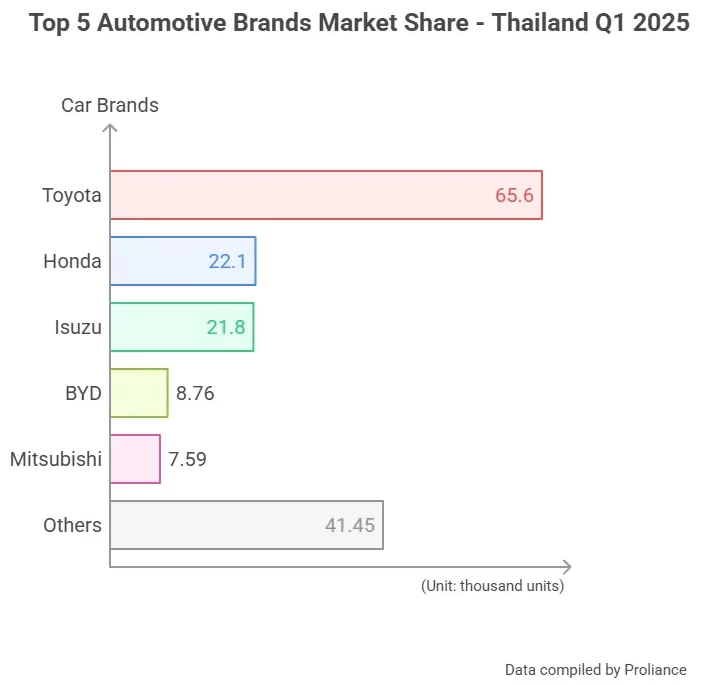

Top 5 Brands Market Share Analysis

-

Toyota: 65,553 units (39.19% market share)

- Maintains market leadership despite overall market decline

- Hilux continues as pickup segment leader

- Hybrid portfolio drives resilience (Yaris Cross, Corolla Cross, Camry)

- Strong performance across multiple vehicle categories

-

Honda: 22,103 units (13.21% market share)

- Strong performance in hybrid sedans (Civic, City)

- HR-V and CR-V maintain SUV segment presence

- Electric vehicle portfolio still developing

-

Isuzu: 21,827 units (13.05% market share)

- Pickup truck specialist maintaining market presence

- D-Max continues to serve commercial segment

- Needs electrification strategy for long-term growth

-

BYD: 8,757 units (5.24% market share)

- Notable performance for Chinese brand

- Dolphin leads BEV market registrations

- Fastest-growing major brand in Thailand

-

Mitsubishi: 7,590 units (4.54% market share)

- Triton pickup maintains loyal following

- Steady performance in challenging market

- Recent introduction of the X-Force HEV is expected to drive up registration figures in the coming months

The BYD Success Story

BYD’s rise to #4 brand position represents a notable market development for Chinese automotive brands in Thailand. With 8,757 registrations in Q1 2025, BYD’s performance indicates that Chinese brands can compete successfully in premium ASEAN markets when offering compelling EV technology, though long-term market acceptance will depend on continued product quality and service network development.

Body Style Revolution: SUVs Now Lead

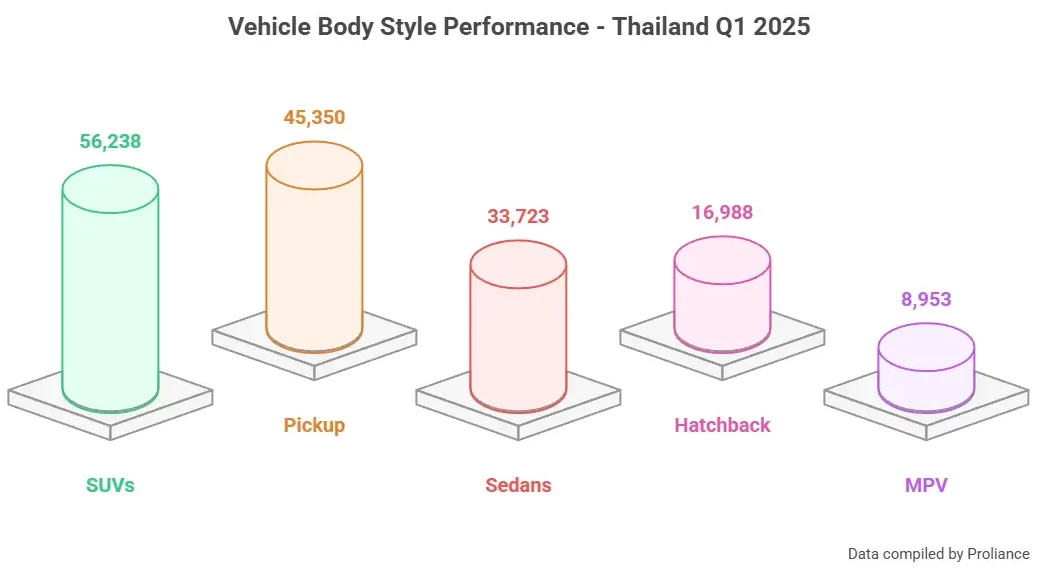

SUVs now lead registrations with 56,238 units compared to pickup trucks’ 45,350 units, representing a notable shift in vehicle body style preferences.

