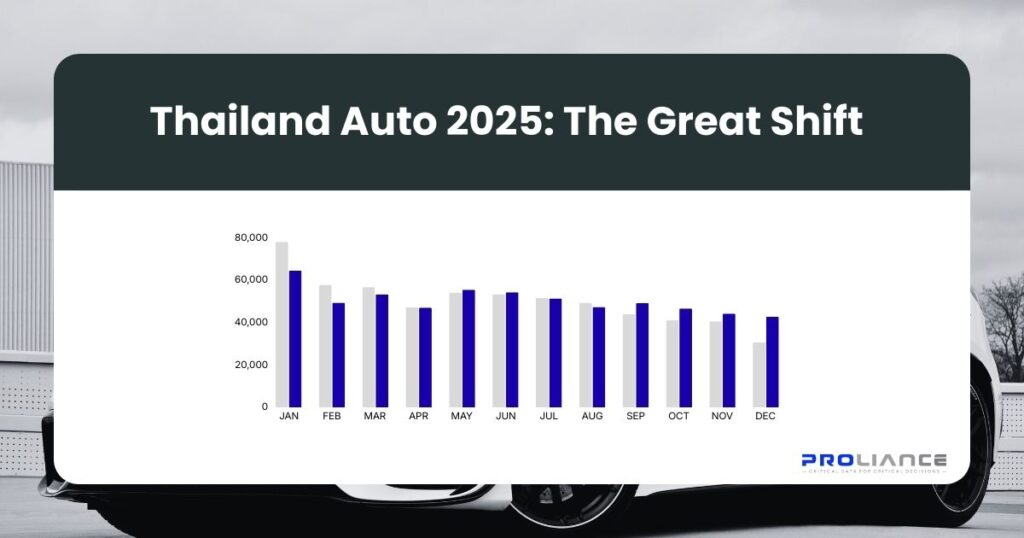

Thailand’s automotive market navigated a complex first half of 2025, with total light‑vehicle registrations easing to an internally compiled 324,152 units (−6.72% YoY) based on Department of Land Transport records, reflecting tighter financing and cautious demand. Yet this headline masks a structural shift: electrified vehicles—comprising Hybrid Electric Vehicles (HEV), Plug-in Hybrid Electric Vehicles (PHEV), and Battery Electric Vehicles (BEV)—expanded to an estimated 42.8% share in H1, building on Q1’s 40.2% baseline and reinforcing Thailand’s leadership in Southeast Asia’s electrification.

