Thailand’s political landscape is once again on edge. Prime Minister Paetongtarn Shinawatra, in office since August 2024, is facing a crisis that threatens her young administration.

The spark? On 15 June, she held a private phone talk with Cambodia’s former leader Hun Sen regarding a border skirmish. Four days later, a nine-minute audio snippet was leaked, in which Paetongtarn referred to a Thai military commander as “an opponent” and appeared overly conciliatory toward Cambodia. The result was swift: the Bhumjaithai Party—the coalition’s second-largest partner—exited, citing concerns over national sovereignty.

With her majority eroding, Paetongtarn is scrambling to placate the military and anxious coalition allies. She’s met with army chiefs, made a symbolic visit to the Cambodia border, and emphasized her support for the military’s role in national defense . But the episode has ignited nationalist backlashes and anti-government protests. The coalition may now face internal revolt from the United Thai Nation Party, with the opposition eyeing no-confidence motions or early elections.

If you look at Thailand’s political history—marked by 13 successful coups since 1932—it’s easy to see why this leaked call could embolden hardliners. Paetongtarn, daughter of former prime minister Thaksin Shinawatra, carries a legacy of political division; her predecessors Thaksin and Yingluck were both ousted in coups. That legacy is now overshadowing her own mandate.

Economically, the timing couldn’t be worse. Growth remains sluggish, interest rates are off tight, and household debt hovers near 90% of GDP. Meanwhile, worries about looming U.S. auto tariffs threaten Thailand’s key manufacturing base. With faltering consumer confidence and coalition fractures, Paetongtarn’s capacity to act on policy has been severely curtailed.

Auto Industry Analysis: Crisis or Chance?

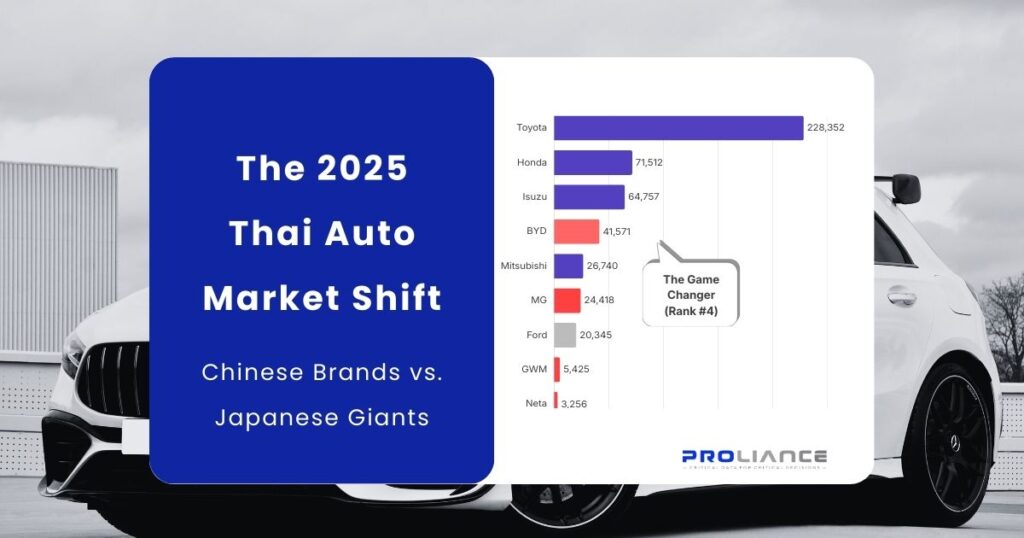

Thailand’s automotive industry—affectionately dubbed the “Detroit of Asia”—is at a critical juncture. Traditional strongholds are under siege from economic headwinds and a global shift to EVs.

Domestic and Export Decline

- Production has declined for 20 straight months. In March alone, output fell 6.1% year‑on‑year to 129,909 units.

- The industry is unlikely to hit its 2025 target of 1.5 million units; forecasts now suggest closer to 1.4 million.

- Domestic sales are still weak: a 10% year‑on‑year slump was seen in early 2025, with pickup trucks—which once anchored the market—suffering most.