Vehicle Body Style Performance – Q1 2025

SUVs: 56,238 units (33.6% market share)

- Leading vehicle segment in Q1 2025

- Electrified SUV options expand choice

- Toyota Yaris Cross Hybrid leads segment

- Premium SUV registrations increase

Pickup Trucks: 45,350 units (27.1% market share)

- Traditional Thai favorite continues strong performance

- Toyota’s pickup models lead the segment based on brand market share

- Commercial buyers remain loyal to established brands

- Electrification options limited across segment

Sedans: 33,723 units (20.2% market share)

- Steady decline continues as SUV preference grows

- Electrified sedan options available from major brands

- Traditional sedan segment maintains steady buyer base

Hatchbacks: 16,988 units (10.2% market share)

- Value segment maintains steady demand

- Attracts first-time buyers and urban consumers

- Electrification options emerging

MPVs: 8,953 units (5.4% market share)

- Family vehicle segment remains niche

- MPV segment maintains niche market position

- Focused buyer base within the Thai auto market

Regional Registration Patterns: Bangkok’s Dominance

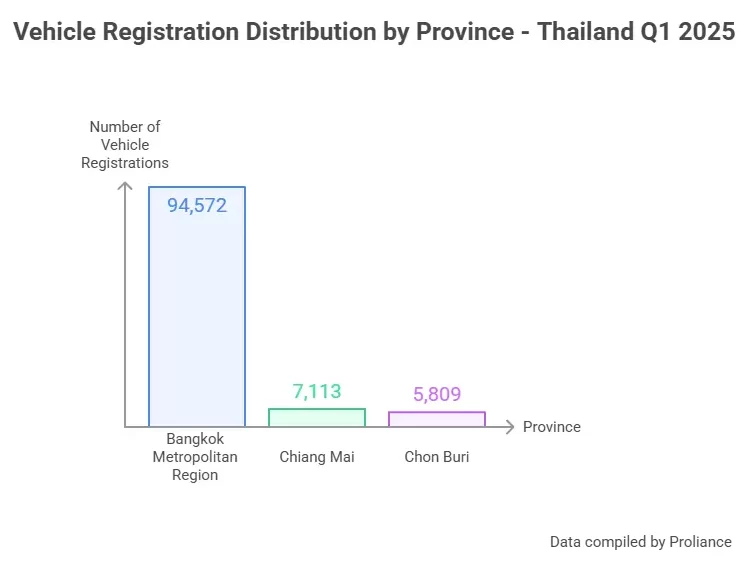

Provincial Registration Distribution

Bangkok Metropolitan Region: 94,572 units (56.68%)

- Overwhelming concentration in capital region

- EV adoption rate highest in kingdom

- The Bangkok Metropolitan area comprises six provinces: Bangkok, Nakhon Pathom, Pathum Thani, Nonthaburi, Samut Prakan, and Samut Sakhon.

- Charging infrastructure is the most well-developed

Chiang Mai: 7,113 units (4.26%)

- Northern region’s largest market

- Second highest provincial registrations after Bangkok

- Key economic hub of northern Thailand

Chon Buri: 5,809 units (3.48%)

- Major Industrial and Business Hub with high concentration of automotive manufacturers and suppliers

- Third highest provincial registrations

- Robust Infrastructure including roads, electricity, and connectivity to Bangkok

Geographic Insights

The extreme concentration of registrations in Bangkok Metropolitan Region (56.68%) reflects Thailand’s economic centralization and infrastructure development patterns. This concentration also explains the rapid EV adoption, as Bangkok’s charging infrastructure and urban driving patterns favor electric vehicles.

Regional markets outside Bangkok show more traditional preferences, with pickup trucks maintaining stronger positions and electrification adoption lagging due to infrastructure limitations.

