For decades, car sales data has been treated as the industry’s gold standard for market insight. But that illusion is now breaking down — fast. In Thailand, major automakers have stopped sharing sales data through the Joint Coordination Committee (JCC), leaving market analysts and competitors blind.

When sales data dries up, companies scramble for visibility. Registration data, however, never stops. It’s official, government-verified, and publicly anchored in reality — not in the selective reporting of manufacturers.

Proliance believes this shift isn’t a temporary hiccup. It’s a wake-up call for the industry.

The Data Disconnect Nobody Talks About

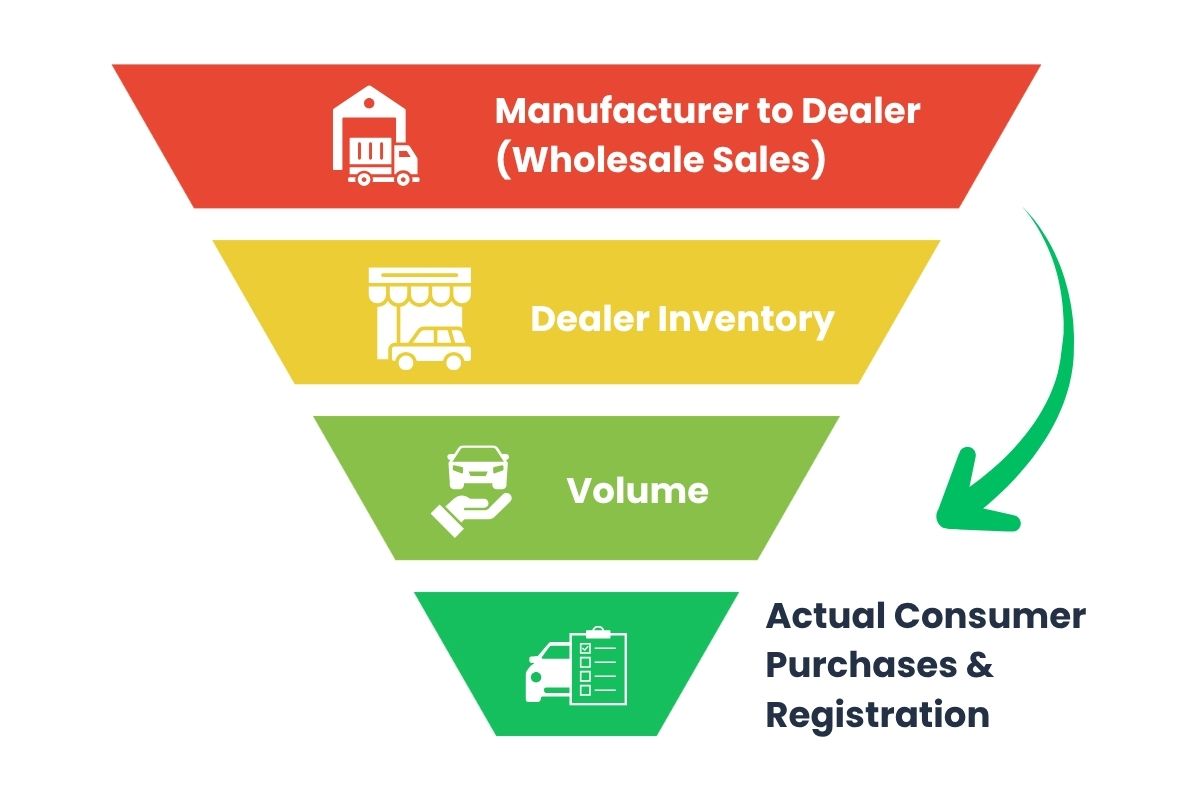

Every new vehicle follows a chain from factory to dealer to customer — yet most traditional “sales” figures stop halfway down that funnel. Sales data reflects only what manufacturers ship, not what consumers register.

In practice, that means car sales data captures intent, while registration data captures reality.

