Thailand’s light vehicle market extended its slowdown in August 2025, with total registrations falling 4.6% year-on-year to 62,078 units, reflecting continued pressure from cautious consumer sentiment and tighter retail lending conditions.

While the market remains under pressure, electrified vehicles continued to show resilience — driven by new BEV launches and intensified price competition.

August 2025 Thailand Registration Highlights

-

Total registrations: 62,078 units (-4.6% YoY)

-

Passenger cars: 21,218 units (-8.4% YoY)

-

Pickup trucks: 15,120 units (-5.9% YoY)

-

SUVs: 22,108 units (-0.9% YoY)

-

Electrified vehicles (HEV + PHEV + BEV): 21,676 units (+6.1% YoY)

Electrified models now account for roughly 35% of total new registrations, underscoring a structural shift in buyer preferences and product mix.

Shift Toward Electrified Vehicles

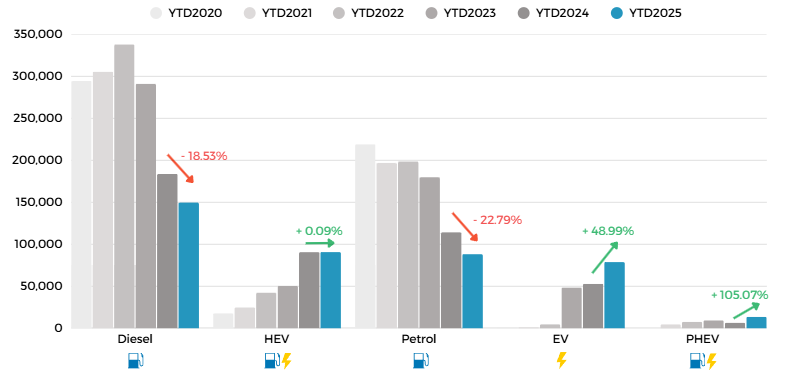

The vehicle market is clearly undergoing a structural transformation, as shown by the shift in fuel type registrations from 2020 to 2025. Diesel and petrol vehicle registrations have decreased sharply, reflecting both tightening environmental regulations and changing consumer mindsets. In contrast, hybrid electric vehicles (HEV) and battery electric vehicles (BEV) have recorded robust growth, signaling increasing acceptance backed by expanding charging infrastructure, improved driving range, and favorable government incentives. Plug-in hybrid vehicles (PHEV) also posted moderate gains, indicating a strong consumer shift toward electrification.

Segment Trends: SUV Strength, Pickups Soft

SUVs remained Thailand’s best-performing segment, reinforcing their role as the market’s volume stabilizer amid weaker pickup and sedan demand, capturing 36% of total registrations in August. Consumers continue to favor SUVs for practicality and perceived prestige, while ongoing promotions helped sustain volumes. Pickups and sedans saw steeper declines, reflecting softer rural demand and limited fleet replacement activity.

Top Brands and Models

Toyota maintained market leadership with 18,634 units, a 3.8% YoY decline. The Toyota Hilux led the pickup segment, while the Corolla Cross remained a key SUV performer. Isuzu followed with 12,812 units, down 6.2% YoY. Honda ranked third with 9,004 units (-2.9%), supported by solid CR-V and City sales. Chinese entrants such as BYD are reshaping Thailand’s brand hierarchy faster than any previous wave of competition.

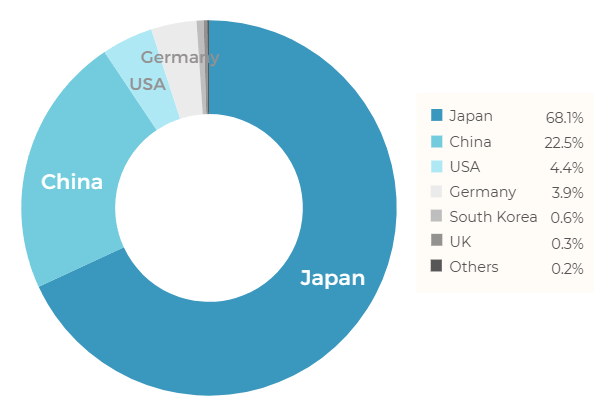

Japanese Brands Still Dominate — but Face Growing Pressure

Japanese OEMs together captured 68% of the market, though their share has gradually declined as Chinese entrants gain ground. The competitive BEV pricing by BYD, MG, and GAC has reshaped Thailand’s compact-car segment, forcing Japanese automakers to recalibrate strategies and localize future EV production.

