In the ever-shifting landscape of international trade, recent developments in the Russia-China automotive sector are turning heads across the globe. A booming export of brand-new “zero-mileage” Chinese vehicles into a post-sanctions Russian market has emerged — a trade worth billions, with both enticing rewards and hidden risks.

Filling the Void: A Market Without Competitors

Since the onset of the Ukraine conflict and subsequent Western sanctions, Russia has faced a dramatic contraction in its automobile market. European, American, Korean, and Japanese brands have either pulled out or scaled down operations dramatically. This left a vacuum in Russia — one that Chinese automakers were quick to recognize and even quicker to fill.

The demand for new vehicles in Russia remains strong. Despite economic downturns and the collapse of the ruble, the Russian middle class still aspires to own cars, especially as the country’s vast geography makes personal transportation essential. Without Western competition, Chinese automakers such as BYD, Chery, Haval (Great Wall), and Geely have ramped up production and shipments to Russia. Many of these vehicles are exported as “zero-mileage”, meaning they are brand-new, straight from the factory.

Profits on Wheels

Exporters — from large trading houses to nimble small operators — are capitalizing on this demand. The profits are handsome: not only are the vehicles sold at prices higher than in China (often by 30%-50%), but buyers in Russia are willing to pay premiums because the alternatives are older second-hand imports or obsolete stock.

Middlemen also benefit, with many Chinese provinces offering tax incentives to boost exports. Shipping companies, freight forwarders, and even Russian car dealerships are part of this fast-moving trade web. Some Russian dealers simply “rebadge” the Chinese vehicles and sell them as local models.

Risks and Shadows

However, this trade also underscores several risks:

- Quality and After-Sales Concerns: Many buyers report limited spare parts availability, minimal warranty coverage, and few authorized service centers.

- Regulatory Issues: Not all imported vehicles comply with Russian certification standards. This could expose consumers to legal gray areas or vehicles with substandard safety ratings.

- Economic Dependency: A deeper reliance on Chinese vehicles could erode what remains of Russia’s domestic automotive industry, creating long-term vulnerabilities.

Moreover, unscrupulous players sometimes engage in “parallel imports” or dubious financing schemes, leaving some buyers stranded without legal recourse.

Could This Happen in Thailand?

The question naturally arises: Could a similar phenomenon unfold in Thailand? The short answer is: unlikely — but with caveats.

1. Open and Competitive Market

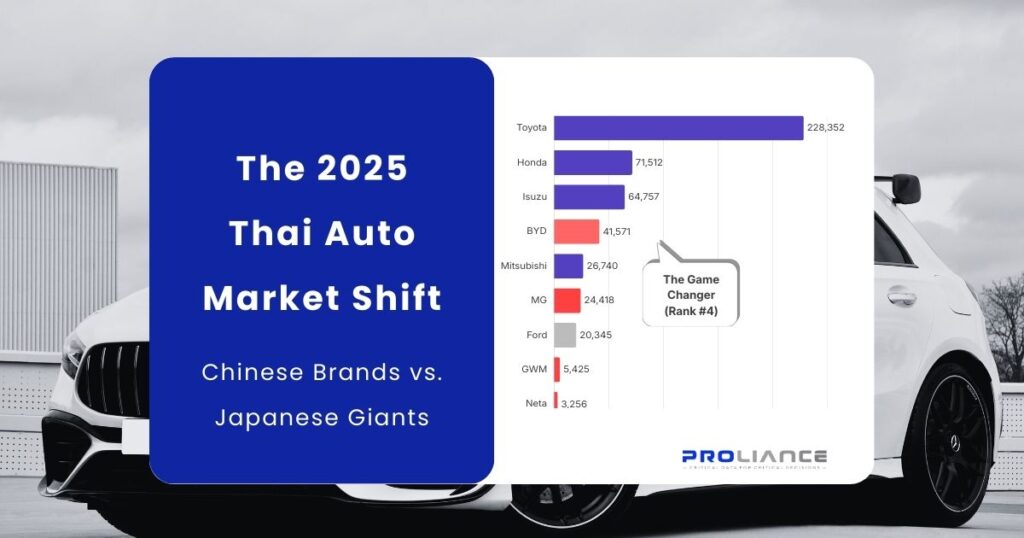

Unlike post-sanctions Russia, Thailand boasts an open, competitive automotive market with established global players: Toyota, Honda, Isuzu, Mitsubishi, Ford, and others have deep roots in the Kingdom. These brands operate local factories, maintain robust dealer networks, and continuously innovate to meet consumer demand. There is no equivalent “void” in the Thai market needing to be filled by opportunistic imports.

2. Consumer Perception and Brand Loyalty

Thai consumers are brand-conscious and wary of new entrants, particularly in segments like sedans, pickups, and SUVs where Japanese dominance is entrenched. While Chinese brands such as MG and BYD have gained a foothold, especially in EVs, they have done so through strategic investment, quality improvements, and strong after-sales networks — not through opportunistic grey-market channels.

3. Government Regulations

Thailand’s import regulations are stringent. Vehicles imported outside of authorized channels face high tariffs and compliance hurdles. The Thai government also enforces safety, emissions, and quality standards rigorously. This creates a controlled environment that discourages “parallel import” booms of the type seen in Russia.

New Local Manufacturing Requirements

Adding to the regulatory complexity, Thailand now requires that for every Chinese vehicle imported, manufacturers must locally produce 1.5 vehicles to maintain market balance and encourage domestic industry participation. Failing to meet this condition would subject companies to significant fines.

Could this incentivize some OEMs or unscrupulous players to artificially inflate registration numbers of unsold vehicles in order to appear compliant with local content rules? While the possibility exists in theory, Thailand’s well-developed regulatory environment and robust VIN tracking systems make large-scale manipulation difficult to achieve without detection.

Furthermore, with the Thai government closely monitoring registration data and production records, coupled with strong scrutiny from established industry players and watchdogs, any attempt at mass registration fraud would likely be uncovered swiftly. Reputational risks and financial penalties would outweigh any short-term gains.

4. Economic Stability

Finally, Thailand is not subject to the kind of geopolitical shocks and sanctions driving the Russian situation. The Thai baht remains relatively stable, consumer credit is available, and local automotive manufacturing is a pillar of the economy.

A Possible Scenario: Niche Parallel Imports?

The only exception could be niche luxury models — electric luxury SUVs or sports cars not officially sold in Thailand — that wealthy enthusiasts might bring in via parallel importers. However, this has always been a small segment and would not replicate the mass-market boom happening between China and Russia.

Conclusion

The Russia-China “zero-mileage” car export boom is a unique byproduct of a fractured global order — one where Chinese manufacturers are proving agile and opportunistic. While Thailand’s market is unlikely to follow the same path, Thai policymakers and industry leaders should still watch this trend carefully. It serves as a reminder of China’s growing automotive power and the speed at which it can reshape markets when opportunity knocks.

At Proliance, we conduct comprehensive due diligence checks on VIN registration, ensuring that all reported registration counts are legitimate and verified. This commitment to data accuracy helps safeguard our clients’ decisions in a dynamic automotive landscape.