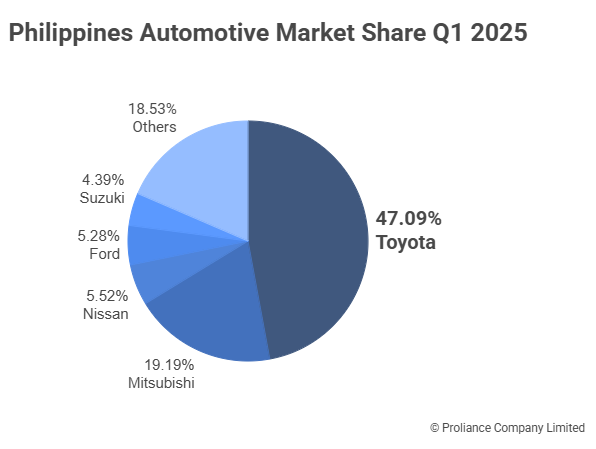

The Philippines automotive market demonstrated solid growth in Q1 2025 with 119,102 light vehicle registrations, representing a 4.66% increase from Q1 2024. Metro Manila’s 52.37% market concentration, combined with Toyota’s commanding 47.09% brand dominance, reveals key dynamics shaping Southeast Asia’s fourth-largest automotive market. Our analysis of Philippines light vehicle registration data uncovers growth patterns and competitive landscapes defining the Philippine automotive sector.

Q1 2025 Philippines Registration Highlights

Market Overview:

- Total registrations: 119,102 units (+4.66% vs Q1 2024’s 113,798)

- Market leader: Toyota with 47.09% market share (56,080 units)

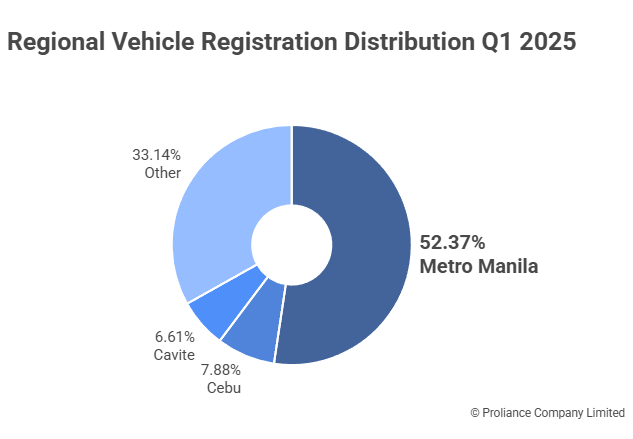

- Geographic concentration: Metro Manila captures 52.37% of registrations

- Body style leader: SUVs dominate with 40,315 units (33.85%)

- Japanese dominance: Toyota, Mitsubishi, and Nissan together hold a 71.8% share of the market.

- Growth momentum: Positive expansion amid challenging regional conditions

Market Overview: Growth Against Regional Trends

The Philippines’ Q1 2025 light vehicle registration performance of 119,102 units tells a story of market resilience and economic recovery. With a solid 4.66% growth compared to Q1 2024’s 113,798 units, the Philippines automotive sector demonstrates positive momentum while other regional markets face headwinds.

This growth reflects several converging factors: continued economic expansion, improved consumer confidence, enhanced financing accessibility, and infrastructure development across key provinces. The market’s steady progression indicates the Philippines’ automotive sector maturity and its position as a significant growth driver within ASEAN.

The Q1 2025 performance positions the Philippines among the positive performers in Southeast Asian automotive markets, with registration growth suggesting robust domestic demand and economic fundamentals supporting vehicle adoption during the quarter.

Brand Performance: Toyota’s Market Command

Top 5 Brands Market Share Analysis

-

Toyota: 56,080 units (47.09% market share)

- Maintains overwhelming market leadership in Philippines

- Diverse portfolio drives dominance across multiple segments

- Vios and Hilux continue strong performance

- Local assembly operations support market position

-

Mitsubishi: 22,856 units (19.19% market share)

- Strong second position reinforces Japanese brand preference

- Mirage hatchback captures budget-conscious buyers

- Xpander Cross attracts buyers looking for a crossover between SUV and MPV

-

Nissan: 6,577 units (5.52% market share)

- Solid third position completing Japanese brand dominance

- Navara pickup truck leads Nissan’s model lineup

- Terra SUV performs strongly in growing SUV segment

-

Ford: 6,283 units (5.28% market share)