Regional distribution of vehicle registrations

Thailand’s vehicle registration patterns reveal strong geographic concentration:

Bangkok Metropolitan Region Dominates 57.15% of all registrations. This dominance is due to the concentration of economic activity, population density, and higher income levels in the capital and its surrounding provinces. Other noteworthy areas include Chon Buri (3.72%)—a key industrial zone, Chiang Mai (3.53%) known for tourism and regional commerce, Nakhon Ratchasima (2.25%), Songkhla (1.97%), and Khon Kaen (1.89%), each emerging as important markets with growing demand aligned to regional development.

In contrast, the five provinces with the lowest vehicle registrations are Mae Hong Son (16 units), Samut Songkhram (36 units), Lamphun (51 units), Amnat Charoen (54 units), and Ranong (54 units). These areas have lower population densities, less urban development, and weaker public transport infrastructure, which limits residents’ mobility needs and reduces demand for vehicles. This reflects broader regional disparities in infrastructure, urbanization, and economic development.

Battery Electric Vehicle Growth Surges

BEV registrations jumped 28.1% YoY in August, led by new models such as the BYD Seal and Tesla Model 3. BEVs now account for 22% of all new registrations — up from 8% a year earlier, highlighting the pace of Thailand’s EV transition. In August 2025 alone, 10,228 BEVs were registered, marking a remarkable 50% year-on-year increase. So far in 2025, more than 78,000 BEVs have been registered during the first eight months, already exceeding the total BEV registrations for 2024.

The MG 4 leads the BEV segment with 1,246 units, followed by the BYD Dolphin (1,036 units) and BYD Atto 3 (558 units). Both MG and BYD hold roughly 23% of the BEV market share each, reflecting strong competition primarily driven by Chinese automakers.

This rapid expansion is fueled by robust government incentives, which provide tax breaks and subsidies while encouraging local BEV production. Thailand’s strategic position as a manufacturing hub, increasing consumer demand, and competitive pricing particularly from Chinese brands are driving electric vehicle adoption. The market is expected to continue growing, potentially surpassing 100,000 BEV registrations by the end of 2025, solidifying BEVs as a significant part of Thailand’s automotive landscape.

Outlook

Thailand’s automotive market faces a cautious second half of 2025. Weak consumer confidence, tighter lending policies and delayed public investment are likely to restrain recovery in traditional ICE segments. However, electrified vehicles — especially BEVs — are expected to remain the market’s bright spot, supported by government incentives and intensified competition. In this environment, automakers with diversified product portfolios, strong dealer networks, and localized EV strategies are best positioned to weather the downturn and capture emerging opportunities.

The August 2025 data highlights a market in the midst of transformation. Despite an overall decline in sales volumes, the accelerating adoption of electric vehicles marks a pivotal shift in consumer behavior and industry direction.

Traditional automotive leaders are facing increasing competition from fast-rising Chinese EV manufacturers, who continue to gain traction through aggressive pricing, expanding product portfolios, and advanced battery technology.

While short-term pressures persist, Thailand’s electrification trajectory remains firmly on course — underscoring a pivotal year of transition for OEMs adapting to evolving consumer dynamics.

Learn more:

- Thailand EV Market August 2025: Sustains Momentum Amid Cooling Incentives

- Market Shakeup: Leading Light Vehicle Brands and Models in Thailand, August 2025

- Dataset: Full Thailand Light Vehicle Registration