The difference matters. In markets like Thailand, dealer stockpiling, delayed registrations, and fleet pre-sales can distort the picture dramatically. By the time those “sales” translate into actual consumer registrations, the market landscape has already changed.

In 2019, India’s automotive industry witnessed a dramatic revelation. The automobile industry association (SIAM) reported a 14% collapse in wholesale vehicle sales. Yet government registration data showed only a 5% decline. The gap wasn’t a reporting error—it exposed a critical truth: dealers were clearing inventory while slashing new purchases. Sales data had masked the real market slowdown by capturing transactions between manufacturers and dealers, not actual consumer demand.

This scenario isn’t unique to India. It’s happening in other markets too. In China, the discrepancy between wholesale figures and registration data has become so pronounced that regulators now treat them as separate measurements entirely. Wholesale figures capture manufacturer-to-dealer transactions, while registration data reflects what consumers actually bought. These are dramatically different things.

What Makes Registration Data Superior

Sales data tells you what automakers report.

Registration data tells you what actually happened.

Registration figures are compiled from government registration databases — verified, standardized, and tamper-proof. They cover every plate, every province, and every powertrain, whether internal combustion or full BEV.

Even when OEMs stop talking, registration data keeps flowing.

This makes registration datasets uniquely powerful for manufacturers, analysts, and policy planners who demand consistency and continuity — two things “shared sales data” has repeatedly failed to deliver.

The Five Problems with Sales Data

1. Wholesale Inflation

Automakers often push cars to dealers to “hit the numbers,” even when the cars haven’t reached customers. These inflated wholesale figures make market volumes look stronger than they truly are. Registration data exposes this gap instantly — because nobody registers a car they haven’t sold.

2. Dealer Gaming

Sales reporting is vulnerable to manipulation. Dealers can pre-register units, reshuffle inventory, or delay returns to mask over- or under-performance. Registration records, by contrast, are timestamped and verified by government systems.

3. Incomplete Time Windows

Sales tallies rarely align across OEMs. Some report monthly, others quarterly, others not at all. Registration datasets update continuously, providing a real-time, synchronized view of the entire market.

4. Regional Blind Spots

Sales data rarely captures geographical depth. Registration data breaks volumes down by province or city — essential for network planning, brand expansion, and incentive tracking.

5. Ownership Opacity

Sales figures stop at the dealership. Registration data continues through the ownership lifecycle — revealing buyer type, usage, and retention trends.

Together, these weaknesses mean that traditional sales data no longer paints a full or reliable picture of market performance.