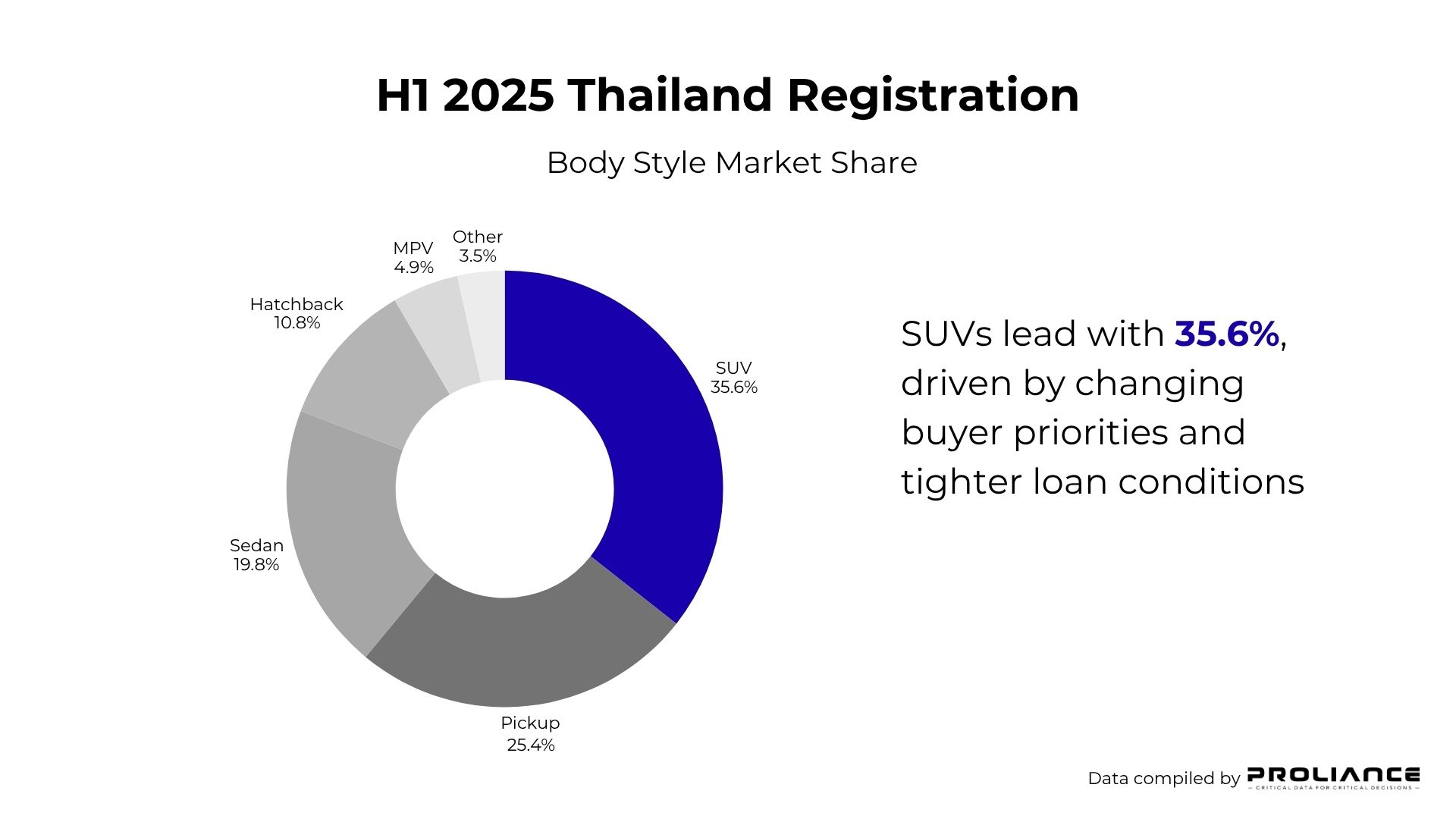

Beyond powertrains, a body‑style pivot gained momentum as SUVs overtook pickup trucks in Q1 and held the lead through H1. This dual transformation—electrification surge combined with the SUV versus pickup power shift—signals permanent structural changes rather than temporary market fluctuations.

H1 2025 Thailand Registration Executive Summary

- Total registrations: 324,152 units (-6.72% vs H1 2024)

- Electrified vehicle market share: 43.3% (140,379 units)