Fuel Type Transformation: The Hybrid Preference

Thailand’s electrification journey reveals a unique preference pattern that differs from Western markets:

Traditional Fuels Still Significant:

- Diesel: 63,448 units (37.9%) – Commercial and pickup preference

- Gasoline: 36,503 units (21.8%) – Declining as electrification grows

Electrified Vehicle Preferences:

- HEV leads EV adoption with 37,262 units vs BEV’s 25,889

- Hybrid vehicles currently capture larger market share than pure electric

- Toyota’s hybrid portfolio holds significant market presence

- Current registration patterns show higher hybrid adoption rates

The registration data shows hybrid vehicles (37,262 units) currently outsell battery electric vehicles (25,889 units) in Thailand’s Q1 2025 market, though this may reflect factors such as product availability, pricing structures, infrastructure development, or market timing rather than consumer technology preferences alone.

Market Implications & Future Outlook

Thailand’s Q1 2025 registration data indicates a fundamental market transformation driven by government EV incentives, rising fuel costs, and evolving consumer preferences. The 40.2% electrified vehicle adoption rate, while total registrations declined 13.23%, suggests buyers are shifting toward advanced technologies rather than avoiding purchases entirely.

Key Market Dynamics

The geographic concentration in Bangkok (56.55% of registrations) reflects infrastructure availability and urban driving patterns that favor EVs. This concentration, combined with successful Chinese brand entry (BYD’s 5.24% market share), indicates consumer openness to new technologies and brands when value propositions align with local needs.

The SUV body style overtaking pickups represents a notable shift in registration patterns, though there are several major underlying causes, one of which is stricter financing terms for potential pick-up truck buyers.

Challenges and Opportunities

Infrastructure expansion beyond Bangkok remains critical for sustained EV growth, while grid capacity and renewable energy integration will determine the environmental benefits of widespread adoption. The traditional automotive ecosystem faces adaptation challenges as EVs require different service approaches and supply chains.

Consumer Confidence in New Brands

BYD’s successful entry into the market highlights consumers’ openness to Chinese automotive brands. However, sustained acceptance will depend on the development of robust aftersales service, reliable parts availability, and comprehensive warranty support. Understanding the specific motivations behind Chinese EV adoption—whether influenced by competitive pricing, advanced features, government incentives, or limited alternatives—will require focused market research. Nevertheless, recent challenges faced by NETA Thailand risk undermining not only consumer confidence in the NETA brand, but potentially in Chinese automotive brands as a whole.

Market Maturation Dynamics

The overall market decline (-13.23%) while certain segments grow indicates selective consumer behavior, possibly influenced by financing availability, economic uncertainty, or strategic purchasing delays. Understanding whether this represents temporary market adjustment or structural changes will be crucial for industry planning.

Regional Context

Thailand’s rapid electrification provides valuable insights for ASEAN automotive strategies; however, maintaining its leadership position will require ongoing investment in infrastructure, continued development of domestic manufacturing, and the implementation of up-to-date government policies that support both EV adoption and local production. Other regional markets are implementing similar policies, creating competitive pressure on Thailand’s first-mover advantages.

Based on official Thailand Department of Land Transport data and Proliance automotive market analysis.

Q2 2025 Forecasts Based on Current Trends

Based on Q1 registration patterns and observable market indicators, we anticipate:

- EV Growth: Continued strong year-over-year growth in Q2, though specific percentages depend on policy continuity, infrastructure development, new model launches, promotional campaigns, and the ease of loan approvals

- Chinese Brands: Potential for increased market share as additional models launch

- Pickup Segment: May continue gradual decline as consumer preferences shift toward SUVs

- Regional Expansion: EV adoption likely to expand to secondary cities with improved infrastructure

- Commercial Electrification: Expected fleet announcements as businesses evaluate EV options

These projections represent analytical insights based on current market trends and are subject to economic, policy, and competitive changes.

About This Analysis

This analysis is based on official Thailand Department of Land Transport light vehicle registration data. Market interpretations, trend analysis, and future projections represent Proliance automotive intelligence insights and should be considered alongside other market research. Registration data covers Light Vehicles but excludes motorcycles, commercial trucks, and specialty vehicles.

Data Sources:

Data from Thailand Department of Land Transport, meticulously compiled, cleansed, and analyzed by Proliance

Coming Next in Our Regional Series:

- India Vehicle Registration Deep Dive

- Philippines Automotive Market Analysis

- GCC Vehicle Registration Analysis & Cross-Border Patterns

Need Thailand automotive market insights for your business?

Our comprehensive registration database provides market intelligence with:

- Brand and model-level performance tracking since 2017

- Provincial breakdowns

- Historical trend analysis and custom benchmarking

- Monthly and Quarterly market updates