Real-World Impact in ASEAN

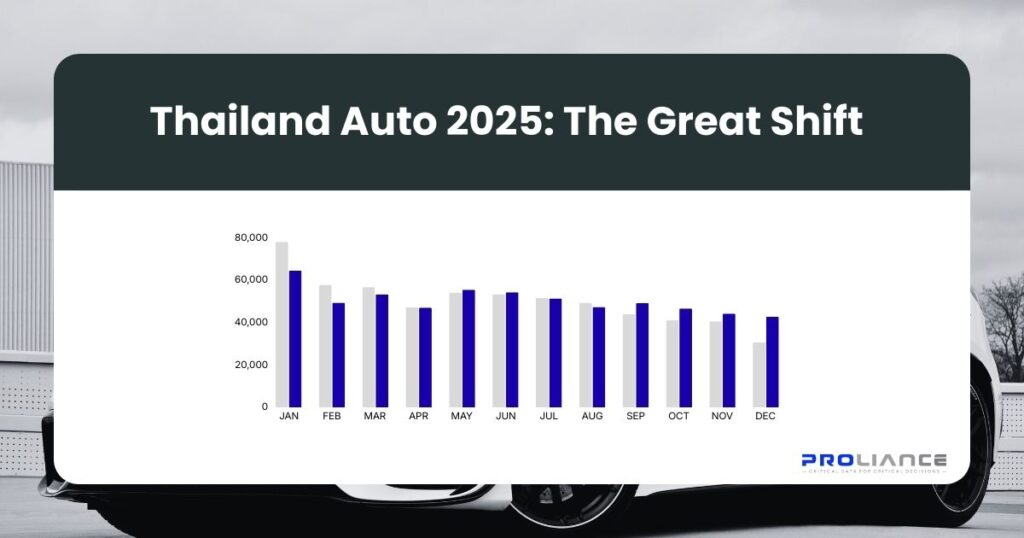

The Thai Market’s Data Blackout

In mid-2025, Thailand’s Joint Coordination Committee (JCC) — long responsible for coordinating inter-OEM sales reporting — saw several key participants withdraw. Major players exited the group, and Chinese OEMs never joined to begin with.

The result: a data blackout.

“With OEMs ending internal data sharing, many analysts across ASEAN are now relying on registration data for continuity and completeness. Here’s why it’s becoming the only dependable source of truth.”

For the first time in decades, Thailand’s automotive industry lost access to complete sales reporting. Analysts and even manufacturers themselves are now relying on secondary estimates, media leaks, or incomplete internal figures.

Meanwhile, registration data continues uninterrupted — clean, verified, and updated every month.

Beyond Thailand

The same trend is spreading. Across ASEAN, government-issued registration data now serves as the only dependable dataset for measuring genuine demand, tracking BEV adoption, and benchmarking OEM performance.

Whether in Malaysia, Indonesia, or the Philippines, registration databases capture fuel-type splits, battery capacity, and regional growth patterns long before automakers release their official numbers.

In short: when sales data stalls, registration data steps in.

In the first half of 2025, ASEAN-6 total vehicle sales fell just 0.4%, suggesting market stability. But this headline masked dramatic regional divergence: Indonesia contracted 9%, Thailand fell 7%, and Malaysia declined 4%, while Vietnam surged 28%, Philippines grew 6%, and Singapore jumped 31%.

Sales data alone would’ve shown a flatline. Registration data revealed structural market shifts, policy impacts, and emerging consumer behavior patterns. For companies planning regional strategies, this distinction between flat sales growth and divergent market fundamentals is the difference between sound strategy and missed opportunity.

Singapore provides another instructive example. Registration data showed that 45% of new vehicles registered in early 2025 were electric, while sales figures from manufacturers lagged weeks behind with inconsistent classifications. Registration data gave market participants weeks of advance information for strategy adjustments; sales data arrived too late to be actionable.

What Registration Data Actually Delivers

1. Precise Market Share Analysis

Registration data shows who’s truly winning — by model, brand, region, and fuel type. It removes estimation and speculation from the equation.

2. Fuel-Type Tracking

As electrification accelerates, the ability to split data by ICE, HEV, PHEV, and BEV is critical. Proliance’s datasets track every registered unit, battery specification, and capacity rating.

3. Policy Impact Measurement

Government incentive programs and local assembly shifts show up first in registration trends — providing early signals for both OEM and supplier strategy.

4. Inventory Health Indicators

Registration-to-sales ratios expose when wholesale numbers are inflated or when dealer networks are sitting on unsold stock.

The Strategic Advantage

OEMs, consultancies, and market analysts are facing a new data reality: sales reports can be paused — but registrations cannot.

As traditional data channels collapse, the firms that continue to operate with clarity will be those using registration-based intelligence. It’s consistent across time, immune to OEM discretion, and verified by government systems.

For Proliance, this isn’t just a dataset — it’s a strategic infrastructure for decision-making.

“Sales data shows what automakers intend to sell.

Registration data shows what consumers actually buy.”

When others see only half the picture, registration data reveals the full market truth — and gives your organization the clarity to act with confidence.

Ready to gain a competitive edge through accurate market intelligence?

Proliance’s registration datasets cover Thailand, the Philippines, Vietnam, Indonesia, and the GCC — complete with model-level fuel-type splits, powertrain attributes, and historical coverage back to 2015.

When sales data stops, registration data keeps the industry moving.

Contact us to learn how registration data can transform your automotive market strategy.