Thailand’s National Electric Vehicle Brand: Strategic Collaborations and Market Ambitions

Thailand is poised to launch its first national electric vehicle (EV) brand in late 2025, marking a transformative step in its automotive industry. Developed through a strategic partnership between the Thai government and Chinese automaker Chery Automobile, the initiative aims to position Thailand as a regional EV hub while addressing evolving consumer demands and competitive pressures. This article examines the project’s foundations, product strategy, and challenges in a rapidly growing market.

Government-Corporate Synergy

The national EV brand is the result of collaboration between multiple Thai government agencies and private entities. Key partners include:

– Ministry of Commerce: Leading policy coordination and market strategy.

– National Science and Technology Development Agency (NSTDA): Providing R&D support for EV technologies.

– KING GEN: A Thai logistics and EV charging infrastructure firm, ensuring commercial viability for fleet vehicles.

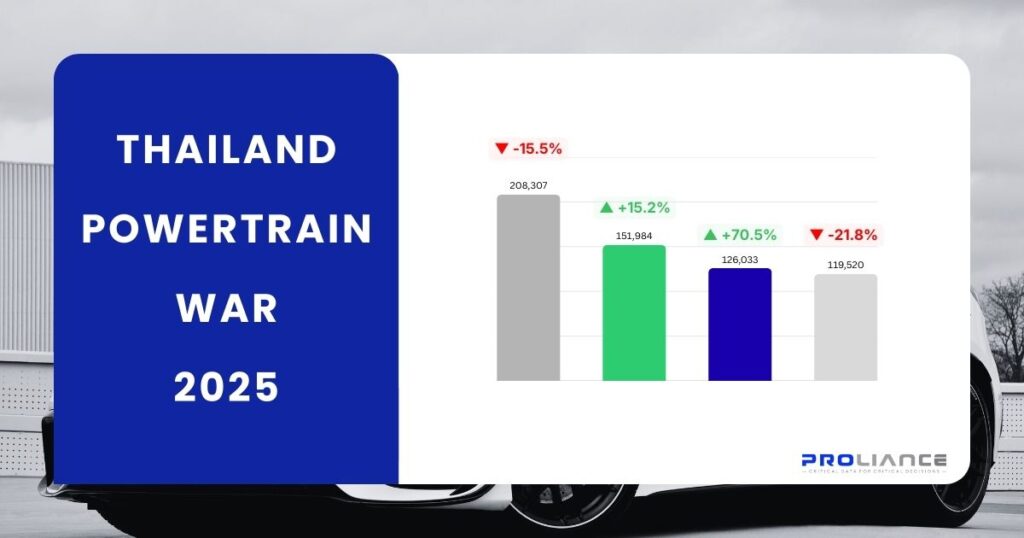

Chery Automobile, China’s fourth-largest automaker by sales (119,000 units in March 2025 alone), brings technological expertise to the partnership. The company’s global portfolio includes luxury brands like Jaguar Land Rover and premium EV sub-brands such as OMODA and JAECOO. This collaboration aims to leverage Chery’s production capabilities while adhering to Thailand’s requirement for over 50% local content in manufacturing.

Product Lineup: Targeting Diverse Market Segments

The national brand will debut three fully electric models, each catering to distinct market needs:

1. Commercial MPV: Designed for logistics and passenger transport, with 4–5 variants to address niche commercial applications.

2. Electric Pickup Truck: A competitive entry into Thailand’s pickup-dominated market, challenging established Chinese players like JAC and BYD.

3. Family SUV: Positioned in Thailand’s most contested EV segment, competing with models from BYD, MG, and NETA.

Local production will occur in Rayong Province, where Chery is constructing a facility to produce 50,000 EVs annually by 2025, scaling to 80,000 by 2028. The emphasis on local sourcing aims to strengthen Thailand’s EV supply chain, which currently relies heavily on imported components.

Strategic Advantages and Market Challenges

Policy Incentives and Cost Dynamics

As a “Thai-branded” vehicle, the EVs will benefit from tax breaks and subsidies under Thailand’s 30@30 policy, which targets 30% EV production by 2030. However, balancing cost remains critical. While local content rules may increase production expenses compared to Chinese imports, they could stimulate domestic industries-from battery manufacturing to aftermarket services.