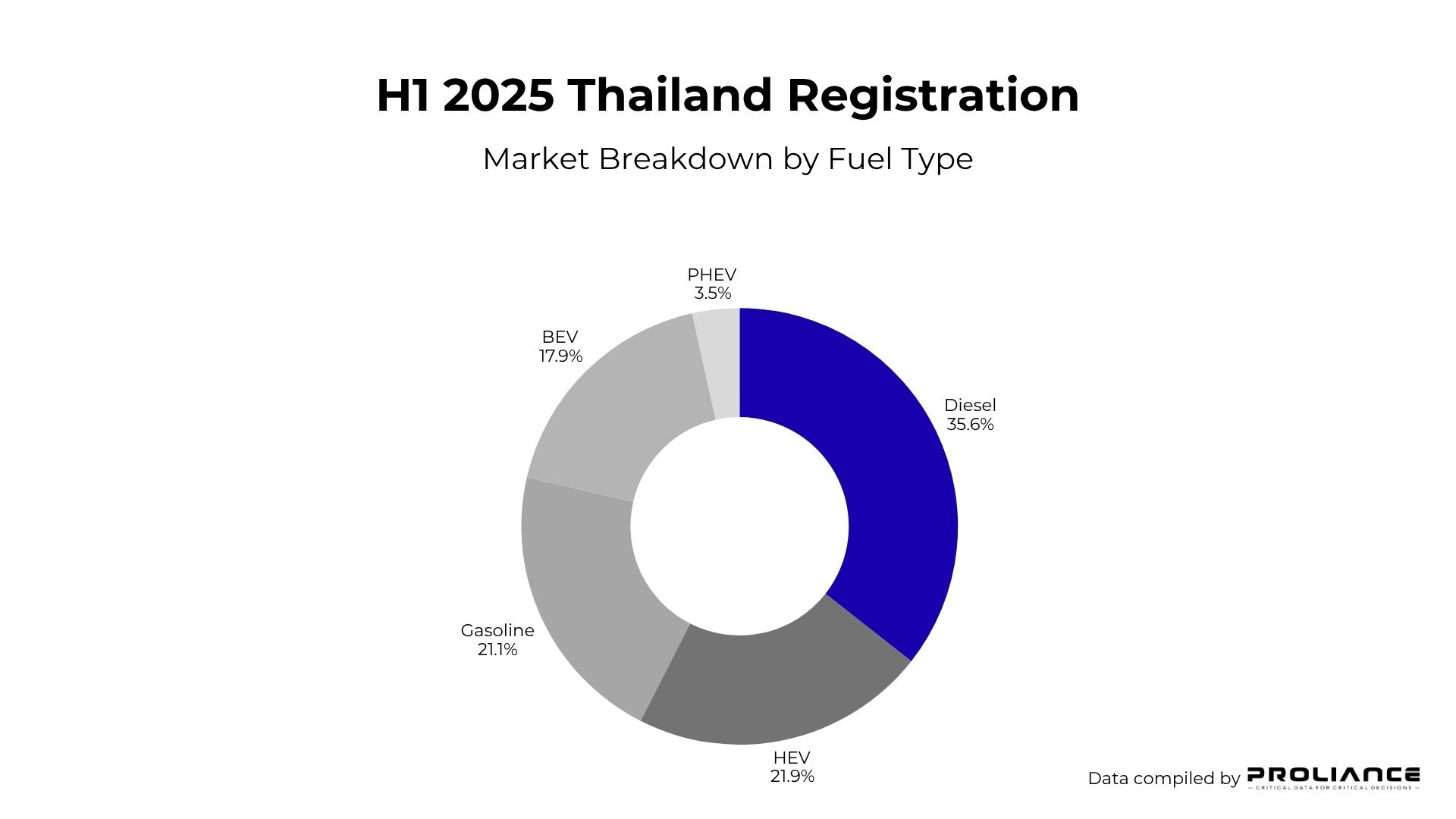

- Hybrid preference continues: HEV, PHEV captures 25.4% vs BEV’s 17.9%

- H1 growth acceleration: EV share expanded from Q1’s 40.2% to Q2’s 46.5%

