By Proliance Automotive Insights Team

Once hailed as a rising star in Thailand’s electric vehicle (EV) revolution, NETA Thailand now finds itself at the center of a crisis that is shaking consumer confidence, disrupting the dealer network, and raising questions about the future of foreign EV brands in the country.

From Rapid Growth to Sudden Downturn

NETA entered the Thai market with ambitious plans. Backed by its Chinese parent, Hozon Auto, the company began local production of the NETA V-II in early 2024, aiming to make Thailand a regional export hub. Early results were promising: NETA captured a 13% share of the Thai EV market in Q1 2024, with sales growth outpacing many competitors.

But by mid-2025, the landscape had changed dramatically. Hozon Auto’s financial troubles—marked by losses exceeding 100 billion yuan and urgent restructuring—triggered a cascade of problems for its Thai subsidiary. As Hozon ceased operations in other Southeast Asian markets, Thailand became its last remaining outpost outside China.

Fire Sale Frenzy and Dealer Inventory Liquidation

In recent weeks, a dramatic price reduction of the NETA V-II to 299,000 baht, from 549,000 baht, has swept through the market, with vehicles offered without warranties. This fire sale, widely promoted by dealer networks, appears to be an urgent effort to liquidate inventory in the face of mounting uncertainty. The campaign has generated significant attention, with dealers racing to offload remaining stock as confidence in the brand’s future wanes.

Dealer Exodus and Its Human Impact

The crisis has led to a rapid contraction of NETA’s dealer network. Since March, the number of dealers has dropped from 66 to just 53 by the end of May, with further closures expected. Major dealer groups have shuttered multiple showrooms and service centers, citing unsustainable business conditions and a lack of support. This wave of exits has had a profound impact on staff and technicians, resulting in widespread layoffs and resignations. Many skilled workers now face uncertain job prospects, and the loss of experienced personnel further undermines after-sales service capacity for existing NETA owners.

Mounting Consumer Woes

For Thailand’s estimated 25,000 NETA owners—though official registration data may indicate a lower number—the ongoing crisis has led to daily challenges and mounting frustration. The Thailand Consumers Council (TCC) has reported a sharp increase in complaints from NETA customers, who are facing significant hurdles such as difficulties in registering their vehicles, persistent shortages, long waiting time of essential spare parts and the sudden shutdown of service centers. As a result, some owners have been left with vehicles they cannot use and have received no compensation, while others are at risk of voiding their warranties if they are forced to turn to independent repair shops due to the lack of authorized service options.

In response to these widespread issues, the TCC is preparing for potential legal action should NETA Thailand fail to provide adequate solutions, highlighting the gravity of the situation for both consumers and the broader automotive market.

Insurance and Industry Ripple Effects

The turmoil at NETA is also affecting Thailand’s broader automotive ecosystem. Insurers report that EV claims—especially for NETA vehicles—are 50–60% higher than those for internal combustion engine vehicles, mainly due to costly battery repairs. This is leading to higher premiums and stricter underwriting standards for all EVs, not just NETA.

Some fear that the collapse of NETA could force smaller dealers out of business, amplifying the impact on the local auto retail sector.

What’s Next for NETA and the Thai EV Market?

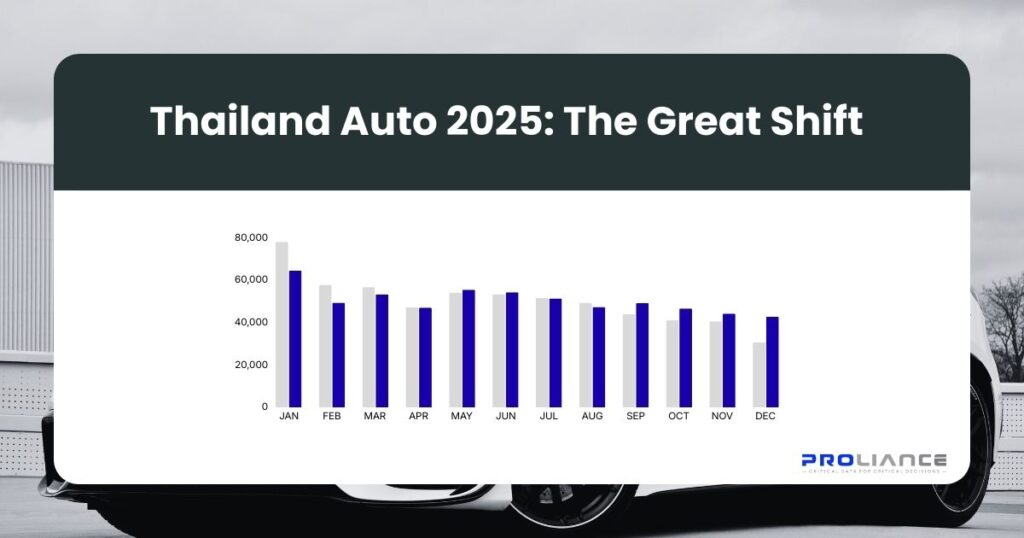

NETA’s dramatic fall stands in stark contrast to the overall momentum of Thailand’s EV market, which continues to grow, with BEV registrations up 22.35% in early 2025. The crisis highlights the risks of rapid expansion by financially unstable foreign entrants and the critical importance of robust after-sales support.

For NETA, the future is uncertain. The company’s fire sale, shrinking dealer network, and unresolved consumer issues point to a possible market exit or drastic downsizing. For existing owners and dealers, the coming months will be crucial as legal, regulatory, and market forces determine the brand’s fate.

Lessons for Thailand’s Automotive Future

The NETA saga is a cautionary tale for Thailand’s EV ambitions. As the country continues its aggressive push toward electrification, policymakers, consumers, and industry players must ensure that growth is built on solid foundations—financial stability, reliable after-sales support, and strong consumer protections.

The road ahead for NETA may be rocky, but the lessons learned will shape the next chapter of Thailand’s EV journey.

For more insights and data-driven analysis on the Thai automotive market, visit Proliance’s Automotive Insights section.