Published by Proliance Company Ltd.

Critical Data for Critical Decisions

Thailand’s electric vehicle (EV) market continues to accelerate in 2025. From January to May, 43,681 battery electric vehicles (BEVs) were newly registered across the country, cementing the kingdom’s position as Southeast Asia’s fastest-growing EV hub.

Monthly Registration Snapshot: Motor Shows Drive the Peaks

Monthly registration volumes reflect a classic pattern influenced by major automotive events:

-

January (12,376 units): High volumes from bookings made during the 2024 Thailand International Motor Expo (Nov–Dec).

-

May (12,034 units): Another surge fueled by promotions at the 2025 Bangkok International Motor Show (March–April).

-

April (6,278 units) and March (7,289 units): A steady buildup leading to May’s post-show deliveries.

-

February (5,164 units): A predictable dip, often seen between major campaign periods.

This cyclical pattern confirms that EV purchasing in Thailand is tightly tied to event-driven campaigns and short-term promotions.

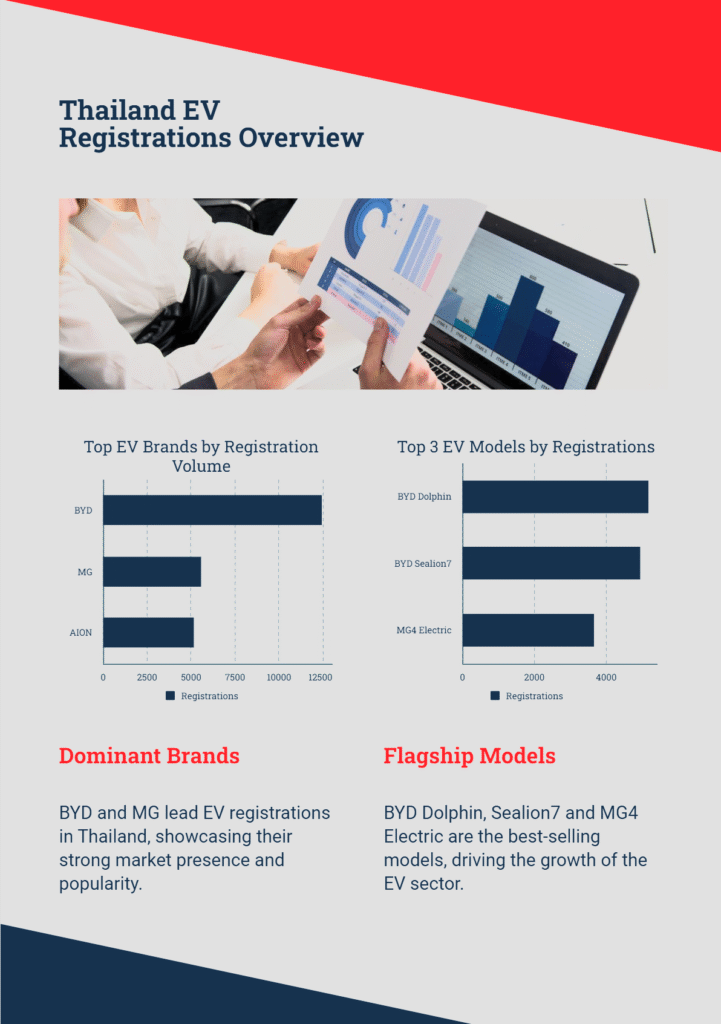

Top 10 EV Models: BYD’s Grip Tightens

The Chinese automaker BYD has cemented itself as the dominant force in Thailand’s EV segment, taking four of the top ten positions. Here are the leading models:

| Rank | Model | Registrations |

|---|---|---|

| 1 | BYD Dolphin | 5,167 |

| 2 | BYD Sealion7 | 3,957 |

| 3 | MG4 Electric | 3,645 |

| 4 | AION V | 2,967 |

| 5 | GWM ORA Good Cat | 2,638 |

| 6 | Deepal S07 | 2,594 |

| 7 | DENZA D9 | 2,151 |

| 8 | BYD Atto3 | 2,104 |

| 9 | AION HYPTCE HT | 1,860 |

| 10 | AION Y PLUS | 1,822 |

Chinese brands, including AION, Deepal, and GWM, are now dominating the market, leveraging aggressive pricing, generous feature sets, and an ever-expanding dealer footprint.

Monthly Registration Trend (All EVs Combined)

| Month | Registrations |

|---|---|

| January | 12,376 |

| February | 5,164 |

| March | 7,829 |

| April | 6,278 |

| May | 12,034 |

Trends and Market Forces at Play

-

Motor Expo Conversions: Registrations are clearly tied to consumer booking patterns at year-end and mid-year motor shows.

-

China’s Rising Influence: The top 10 is now a Chinese stronghold. Japanese and European automakers have all but vanished from the high-volume EV conversation.

-

Luxury EVs Stall: Brands like BMW, Mercedes-Benz, and Audi continue to struggle in the Thai EV market, likely due to high pricing, lack of incentives, and slow dealer adaptation.

-

NETA’s Slump: Once a budget champion, NETA has slipped below the top 10. Financial uncertainty in its parent company may be causing consumer hesitation and lower dealer confidence.

-

Notable Newcomers

-

LeapMotor C10 EV: 39 units

-

Lotus ELETRE: 40 units

-

KIA EV9: 12 units

-

Updated Outlook: Hitting 100,000 Units No Longer Guaranteed

Earlier projections suggested that Thailand could cross the 100,000 EV registration mark by the end of 2025. However, based on updated conditions, that trajectory is now in doubt:

-

Rising political uncertainty—including cabinet instability and unclear EV subsidy continuity—may dampen investor and consumer confidence.

-

Stricter credit approval criteria from banks and leasing companies are making it harder for consumers—especially in the sub-500,000 baht segment—to secure financing for EV purchases.

Unless Q3 sees new incentives or credit conditions ease, the market may plateau below the 100K mark—posing a challenge to OEMs and dealers counting on year-end targets.

For Industry Analysts and B2B Stakeholders

At Proliance, we continue to monitor the pulse of Thailand’s fast-moving EV sector. For our clients in automotive, mobility, finance, and infrastructure, here’s what matters now:

-

Forecast with campaign cycles: Base your sales and logistics on expo-linked registration peaks.

-

Track credit conditions: Credit tightening could hit the entry-level EV segment hardest.

-

Integrate dealer-level data: Real-time insight on brand velocity, warranty risks, and registration gaps is crucial to plan ahead.

We provide granular, up-to-date registration data for Thailand, the Philippines, and key GCC markets—broken down by model, brand, location of registration, price band, and drivetrain.

Looking to license this data or subscribe to our monthly EV Tracker?

📩 Email us at info@proliance.co.th