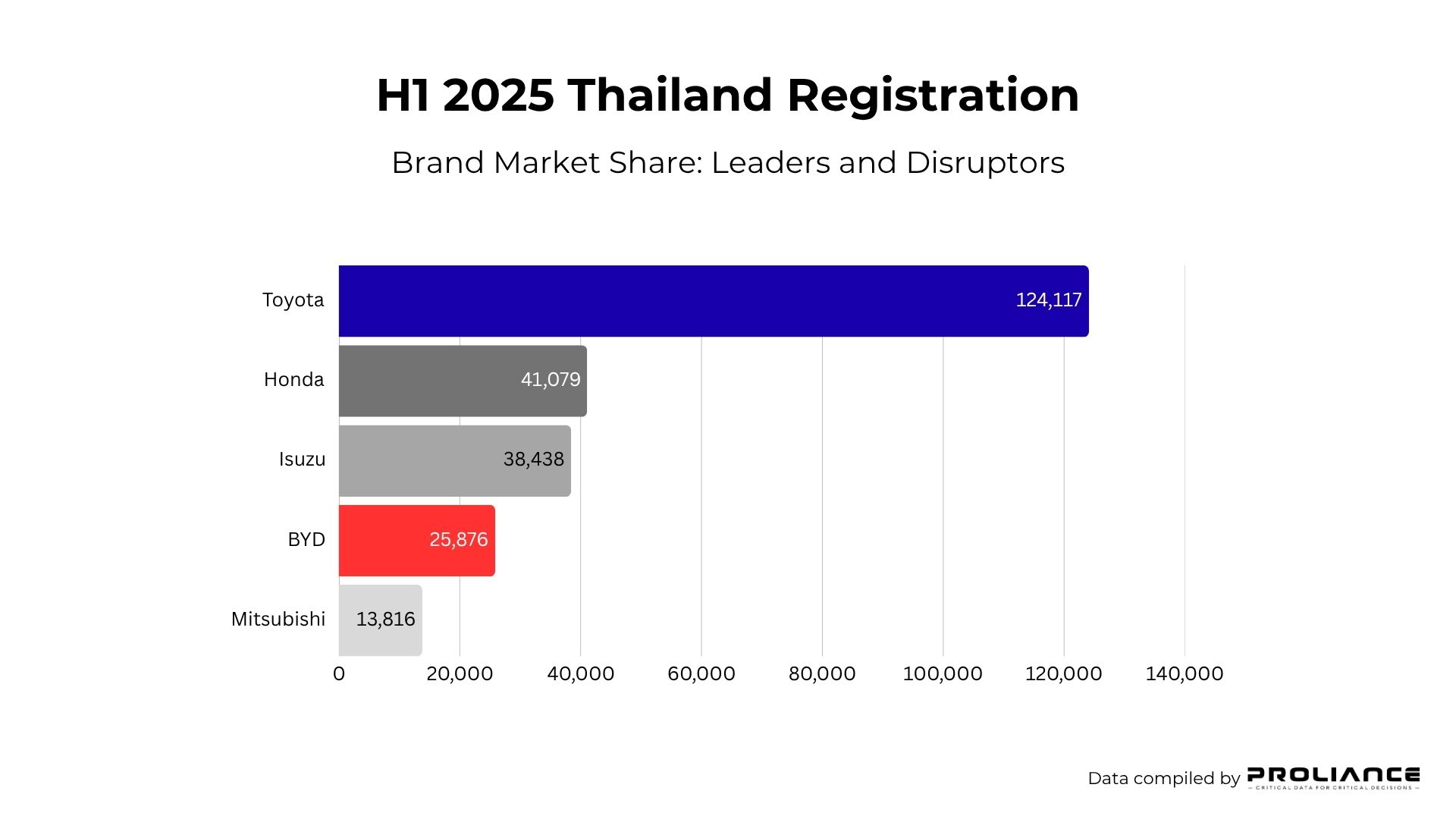

- Brand disruption: BYD claims #4 position with 7.98% market share, up from Q1 2025’s 5.24%

- SUV lead strengthens: 35.6% share vs 25.4% for pickups (H1 2025)

