By Proliance Company Ltd.

“Critical data for critical decisions.”

Thailand’s electric-vehicle (EV) landscape has shifted once again. In late November 2025, the Thai government quietly introduced a significant policy adjustment: every EV exported from Thailand will now count as 1.5 units toward a manufacturer’s mandatory local production quota under the EV incentive program.

At first glance, this may appear to be a technical recalibration. In reality, it reflects a strategic pivot — away from an over-reliance on domestic subsidies and toward export-driven growth, aimed at preventing future oversupply in the Thai market while strengthening the country’s position as a regional EV manufacturing hub.

This analysis breaks down what changed, why it matters, and how it will reshape Thailand’s automotive sector in the years ahead — with a special lens on how production-versus-registration imbalances will impact downstream analytics and forecasting.

1. Background: How Thailand Got Here

Over the past three years, Thailand has rolled out multiple phases of EV incentives — commonly referred to as EV 3.0, EV 3.5, and most recently, EV 4.0 in internal policy discussions.

Between 2022 and 2024, the emphasis was on stimulating domestic EV adoption:

-

Import duty reductions for battery electric vehicles

-

Excise-tax cuts (often down to 0–2%)

-

Government subsidies of THB 70,000–150,000 per unit

-

Incentives for OEMs to assemble EVs in Thailand under strict “import–production balancing” rules

Under the original framework, global manufacturers that imported EVs at reduced duties were obligated to offset these volumes with local production (CKD/assembly). Over time the required ratio increased, ensuring that subsidized imports translated into genuine industrial investment.

But 2024–2025 brought challenges:

-

A sudden wave of affordable Chinese EV imports, many aggressively priced

-

Domestic inventory build-up at dealers

-

Episodes of deep discounting, which worried policymakers and disrupted resale values

-

Slower-than-expected charging-infrastructure rollout outside major cities

-

Early signs of consumer fatigue in the low-end EV segment

At the same time, Thailand attracted more than THB 130–140 billion (USD 3.7–4.2 billion) in EV-related investments by mid-2025, spanning battery packs, modules, motors, and complete vehicle assembly. Several OEMs announced Thailand as a key export base for future right-hand drive (RHD) EVs.

This combination — surging production and uneven domestic absorption — pushed policymakers to recalibrate.

2. What’s New: Exported EVs Now Count 1.5× Toward Production Targets

In November 2025, Thailand’s EV Board enacted a new formula:

1 exported BEV = 1.5 units of local-production credit

This effectively reduces the domestic-market pressure on OEMs. If a brand needs to meet a certain local-production quota, they can now achieve it faster by exporting EVs rather than pushing additional units into the Thai market.

The change follows earlier revisions in July 2025, when exports were first allowed to count toward production quotas. The November update enhances that flexibility.

For OEMs, this means:

-

Less risk of domestic oversupply

-

Faster compliance with production obligations

-

More predictable return on investment from Thai assembly plants

-

Stronger justification for turning Thailand into a global export node

For policymakers, the objective is straightforward:

avoid domestic market distortion while still capturing manufacturing investment and supply-chain development.

3. Why Thailand Is Moving Toward an Export-Led Strategy

3.1 Domestic EV demand is growing—just not fast enough

While BEV registrations climbed sharply from 2022 to 2024, growth in 2025 has been more nuanced. Price-sensitive consumers remain cautious due to:

-

Battery-replacement cost concerns

-

Insurance constraints (many insurers in Thailand now restrict EV coverage or impose higher premiums)

-

High depreciation rates from constant price cuts by some Chinese OEMs

-

Uncertainty about long-term servicing and spare-part availability

The government does not want domestic demand stagnation to lead to excess inventory — something already witnessed in late 2024 and early 2025.

3.2 Thailand has a comparative advantage in automotive exports

For four decades, Thailand has been ASEAN’s leading vehicle exporter, particularly for pickup trucks. The EV transition threatens that dominance unless Thailand establishes itself early in global EV supply chains.

By allowing exported EVs to carry more “production weight,” Thailand signals its intention to:

-

Compete with China for RHD EV exports

-

Supply markets such as Australia, New Zealand, the UK, the Middle East, and South Africa

-

Anchor battery-pack and cell manufacturing within the Kingdom

-

Keep assembly plants running at stable, export-driven utilization rates

3.3 Chinese OEMs need overseas markets

With China itself facing EV overcapacity, global expansion is a priority for Chinese automakers. Thailand’s incentive scheme, combined with its established supplier network and logistics infrastructure, makes it an ideal platform for RHD-market exports.

4. Market Implications: Winners, Losers, and New Pressures

4.1 For global OEMs (Chinese, Japanese, Korean, Western)

Winners:

-

Chinese OEMs that already invested in Thai CKD plants

-

Battery pack/module suppliers

-

Manufacturers with export-oriented strategies

Challenges for others:

-

Japanese OEMs still catching up in BEVs

-

Brands relying solely on CBU imports from China

-

Local dealers who previously depended on heavy incentives to move volumes

4.2 For Thailand’s domestic EV market

Expect a cooling period:

-

Fewer extreme discounts

-

More stable pricing

-

Slower introduction of some low-end EV models

-

More focus on quality, warranty, after-sales support

-

Potential resurgence in hybrid/ICE choices among conservative buyers

Insurance constraints remain a major barrier. A number of insurers have restricted EV coverage, particularly for models with documented high repair costs or poor parts availability. Some small accidents have resulted in total-loss declarations due to battery-pack location and structural complexity.