- Leading American brand maintaining market presence despite intensifying competition

- Facing headwinds with declining sales trends and increased pressure from Asian competitors

- Ranger pickup truck leads Ford’s Philippines lineup but encounters growing competition

- Everest SUV performs strongly in premium segment amid market challenges

- Strategic repositioning needed to address market share erosion and strengthen competitive position

-

Suzuki: 5,227 units (4.39% market share)

- Japanese value brand completing top five

- S-Presso leads Suzuki’s model lineup as top performer

- Swift Dzire captures sedan segment with strong value proposition

- Ertiga MPV serves multi-purpose vehicle segment as third bestseller

- Diverse portfolio spans entry-level to family vehicle categories

Japanese Brand Dominance

The combined performance of Toyota, Mitsubishi, and Nissan captures an remarkable 71.8% of the Philippine automotive market, demonstrating exceptional brand loyalty and preference for Japanese automotive technology. This concentration reflects decades of market development, comprehensive dealer networks, and product positioning that aligns with Philippine consumer preferences and economic conditions.

Body Style Dynamics: SUV Leadership with Balanced Portfolio

Vehicle Body Style Performance – Q1 2025

SUVs: 40,315 units (33.85% market share)

- SUVs remain the leading body style in the Philippine automotive market for Q1 2025.

- Strong demand is driven by their versatility, higher ground clearance, and suitability for the country’s diverse road conditions.

- The top three best-selling SUVs are the Mitsubishi Xpander Cross, Toyota Raize, and Toyota Fortuner.

- Both mainstream and premium SUV models are popular among buyers.

Sedans: 22,135 units (18.58% market share)

- Sedans hold their position as the second most popular segment.

- They continue to appeal to buyers looking for affordability and fuel efficiency.

- The Toyota Vios, Mitsubishi Mirage, and Suzuki Swift Dzire are the leading models in this segment.

- Some hybrid or electrified sedan models are available from major brands, but they are not yet widespread.

MPVs: 17,465 units (14.66% market share)

- MPVs remain a preferred choice for families and businesses needing flexible seating and cargo space.

- The segment offers a wide range of models at various price points.

- The Toyota Innova, Toyota Avanza, and Toyota Veloz are the top performers in this category.

- MPVs are valued for their practicality and comfort, especially for group travel.

- Electrified or hybrid MPV options are still rare in the Philippine market.

Pickups: 16,680 units (14.00% market share)

- Pickup trucks continue to perform strongly, supported by demand from both commercial and private buyers.

- Known for durability and utility, pickups are popular in both urban and rural areas.

- The Toyota Hilux, Ford Ranger, and Nissan Navara are the segment’s best-selling models.

- Leading brands maintain a loyal customer base.

- Electrified or hybrid pickup trucks are not yet available in the Philippines.

Vans: 10,990 units (9.23% market share)

- Vans hold a steady share, driven by the needs of transport and logistics businesses.

- Popular among shuttle operators and companies requiring people movers.

- The Toyota Hiace, Mitsubishi L300, and Toyota Lite Ace are the most popular van models.

Geographic Concentration: Metro Manila’s Market Control

Provincial Registration Distribution

Metro Manila: 62,373 units (52.37%)

- Metro Manila remains the largest automotive market in the Philippines, accounting for over half of all new vehicle registrations in Q1 2025.

- As the country’s economic center, Metro Manila benefits from higher purchasing power, advanced infrastructure, and the densest dealer network in the nation.

- These advantages continue to drive strong vehicle adoption in the capital region.

Cebu: 9,387 units (7.88%)

- Cebu stands as the leading provincial automotive market outside Metro Manila.

- As the economic hub of the Visayas, Cebu attracts significant vehicle registrations, supported by robust tourism and business activities.

- Its status as a major port city further enhances its role in automotive distribution.

Cavite: 7,871 units (6.61%)

- Cavite is a rapidly growing provincial market near Metro Manila, benefiting from ongoing industrial development and proximity to the capital.

- Manufacturing and logistics activities in Cavite drive demand for both passenger and commercial vehicles.

Metro Manila Market Dynamics

Metro Manila’s 52.37% market share highlights the concentration of economic activity, infrastructure development, and purchasing power in the capital region. However, compared to other ASEAN capitals, the Philippine market shows a more balanced distribution, with 47.63% of vehicle registrations occurring outside Metro Manila. This indicates healthy automotive demand across the country’s diverse regions.