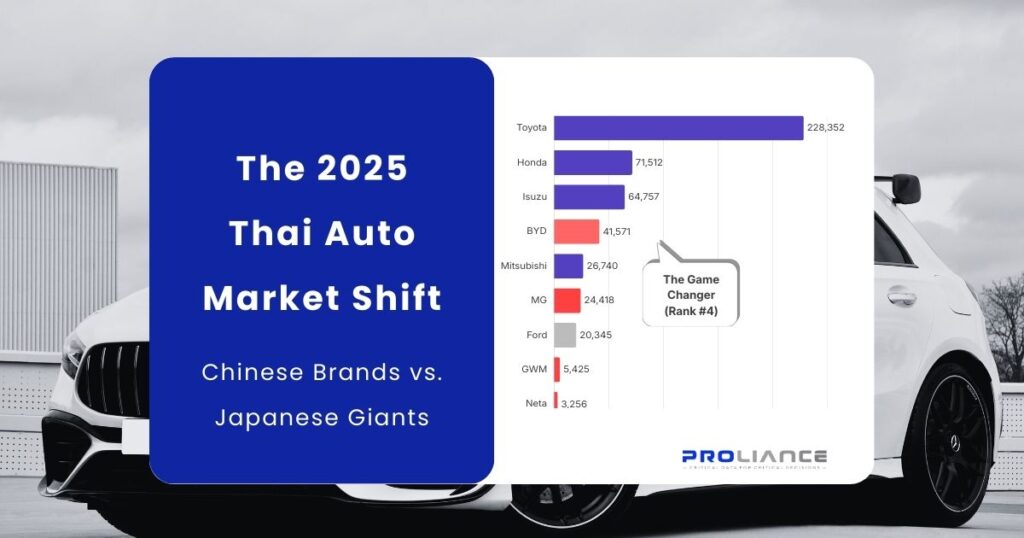

Brand Identity in a Crowded Market

Thailand’s EV market is dominated by Chinese brands, which held a 58% share in 2024. BYD leads with 41,660 registrations, followed by MG and NETA. The national brand must differentiate itself despite relying on Chery’s platforms. Analysts question whether it can develop a distinct Thai identity, given historical struggles of local brands like Thai Rung and Thai Narin. Success may hinge on pricing: sources suggest targeting a 20–30% cost advantage over imported rivals by leveraging tax incentives.

Technological Transfer Concerns

While Chery’s involvement provides immediate access to EV technology, Thailand’s ability to absorb and innovate remains uncertain. China’s restrictions on core technology exports complicate knowledge transfer, potentially limiting long-term R&D growth. The partnership’s success will depend on joint ventures in software development, including collaborations with Huawei-backed Tunya Smart for cloud-based cockpit systems.

Implications for Thailand’s Automotive Sector

Strengthening the Supply Chain

The 50% local content mandate could catalyze investments in component manufacturing, particularly in batteries and power electronics. Currently, Thailand imports 80% of its EV parts. Localizing production would reduce dependency on China and create jobs-critical for an industry contributing 10% to Thailand’s GDP.

Shifting from Assembly to Innovation

Thailand has long been Southeast Asia’s automotive assembly hub, hosting major Japanese and Western brands. The national EV project represents a pivot toward owning intellectual property, aligning with the government’s Thailand 4.0 economic strategy. If successful, it could inspire similar initiatives in ASEAN, reshaping regional trade dynamics.

Road Ahead: Opportunities and Risks

The national brand’s launch coincides with a projected 40% growth in Thailand’s EV market in 2025. However, challenges persist:

– Consumer Trust: Building confidence in a new brand amid established competitors.

– Infrastructure Readiness: Expanding charging networks, particularly in rural areas.

– Global Competition: Navigating trade barriers as Western markets impose tariffs on Chinese EVs.

The government’s continued support through subsidies and infrastructure investments will be vital. As Narit Therdsteerasukdi, Secretary-General of Thailand’s Board of Investment, notes: “Our goal is not just to assemble EVs, but to create a holistic ecosystem-from R&D to recycling”.

Conclusion

Thailand’s national EV brand embodies a bold vision to transition from an automotive assembler to an innovation leader. While Chery’s expertise accelerates entry into the EV arena, long-term success requires fostering local talent, securing technology transfer and cultivating a unique brand identity. As global automakers like BMW and BYD expand their Thai operations, the national brand’s ability to carve a niche will test Thailand’s ambition to lead ASEAN’s electric mobility revolution.