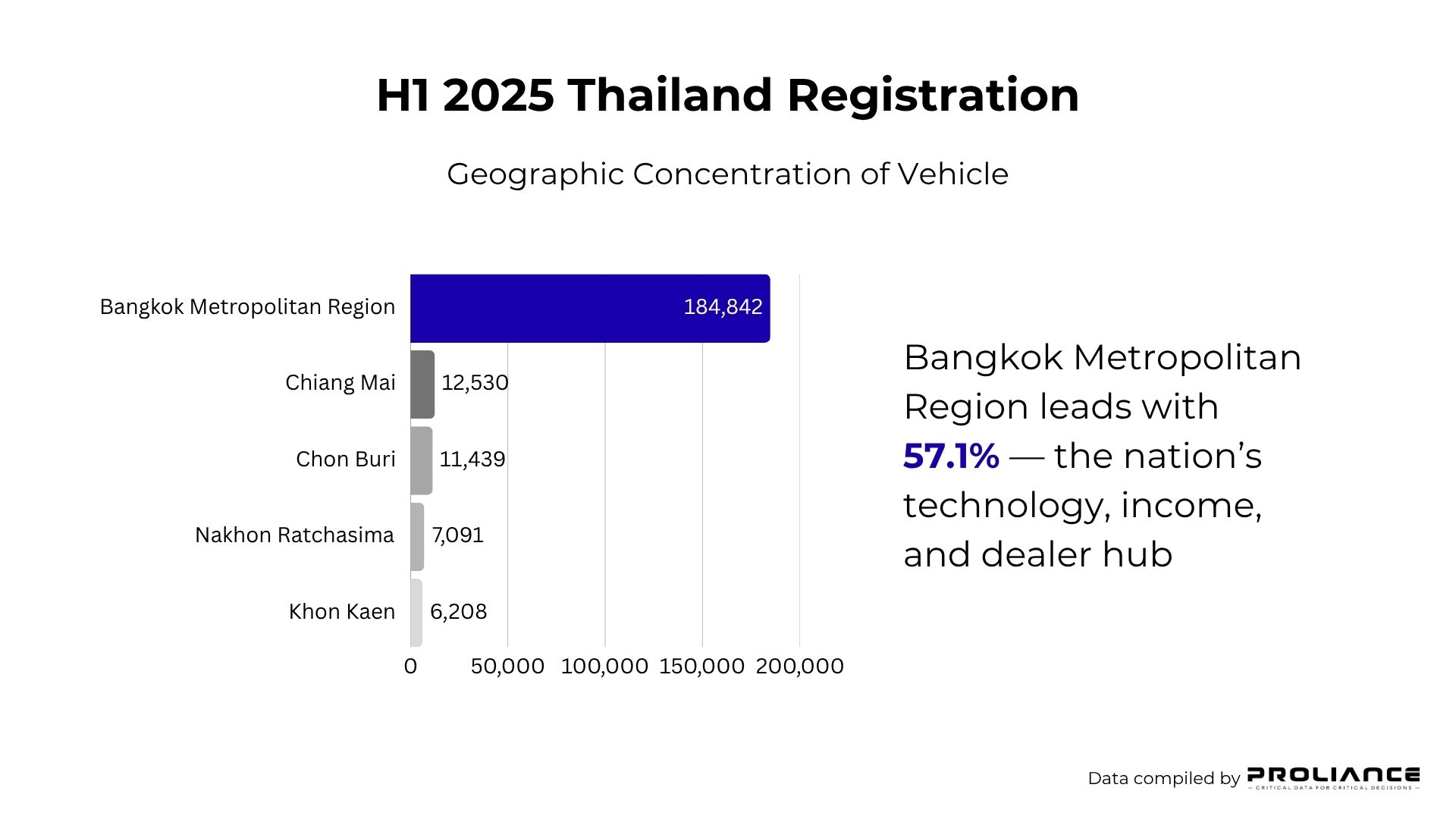

- Bangkok Metropolitan Region concentration: 57.1% of national registrations

Market Overview: Navigating Transformation Amid Uncertainty

Thailand’s H1 2025 market decline masks a structural transformation: despite tighter financing and cost‑of‑living pressures, consumers are migrating toward premium electrified segments, indicating strategic timing rather than inability to purchase.

Most striking is the acceleration of electrified vehicles under these headwinds, with Q1 at 40.2% share and Q2 rising to 46.5% share, signaling that electrification has reached critical mass under supportive policies, expanding infrastructure, and resilient consumer enthusiasm. Household debt remains elevated 87.4% of GDP in Q1/2025, reinforcing the financing‑drag narrative while not preventing continued xEV share gains.

Fuel Type Analysis: Why Hybrids Lead

Traditional Fuels Declining But Substantial

Diesel maintained 115,373 units (35.6%) through commercial vehicle dominance where fuel efficiency and proven durability matter more than emissions. Gasoline’s 68,400 units (21.1%) indicate a decline, squeezed between diesel’s commercial strength, hybrid efficiency, and electric performance advantages.

Hybrid Preference Over Pure Electric

HEV leadership with 82,307 units (25.4%) versus BEV’s 58,072 units (17.9%) reflects infrastructure realities and consumer psychology. Hybrids require no behavioral change, charging access, or range anxiety management, making them psychologically comfortable for traditional owners seeking efficiency without lifestyle disruption.