4.3 For supply-chain localization

The export-led model will accelerate component manufacturing:

-

Battery-pack assembly

-

Power electronics

-

Thermal-management systems

-

High-voltage wiring

-

Motors and reduction gears

However, localisation may remain model-dependent. Export-focused OEMs will localize only what is cost-effective for external markets, not necessarily what is optimal for Thailand’s own EV fleet.

5. Production vs. Registration: Why This Matters for Data Providers

For companies like Proliance, the policy shift introduces new analytical challenges:

5.1 Domestic registrations will no longer reflect Thailand’s true EV output

If Thailand produces 200,000 BEVs in a calendar year but exports 120,000 of them, then domestic registration data captures only a fraction of the industrial reality.

5.2 Market-share analysis becomes more nuanced

OEM ranking in Thailand’s production landscape may diverge sharply from their ranking in registrations.

For example:

-

Brand A may be Thailand’s largest EV producer

-

Brand B may lead domestic registrations

-

Brand C might export 90% of its output

5.3 Demand forecasting must separate:

-

Local consumer adoption

-

Export-driven production

-

Inventory cycles

-

Global supply-chain constraints

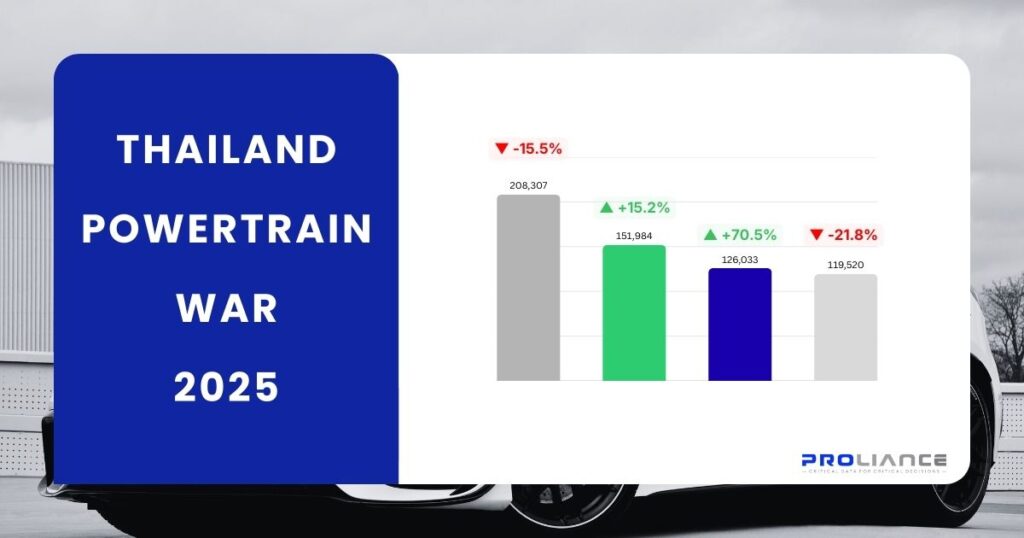

5.4 SPG, Dataforce, JATO, Autovista, MarkLines and others will rely heavily on quality registration datasets

As Thailand becomes the region’s EV manufacturing hub, the world will want clean, structured, monthly registration data to track:

-

Adoption rates

-

Powertrain shifts (BEV, PHEV, HEV, ICE)

-

Geographic differences across Thai provinces

-

Fleet turnover

-

Market entry/exit timing for new EV brands

This is where Proliance’s monthly provincial registration data becomes critical — especially as sales data in Thailand has become harder to obtain since JCC discontinued sharing.

6. Export Growth Outlook (2026–2030)

Based on policy intentions, investment announcements, and global RHD market demand, Thailand’s EV export potential could follow this trajectory:

| Year | Estimated EV Production | Estimated Exports | Key Drivers |

|---|---|---|---|

| 2025 | ~120,000 | ~12,000–15,000 | Pilot volumes, early CKD lines |

| 2026 | ~180,000–220,000 | ~45,000–60,000 | New plants operational; 1.5× rule kicks in |

| 2027 | ~250,000–300,000 | ~100,000+ | Battery plants online; more RHD export markets |

| 2028–2030 | 350,000–500,000+ | 150,000–250,000 | Mature ecosystem; EV 4.0 successor policy |

This trajectory would make Thailand one of the top EV exporters outside China by the end of the decade.

7. Risks & Uncertainties

No policy shift is without risk:

7.1 Global EV demand volatility

Europe’s shifting subsidy frameworks and geopolitical tensions could dampen demand for imported Asian EVs.

7.2 RHD market size limitation

RHD markets represent only ~25% of global volume. Growth will depend on:

-

UK import regulations

-

Australia’s shifting emissions targets

-

Southeast Asian integration

-

GCC fleet-electrification policies

7.3 Model redundancy and price erosion

Rapid model cycles among Chinese brands could impact Thailand-exported EVs’ competitiveness abroad.

7.4 Insurance and after-sales challenges at home

If domestic EV ownership becomes risky or costly, adoption may stagnate regardless of price.

8. Conclusion: A Smart Policy Move — but One That Changes the Game

Thailand’s new 1.5× export credit is more than a technical rule. It signals a deliberate national strategy:

-

Prevent oversupply at home

-

Maintain stable pricing

-

Attract long-term investment

-

Transform Thailand into a leading EV export hub

-

Strengthen the automotive value chain for the next decade

For the domestic market, a period of normalization is likely. For industry analysts and B2B data clients worldwide, Thailand’s EV story has now entered a more complex, export-driven chapter — one where production, exports, and registrations must be studied together, not in isolation.

This shift underscores why Proliance’s monthly, Sub-district-level registration dataset remains the most accurate and transparent measure of Thailand’s real EV uptake.