Monthly EV Registration Trends — Thailand Electric Vehicle Market August 2025

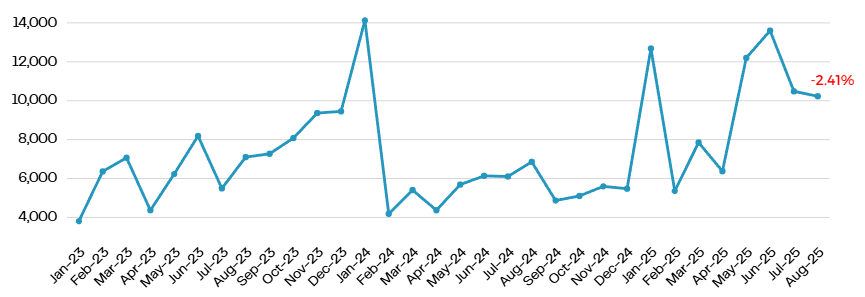

Thailand’s electric vehicle (EV) market continued its upward trajectory in August 2025, showing that strong consumer demand and expanding product variety are offsetting the gradual phase-out of government incentives.

Battery electric vehicle (BEV) registrations climbed 8.4% month-on-month to 12,972 units, while plug-in hybrids (PHEVs) edged up slightly to 4,150 units. Compared with the same period last year, total EV registrations are up 41.7% year-on-year, underscoring that Thailand remains Southeast Asia’s most resilient EV market.

The Thailand electric vehicle market August 2025 shows significant growth, driven by both policy shifts and consumer preferences.

Key Highlights for August 2025

-

Total EV registrations: 17,122 units (+7.2% MoM, +41.7% YoY)

-

BEV share: 75.8% of total EVs, led by compact SUVs

-

Top BEV brand: BYD (3,625 units, +9.5% MoM)

-

Top model: BYD Dolphin, continuing its lead in the entry-level segment

-

Top PHEV brand: MG, spear-headed by the MG 4 model

-

Regional concentration: Greater Bangkok accounted for 58% of all registrations

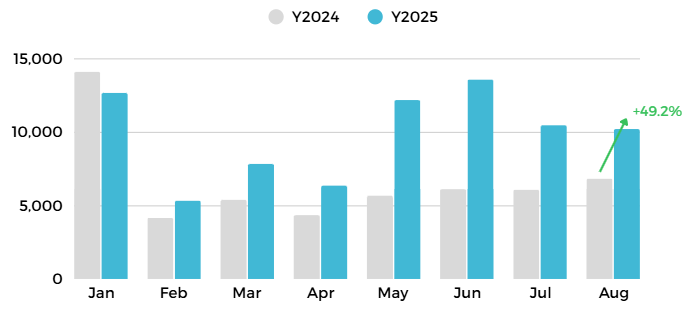

Monthly Electric Vehicle Registration Volume in Thailand, August 2025

Monthly EV Registration Trends

After a mild mid-year slowdown, August marked the third consecutive month of growth in Thailand’s EV registrations.

While BEV momentum remains strong, growth is beginning to normalize as the second phase of the government’s EV subsidy scheme approaches its end. Fleets — including ride-hailing operators and delivery companies — remain a key volume driver, while retail demand is shifting toward more affordable city-EVs.

“August’s numbers show a market transitioning from early adopters to mass consumers,” notes Proliance’s market analysis team. “Chinese brands continue to dominate, but the competition is widening as new models from Japanese and Korean automakers arrive.”

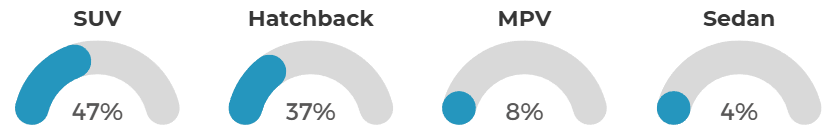

Electric Vehicle Popular Body Styles Among Thai Consumers

What Thai Consumers Are Buying

SUVs remain the preferred body style among Thai EV buyers, capturing 47% of registrations. Their practicality and road presence make them an ideal fit for both Bangkok commuters and provincial families.

Hatchbacks follow with 37%, boosted by compact BEVs like the MG 4, BYD Dolphin and the GAC Aion UT — all priced below 800,000 baht and appealing to first-time EV owners.

MPVs and sedans account for the remaining 8% and 4%, respectively, but are expected to gain traction as more long-range models become available in 2026.

