New excise tax framework promotes local supply chains, supports EV exports, and reinforces Thailand’s role as a regional manufacturing hub.

As part of its ongoing commitment to strengthening the domestic automotive industry and accelerating the transition to electric mobility, the Thai government has introduced key changes to its excise tax structure. The revised policy favors electric vehicles (EVs) that incorporate a higher proportion of locally produced components, with the goal of enhancing national competitiveness and reducing dependency on imports.

This latest development, led by the Ministry of Finance, is expected to have significant implications for automakers operating in Thailand, particularly those in the EV segment. It marks a strategic pivot toward bolstering the country’s parts manufacturing base and encouraging long-term investments in local supply chains.

Key Policy Shift: Excise Tax to Favor Local Content

Deputy Finance Minister Paopoom Rojanasakul confirmed that the excise tax system will be adjusted to provide stronger incentives for EVs with higher local parts content. The new structure is designed to promote domestic production of key EV components such as batteries, seats, electronics, and structural parts. By reducing the excise burden for manufacturers that meet local content thresholds, the government aims to make Thailand more attractive as a regional EV manufacturing hub.

The new approach also responds to concerns voiced by former Prime Minister Thaksin Shinawatra, who noted that Thailand’s traditional automotive ecosystem could be at risk due to the growing number of fully imported EVs entering the market under low-tariff schemes. The former prime minister advocated for stricter localization requirements, even for basic components, as a measure to support Thai suppliers and preserve employment across the sector.

Plug-In Hybrid Incentives to Be Adjusted from 2026

In parallel with the EV tax restructuring, the Thai government will also revise its incentives for plug-in hybrid electric vehicles (PHEVs). Starting in 2026, the excise tax for PHEVs will be linked to the battery-only driving range. Models with longer electric ranges will benefit from lower tax rates. This approach aligns with global trends in environmental regulation and is designed to encourage the development and adoption of more efficient hybrid technologies.

The full details of the revised tax structure are currently under review and are expected to be finalized before mid-2025. The implementation timeline may coincide with the 2026 Bangkok International Motor Show, where key stakeholders from the automotive sector are typically present.

Export-Focused Production Now Counts Toward Incentive Conditions

Another notable adjustment involves the eligibility criteria for EV manufacturers participating in Thailand’s EV incentive scheme. Previously, automakers were required to meet a domestic sales quota to qualify for government subsidies. Under the updated policy, EVs that are produced in Thailand for export markets will also count toward fulfilling production obligations under the scheme.

This change is expected to have a positive impact on EV production volumes. According to government projections, EV exports are set to rise from approximately 12,500 units in 2025 to more than 52,000 units in 2026. This export-oriented policy framework is designed to reinforce Thailand’s position as a regional production base for EVs, especially for markets in ASEAN, Australia, and Europe.

Impact on Foreign Automakers and Investors

The policy shift has been welcomed by many foreign automakers that have already invested heavily in Thailand’s EV sector. Chinese brands in particular have established a strong foothold in the Thai market. BYD, currently the market leader in EV sales in Thailand with a 46% share, recently inaugurated its first Southeast Asian production facility in the country. Great Wall Motors and Changan Automobile have also made substantial investments.

These manufacturers are increasingly turning to Thai suppliers to source key components. For example, Omoda & Jaecoo, another Chinese automaker with local operations, reported that 45–50% of its EV parts will be sourced locally in 2025, with a target of increasing that figure to 70–80% within five years. This shift aligns with the government’s long-term goal of developing a robust local EV parts industry.

The Board of Investment (BoI) reported that over US$4 billion has been invested in Thailand’s EV sector since the beginning of the EV3.0 incentive program. The revised tax framework is expected to further enhance investor confidence and attract additional capital into localized production facilities, R&D centers, and component manufacturing.

Strategic Implications

From a business standpoint, the excise tax realignment reflects a coordinated effort to balance Thailand’s legacy strength in automotive manufacturing with the strategic imperative of EV adoption. The key implications include:

- Increased Localization: Automakers will be encouraged to deepen their supply chains in Thailand, benefiting local parts manufacturers and service providers.

- Greater Export Flexibility: By counting exports toward incentive fulfillment, the policy allows producers to align their Thai operations more closely with global supply networks.

- Support for Transitional Technologies: Continued incentives for plug-in hybrids ensure that the country maintains a diversified technological roadmap as it transitions away from internal combustion engines.

- Policy Predictability: Clear timelines for implementation provide manufacturers with the visibility required for long-term investment planning.

Outlook

Thailand’s updated excise tax policy forms part of a broader strategy to sustain its competitiveness in the global automotive value chain while supporting domestic industry. For stakeholders in the EV ecosystem—automakers, parts suppliers, logistics providers, and data analytics firms—the evolving regulatory environment presents both challenges and opportunities.

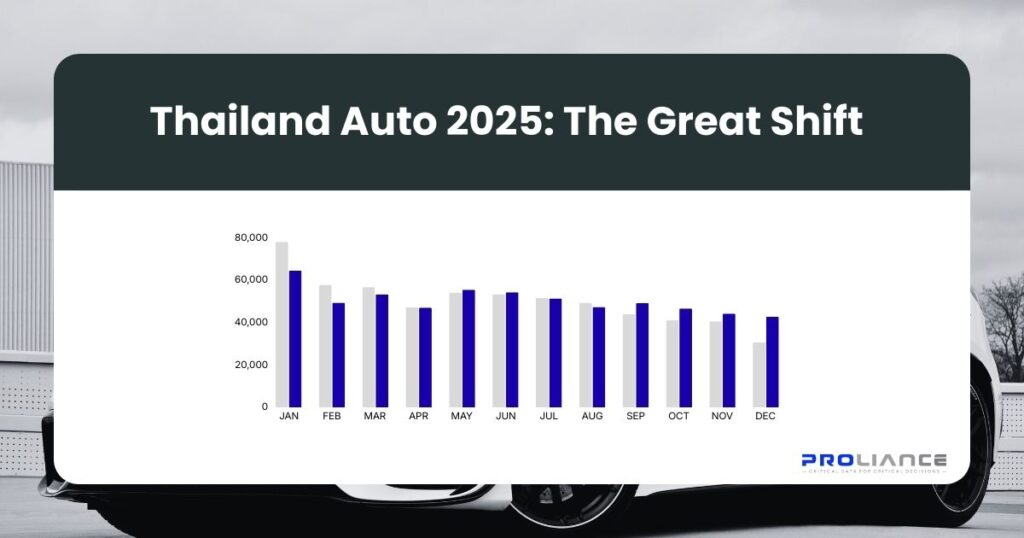

As these policies take effect, vehicle registration trends, production volumes, and export dynamics are expected to shift accordingly. Proliance will continue to monitor these developments and provide detailed analysis to support strategic decision-making for our clients across Thailand, the Philippines, and the GCC region.