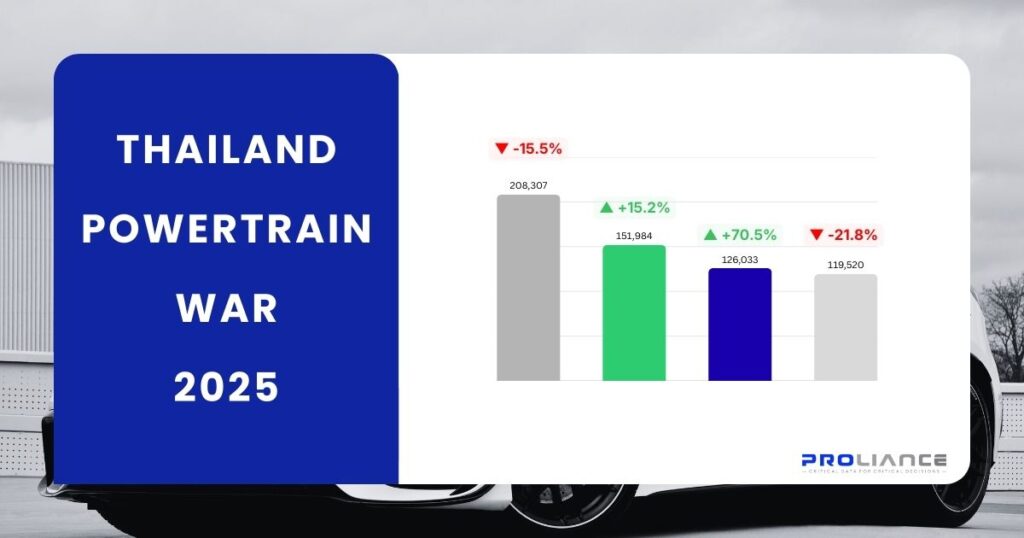

Exports, too, have dropped—down nearly 15% in March and over 18% in the first quarter—hit by U.S. tariffs and lower global demand.

Credit Crunch & Household Debt

Tight auto‑loan standards and high household debt are major choke points. Loan approval rates have declined significantly, and non‑performing loans among auto borrowers have spiked. Indeed, banks have rejected up to 30–40% of applications , deterring buyers from making big purchases.

The EV Opportunity

Thailand’s EV ambitions shine amid this gloom:

- EV production is expected to grow by 40% in 2025, with BEVs crossing the 100,000‑unit mark.

- Hybrid (HEV) and plug‑in hybrid (PHEV) production surged in 2024—up 46% and nearly 5,000%, respectively .

- Major investments are taking shape: Mazda’s $150 million electric‑SUV plant; BYD’s Rayong EV facility employing 10,000; Toyota doubling hybrid output.

Government incentives like the “30@30” policy (targeting 30% ZEV output by 2030) and consumer tax breaks are aiming to accelerate this transition.

Structural Shifts & Talent Gaps

However, the scramble to retool is real:

- Tier‑2 auto‑parts manufacturers face existential risk—many lack capital and know‑how to shift toward EV component production.

- EV supply chains require new skills in software, battery tech, and electrification—Thailand must invest heavily in workforce reskilling .

Regional Pressure & Policy Response

Thailand’s lead in ASEAN is being challenged. Vietnam and Indonesia are ramping up auto sector development. Thailand slipped to third place in ASEAN car sales .

The government is responding: lending guarantees for pickup trucks, continued EV subsidies, interest‑rate cuts, and infrastructure spending. But these measures may only stabilize—not transform—the sector unless paired with private investment and clear long‑term planning.

Final Take: Crossroads of Politics and Industry

Thailand stands at a crossroads. On one side is political uncertainty: a fractured coalition, a restless electorate, and a leader whose legitimacy is under scrutiny. On the other is an automotive sector in deep transition: aging ICE models shrinking, EVs rising, and global forces reshaping old certainties.

For businesses like Proliance—and our B2B global clients—this is more than headline‑reading. It’s about analyzing risk and opportunity: understanding how political shifts could impact tariffs, incentives, and infrastructure. It’s about tracking auto‑market data to guide investments and sales strategies in electrification.

To thrive in this dual‑shock environment, Thailand must embrace its traditions—strong manufacturing, regional export strengths—while pushing boldly into EV innovation and governance stability. Only then can it ensure not only survival, but reinvention on its own terms.+