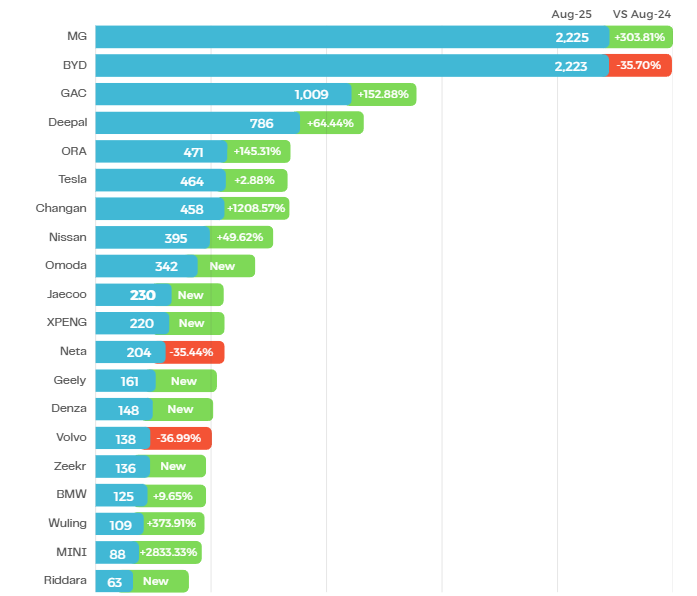

Top 20 Most-Registered BEV Brands in August 2025

Top BEV Brands in August 2025

BYD extended its dominance with 2,223 registrations, supported by strong deliveries of the Dolphin and Seal. MG leads by 2 units at 2,225 units, rebounding after months of supply constraints.

Tesla was at sixth place with 464 units, reflecting improved delivery consistency following local logistics adjustments. As for Neta, registrations in August came solely from pre-bankruptcy inventory. Following Hozon’s financial collapse in China, Neta Thailand has effectively ceased operations, and its remaining dealer stock is expected to clear by late 2025.

Other notable performers included Ora (GWM) with 471 units (+145% YoY) and Changan with 458 units (+1,208% YoY).

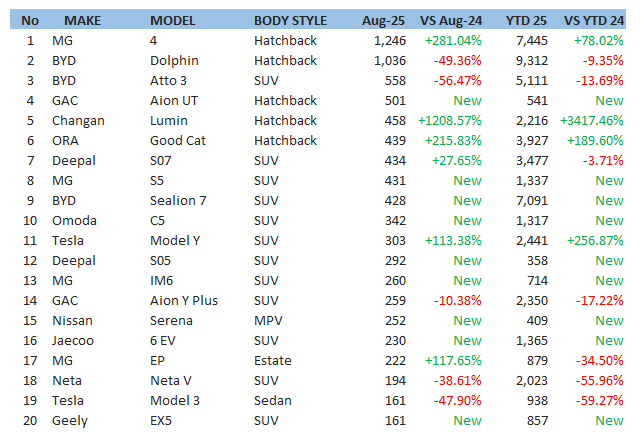

Top 20 Most-Registered BEV Models in August 2025

The BYD Dolphin continues to set the pace for Thailand’s entry-level EV market, balancing affordability and range. Meanwhile, Tesla’s Model Y remains the benchmark in the premium crossover class, aided by price revisions earlier this year.

“Honda has already commenced local production in Thailand (e.g., the e:N1) and is earmarked to launch a new EV in 2026—industry sources suggest this will be locally assembled, aligning with Thailand’s 2026-localisation policy. Nissan has likewise committed to new model(s) in 2026–27 and is preparing its Thai manufacturing base accordingly, though model names and CKD status are not yet publicly confirmed.”

Regional Distribution: Bangkok Still Leads

Greater Bangkok retained its dominance with 58% of total EV registrations, followed by Chonburi, Chiang Mai, and Nakhon Ratchasima.

The capital’s infrastructure advantage — including the country’s densest network of public chargers and urban EV showrooms — continues to attract early adopters.

In contrast, provincial adoption is growing rapidly in the North and Northeast, supported by the rollout of charging stations along intercity corridors and aggressive dealer promotions.

“EV penetration outside Bangkok is finally scaling,” says Proliance’s Bangkok office. “We’re seeing stronger retail interest in Chiang Mai and Khon Kaen, where public charging has become noticeably more accessible over the past six months.”

Market Outlook

Looking ahead, Thailand’s EV market is expected to maintain moderate growth through the remainder of 2025. The upcoming local production start-ups by BYD and Great Wall in Rayong will help stabilize supply and could lead to localized pricing advantages by early 2026.

However, competitive pressure will intensify: nearly a dozen new BEV models are slated for launch in Q4 2025 alone, including compact crossovers from Japanese, Korean, and Chinese OEMs.

Policy-wise, uncertainty remains over the next phase of the EV3.5 incentive scheme. While demand has held firm, any delay or reduction in subsidies could cool private-buyer enthusiasm, especially in the 1–1.5 million baht range.

“This phase of the market will separate brand loyalty from price sensitivity,” Proliance analyst adds. “Consumers are becoming more informed — and more willing to switch brands if the value equation changes.”

Despite looming headwinds, Thailand’s transition toward electrification remains on track. Charging infrastructure, though unevenly distributed, has expanded by 42% year-on-year, and local component suppliers are beginning to benefit from EV-related contracts.

Summary

Thailand’s August 2025 EV results show a market that’s stabilizing rather than slowing — moving from incentive-driven expansion to sustainable demand.

With Chinese brands leading, Japanese entrants regaining relevance, and regional adoption accelerating, Thailand is steadily cementing its position as Southeast Asia’s most advanced EV ecosystem.

Source: Proliance new vehicle registration data — Thailand EV market August 2025

Learn more:

- Thailand Auto Market Contracts 4.6% in August 2025, EVs Continue to Gain Share

- Market Shakeup: Leading Light Vehicle Brands and Models in Thailand, August 2025

- Dataset: Full Thailand Light Vehicle Registration