Thailand’s charging network, while expanding, remains Bangkok-concentrated with significant provincial gaps. Apartment dwellers lack home charging, while long-distance travelers fear inadequate highway coverage. These practical barriers make hybrids attractive as “good enough” electrification delivering benefits without infrastructure dependency. BEV growth accelerates as infrastructure expands and prices decline, but current adoption concentrates among segments with favorable charging access or economic incentives compelling despite inconveniences.

The Electrification Journey: 43.3% Market Share

Hybrid Electric Vehicles (HEV) Lead at 21.9%

Hybrids dominate H1 thanks to broad Toyota coverage across core segments, delivering reliability and fuel savings without charging needs—making them the lowest‑friction bridge for ICE owners.

Battery Electric Vehicles (BEV) at 17.9% and rising

Momentum is driven by competitive Chinese entries and urban charging growth; incentives and improving battery economics keep demand resilient among city users and fleets.

Plug-in Hybrid Electric (PHEV) at 3.5%

Concentrated in luxury nameplates serving executives with home charging; likely to remain niche as HEV convenience and BEV performance improve.

Brand Performance: Winners and Disruption

Toyota Maintains Dominance Through Hybrids

Toyota’s 124,117 units (38.29% share) demonstrates strategic electrification success. Aggressive hybrid portfolio deployment through Yaris Cross, Corolla Cross, and Camry absorbed demand migrating from traditional segments, while Hilux maintained pickup leadership. This dual capability—excelling in both emerging electrified and established conventional categories—delivered resilience while single-strategy competitors struggled.

Honda and Isuzu: Defensive Positions

Honda secured 41,079 units (12.67%)leveraging its HR-V hybrid as the brand’s volume driver alongside sedan strength in Civic and City hybrids, though lacking compelling BEV portfolio creates vulnerability as pure electric captures growing share. Isuzu’s 38,438 units (11.86%) maintained third position through commercial pickup loyalty, but over-concentration in declining segments without clear electrification strategy threatens long-term positioning.

BYD’s Disruptive Ascent

BYD’s rise to fourth position with 25,876 units (7.98% share) represents H1’s most significant brand development. Growth from Q1’s 5.24% demonstrates Chinese brands can compete successfully through compelling EV technology at accessible pricing. The Dolphin leads segment registrations while Sealion 7 strengthens BYD’s premium positioning by offering advanced driver assistance and long‑range variants at a price point that compresses the typical premium delta in the D‑SUV class. Rapid dealer network expansion enhances penetration beyond initial Bangkok concentration, though sustainability requires proven service quality as weaker Chinese entrants like NETA demonstrate through recent struggles.

Mitsubishi: Provincial Loyalty

Mitsubishi’s 13,816 units (4.26%) maintained fifth position through provincial market strength and Triton pickup loyalty. Recent X-Force HEV launch signals electrification recognition, with H2 performance expected to reflect this hybrid crossover’s contribution as dealer inventory builds and marketing gains traction.

Body Style Revolution: SUVs Claim Leadership

SUVs captured 115,529 registrations (35.6% share) in H1, ahead of pickups at 82,368 (25.4%), extending an SUV lead that opened in mid‑2024 and persisted through early 2025 as the market mix rotated toward crossovers. The shift reflects a broader re‑ranking of buyer priorities—middle‑class households increasingly prize comfort, in‑cabin technology, and family versatility over pure payload—while higher seating positions reinforce confidence and perceived safety in dense urban traffic. Automakers reinforced these preferences by front‑loading crossover launches and concentrating electrified powertrains on SUV nameplates more than on pickups, giving shoppers a straightforward pathway into xEVs without sacrificing daily usability. Credit conditions added momentum, as tighter underwriting in the pickup segment constrained approvals for some traditional buyers and nudged part of that demand toward passenger‑vehicle classifications with comparatively more favorable terms. Taken together, these product, policy, and behavioral forces have kept SUVs ahead of pickups across multiple months—not a one‑off quarterly blip, but an ongoing structural realignment of Thailand’s body‑style hierarchy.