While Metro Manila accounts for the majority of new vehicle registrations, provincial registrations are primarily concentrated in major economic hubs and key provincial centers such as Cebu, Cavite, Laguna, Davao, Pampanga, and Bulacan. Vehicle registration in smaller provinces and rural areas remains significantly lower. Thus, the distribution of new vehicle registrations outside Metro Manila is not evenly spread across the archipelago, but rather focused in the country’s largest and most economically active provinces.

Market Implications & Growth Drivers

The Philippines’ positive Q1 2025 registration growth demonstrates several key market dynamics driving automotive expansion. Economic recovery following global challenges has strengthened consumer confidence and vehicle purchasing ability, while improved financing accessibility has expanded market reach across income segments.

Key Growth Drivers

Infrastructure development across provinces continues expanding vehicle accessibility and practical necessity, while urbanization trends in secondary cities create new automotive demand centers. The strong preference for Japanese brands reflects proven reliability, comprehensive service networks, and product positioning aligned with Philippine market requirements.

Geographic Distribution Advantages

While the Philippines demonstrates a broader provincial automotive market than some ASEAN peers, new vehicle registrations outside Metro Manila are primarily concentrated in the country’s major economic hubs. Provinces such as Cebu, Cavite, Laguna, Davao, Pampanga, and Bulacan account for a significant share of provincial registrations, driven by stronger local economies, higher population densities, and better infrastructure.

In contrast, smaller provinces and rural areas contribute modestly to overall registration volumes due to lower purchasing power and limited dealership presence. This pattern highlights the Philippines’ advantage in having multiple regional growth centers, though the distribution is not fully balanced nationwide. The market’s resilience is rooted in the strength of these key provincial hubs, which help diversify demand beyond the capital but do not represent an even spread across the archipelago.

Economic Resilience Indicators

Despite a moderating pace, the Philippines economy posted 5.4% GDP growth in Q1 2025, supported by robust household consumption and increased government spending. The automotive sector continues to benefit from rising disposable incomes, a growing middle class, and improved—though still uneven—access to auto financing. Consumer demand remains strongest in major urban and provincial economic hubs, reflecting the country’s diverse but regionally concentrated economic activity.

Automotive sales growth is further supported by government incentives for new vehicle purchases and the introduction of more affordable models, especially in the commercial and entry-level segments. However, higher interest rates and stricter loan approval criteria continue to limit financing accessibility for some buyers, particularly in rural areas. The market’s resilience is underpinned by strong fundamentals, but future growth will depend on continued economic stability, infrastructure expansion, and broader access to financing.

Based on Philippines light vehicle registration data and Proliance automotive market analysis.

Q2 2025 Outlook Based on Current Trends

Based on Q1 performance and observable market indicators, we anticipate:

- Continued Growth: Sustained positive registration trends supported by economic expansion, despite a slight moderation in GDP growth.

- Japanese Brand Strength: Toyota and Mitsubishi are expected to maintain their dominant market positions.

- SUV Expansion: Continued strong performance in the SUV segment, driven by both urbanization trends and demand from family and commercial buyers.

- Provincial Development: Ongoing growth in key provincial economic centers, with automotive adoption expanding in major hubs such as Cebu, Davao, and Cavite, rather than uniformly across all provinces.

- Infrastructure Impact: Major road and transport infrastructure projects in urban and key provincial areas are supporting increased vehicle usage and market growth.

These projections represent analytical insights based on current market trends and are subject to economic, policy, and competitive changes.

About This Analysis

This analysis is based on Philippines light vehicle registration data. Market interpretations, trend analysis, and future projections represent Proliance automotive intelligence insights and should be considered alongside other market research. Registration data covers Light Vehicles but excludes motorcycles, commercial trucks, and specialty vehicles.

Coming Next in Our Regional Series:

- GCC Vehicle Registration Analysis & Cross-Border Patterns

- India Vehicle Registration Deep Dive

- ASEAN Comparative Market Analysis

Need Philippines automotive market insights for your business?

Our comprehensive registration database provides market intelligence with:

- Brand and model-level performance tracking since 2017

- City/Municipality breakdowns

- Historical trend analysis and custom benchmarking

- Quarterly market updates