Pickup registrations reached 82,368 units in H1, but volumes eased in Q2 versus Q1, indicating a cooling trend even as the segment remains essential for provincial commercial and agricultural use. Toyota Hilux still anchors share and loyalty, yet electrification poses structural hurdles: battery mass and packaging work against payload‑oriented platforms, and most commercial operators want long, real‑world duty‑cycle proof before switching. With underwriting standards tighter than for passenger segments, these constraints together tempered pickup momentum in Q2 while the market mix continued to tilt toward SUVs.

Sedans registered 64,123 units (19.8%), continuing a gradual decline as buyers shift toward SUV versatility, while hatchbacks held 35,069 units (10.8%) at the entry tier. MPVs’ 15,863 units (4.9%) confirm a niche role focused on large‑family use.

Geographic Concentration: Bangkok’s Dominance

Bangkok Metropolitan Region: 57.12% of Market

Bangkok Metropolitan Region accounts for 184,842 registrations, or 57.12% of the national LV market, underscoring the capital’s outsized purchasing power and dense corporate fleets. High household incomes, extensive dealer and financing networks, and superior charging infrastructure make Bangkok the launchpad for new technologies, accelerating EV and hybrid adoption alongside steady replacement demand. The region’s concentration of services, logistics, and headquarters sustains resilient volumes across passenger and commercial segments, keeping Bangkok the decisive driver of Thailand’s H1 2025 registration landscape.

Provincial Markets: Growth Opportunity

Chiang Mai emerged second with 12,530 units (3.87%) as northern economic hub, while Chon Buri’s 11,439 units (3.54%) represents Eastern Seaboard industrial strength. Nakhon Ratchasima’s 7,091 units (2.19%) captured fourth position as Northeastern gateway, with Khon Kaen’s 6,208 units (1.92%) rounding out the top five provincial markets. The dramatic scale gap between Bangkok and even largest provincial markets—with remaining provinces combining for roughly 31.4% despite representing majority population—illustrates geographic concentration challenges. Cracking provincial growth requires different strategies than Bangkok-focused approaches, with infrastructure gaps and limited dealer networks constraining adoption despite collective market potential.

Market Implications & Future Outlook

Thailand’s H1 2025 light vehicle registration data confirms Southeast Asia’s electrification leadership position, with 43.3% market share representing fundamental transformation rather than temporary disruption. Despite 6.72% overall decline, EV adoption acceleration from Q1’s 40.2% to Q2’s 46.5% demonstrates sustained momentum independent of economic headwinds.

Several key insights emerge. Market transformation proceeds through simultaneous disruptions—electrification surge combining with historic SUV-pickup power reversal signals permanent structural shifts. Thailand’s hybrid-first transition pathway reflects pragmatic approach balancing electrification ambitions against infrastructure realities, with gradual BEV migration inevitable as charging expands and costs decline.

Geographic concentration at 57.12% Bangkok share creates opportunity and challenge. Urban density enables rapid adoption and technology deployment, but sustainable leadership requires provincial expansion ensuring benefits extend beyond metropolitan elite. Chinese brand disruption fundamentally altered competitive dynamics, with traditional automakers requiring accelerated electrification while leveraging service network advantages.

H1 2025 data provides compelling evidence that Thailand’s electrification achieved critical mass, with transformation momentum carrying forward through challenges that might derail less-established transitions. Maintaining long-term leadership requires continued policy support, infrastructure investment, and competitive pressure driving continuous improvement. Thailand stands as living laboratory demonstrating emerging market electrification potential when policy frameworks, market conditions, and consumer readiness converge.

About This Analysis

This analysis is based on official Thailand Department of Land Transport light vehicle registration data. Market interpretations, trend analysis, and future projections represent Proliance automotive intelligence insights and should be considered alongside other market research. Registration data covers Light Vehicles but excludes motorcycles, commercial trucks, and specialty vehicles.

Data Sources:

Data from Thailand Department of Land Transport, meticulously compiled, cleansed, and analyzed by Proliance

Related Analysis:

Need Thailand automotive market insights for your business?

Our comprehensive registration database provides market intelligence with:

- Brand and model-level performance tracking since 2017

- Provincial breakdowns

- Historical trend analysis and custom benchmarking

- Monthly and Quarterly market updates